- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Upcoming Q2 2025 Earnings Release Might Change The Case For Investing In Ivanhoe Mines (TSX:IVN)

Reviewed by Simply Wall St

- Ivanhoe Mines Ltd. has announced it will report its second quarter 2025 financial results on July 8, 2025, at 9:30 AM US Eastern Standard Time.

- This upcoming earnings announcement often prompts investors to reassess their outlook, anticipating fresh insights into the company's production ramp-ups and project progress.

- With investors positioning ahead of the earnings release, we will assess how this anticipation could influence Ivanhoe Mines' investment narrative.

Outshine the giants: these 19 early-stage AI stocks could fund your retirement.

Ivanhoe Mines Investment Narrative Recap

To own shares in Ivanhoe Mines, investors need confidence in the continued ramp-up and expansion at Kamoa-Kakula and Platreef, as well as the company’s ability to navigate complex operating conditions and geopolitical risks in Africa. The upcoming second quarter results could shed light on production momentum and operational reliability, but the scheduled reporting date alone does not alter the most important catalyst, the successful ramp-up at Kamoa-Kakula, or materially change the main risks, such as execution setbacks or regulatory shifts in the Democratic Republic of Congo. Of the company’s recent announcements, the revised production guidance for 2025 at Kamoa-Kakula stands out. With a new range set between 370,000 to 420,000 tonnes of copper, and the withdrawal of the ambitious 2026 guidance, investors are reminded that production growth is inherently subject to uncertainties. These moving targets are particularly relevant to Ivanhoe’s valuation and speak directly to the current catalyst and risk balance at play. Yet, while the current outlook for Kamoa-Kakula’s ramp-up is a key focus, there is also the risk that changes to regulatory or tax regimes in the DRC could impact Ivanhoe’s revenue stability and investors should be aware of...

Read the full narrative on Ivanhoe Mines (it's free!)

Ivanhoe Mines is expected to generate $954.2 million in revenue and $691.6 million in earnings by 2028. This projection is based on a 100.8% annual revenue growth rate and an earnings increase of $268.2 million from the current earnings of $423.4 million.

Uncover how Ivanhoe Mines' forecasts yield a CA$15.99 fair value, a 44% upside to its current price.

Exploring Other Perspectives

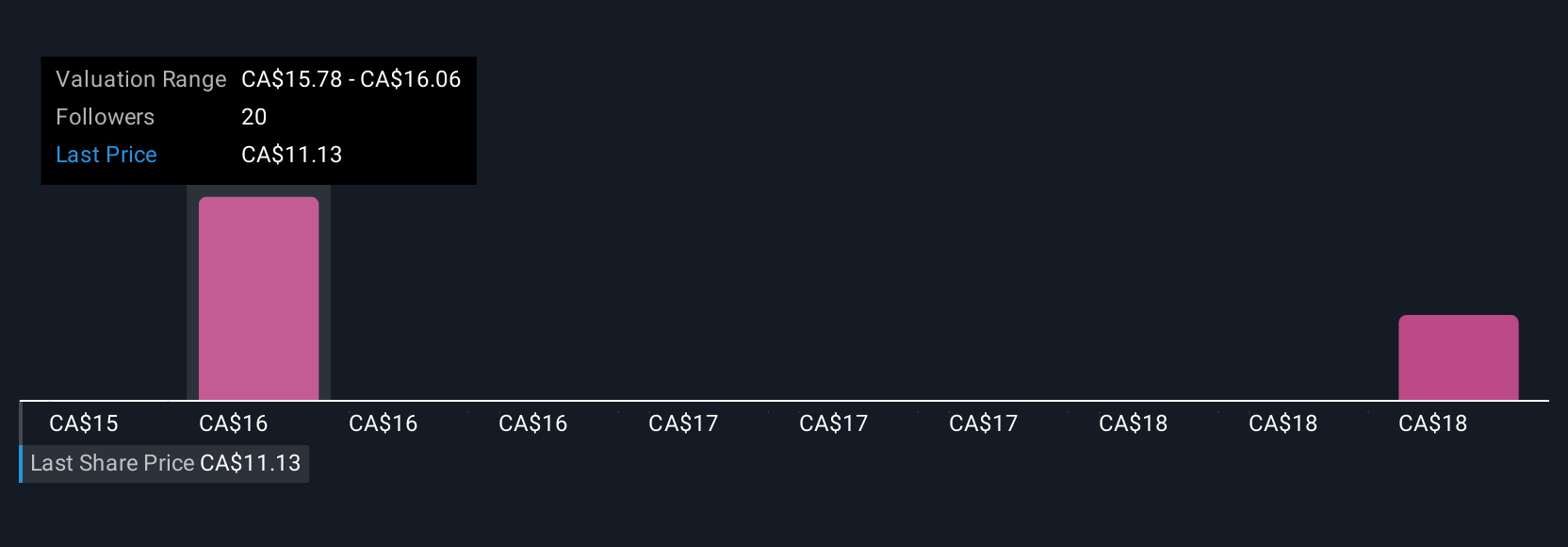

Three community members on Simply Wall St peg Ivanhoe’s fair value between CA$15.51 and CA$18.39 per share. With production guidance recently revised, consider whether shifting operational targets could alter the company’s financial outlook more than anticipated by the consensus.

Explore 3 other fair value estimates on Ivanhoe Mines - why the stock might be worth just CA$15.51!

Build Your Own Ivanhoe Mines Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ivanhoe Mines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Ivanhoe Mines research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ivanhoe Mines' overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- These 17 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 26 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives