- Canada

- /

- Metals and Mining

- /

- TSX:IVN

Ivanhoe Mines (TSX:IVN): Valuation in Focus Following Major Leadership Changes and Platreef Mine Launch

Reviewed by Simply Wall St

Ivanhoe Mines (TSX:IVN) is drawing fresh investor interest following significant leadership changes. Mark Farren is moving into a Strategic Advisor role, and Tom van den Berg is set to become the new Chief Operating Officer. These moves come as the company shifts into its next stage of growth, coinciding with the official launch of the Platreef Mine.

See our latest analysis for Ivanhoe Mines.

Momentum around Ivanhoe Mines has picked up noticeably, in part due to leadership changes and major milestones such as the launch of the Platreef Mine. While the 1-year total shareholder return is still down around 22%, the share price has increased more than 20% in the past three months and rose 16% just this past week. This reflects growing optimism that the company's long-term growth story is regaining traction.

If this kind of turnaround story sparks your curiosity, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

With Ivanhoe shares now trading well below analyst targets but recent momentum boosting optimism, the key question emerges: does the current price still underappreciate Ivanhoe's long-term growth, or has the market already factored in the company's next moves?

Most Popular Narrative: 20.5% Undervalued

The most widely followed narrative suggests Ivanhoe Mines' fair value sits well above the last close, highlighting a notable gap between price and projected future potential. This sets the stage for a deeper look at the drivers and catalysts underpinning analyst sentiment.

Ongoing capacity expansions at Kamoa-Kakula (Phases 1 to 3) and de-bottlenecking at Kipushi, alongside operational recovery from the recent seismic event, are projected to drive substantial increases in copper and zinc output. This is expected to support strong top-line revenue growth in the next 12 to 24 months as production returns to full scale.

How do analysts justify this premium? It comes down to a high-octane growth plan, bold profit forecasts, and future multiples rarely seen in the sector. What precise assumptions fuel these expectations, and how do they compare with sector norms? The full narrative contains deeper insights.

Result: Fair Value of $18.40 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant risks remain. Unexpected operational setbacks or persistent production delays could swiftly undermine current optimism about Ivanhoe's recovery story.

Find out about the key risks to this Ivanhoe Mines narrative.

Another View: Peer Multiples Paint a Cautionary Picture

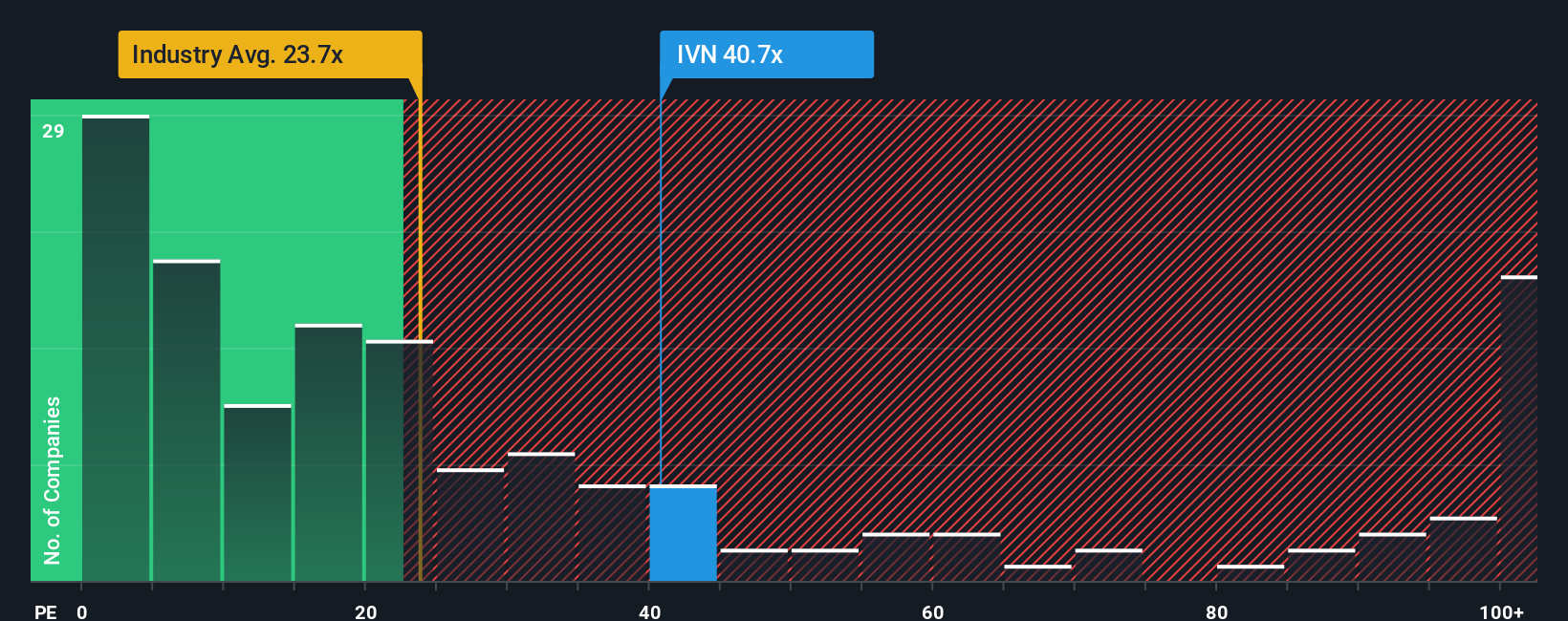

While analysts see upside in Ivanhoe's fair value, the current price-to-earnings ratio stands at 48.6x. This is more than double the Canadian Metals and Mining industry average of 21.2x and well above both peer averages and the fair ratio of 30.2x. This sizable premium suggests the market is pricing in a lot of future growth already. Could this optimism be overextended, or does it signal confidence in Ivanhoe’s unique growth story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Ivanhoe Mines Narrative

If you have a different perspective or want to dig into the numbers yourself, it's never been easier to craft your own narrative and insights. Do it your way

A great starting point for your Ivanhoe Mines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Seize the chance to broaden your investment horizons with unique opportunities hand-picked through the Simply Wall Street Screener. Top stocks can move quickly. Make your next move count before you miss out.

- Benefit from remarkable growth potential by starting your search with these 3560 penny stocks with strong financials offering strong financials and robust business models.

- Unlock value and protect your portfolio by targeting these 914 undervalued stocks based on cash flows that show compelling fundamentals and attractive price points right now.

- Tap into the future of medicine by exploring these 30 healthcare AI stocks, putting you ahead of trends in digital health and the AI-driven transformation of healthcare.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IVN

Ivanhoe Mines

Engages in the mining, development, and exploration of minerals and precious metals in Africa.

High growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026