As the Canadian market navigates through a period of elevated inflation and potential interest rate adjustments by central banks, investors are keenly observing how these factors might impact small-cap stocks. Amidst this backdrop, identifying undiscovered gems with strong fundamentals and growth potential becomes crucial for those looking to capitalize on market opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

GoGold Resources (TSX:GGD)

Simply Wall St Value Rating: ★★★★★★

Overview: GoGold Resources Inc. is involved in the exploration, development, and production of silver, gold, and copper mainly in Mexico with a market capitalization of CA$983.81 million.

Operations: The primary revenue stream for GoGold Resources comes from its metals and mining segment, specifically gold and other precious metals, generating $64.81 million.

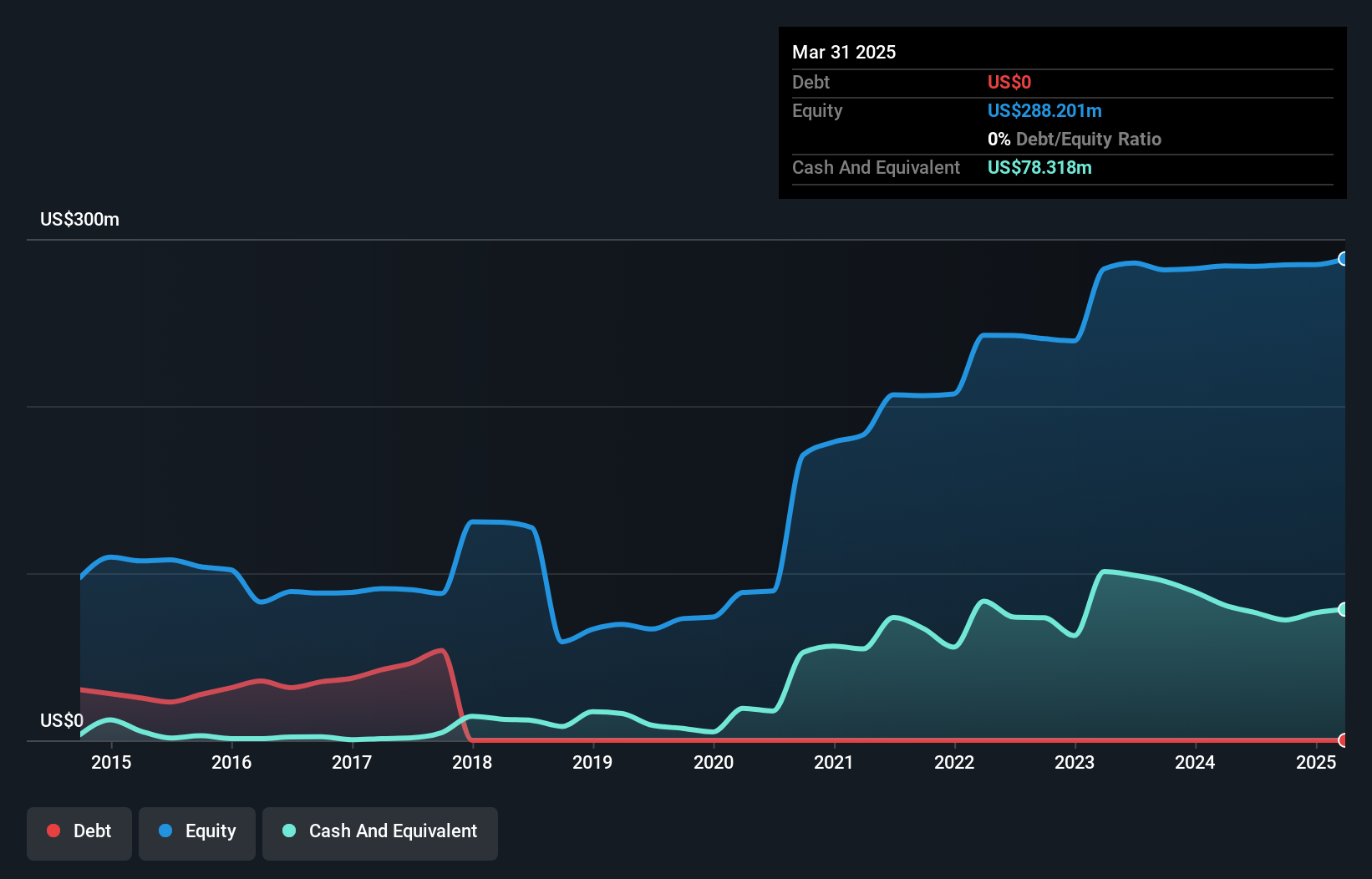

GoGold Resources is making waves with its recent profitability, reporting a net income of US$8.21 million for Q3 2025, a significant turnaround from last year’s net loss of US$0.48 million. The company also saw sales climb to US$17.71 million from US$10.36 million the previous year, showcasing strong growth momentum. With no debt on its books and positive free cash flow, GoGold appears financially robust in the metals and mining sector. Their production for Q2 2025 included 555,500 silver equivalent ounces, highlighting operational efficiency and potential for continued success in precious metals exploration.

- Unlock comprehensive insights into our analysis of GoGold Resources stock in this health report.

Explore historical data to track GoGold Resources' performance over time in our Past section.

TWC Enterprises (TSX:TWC)

Simply Wall St Value Rating: ★★★★★★

Overview: TWC Enterprises Limited, with a market cap of CA$569.92 million, owns, operates, and manages golf clubs under the ClubLink One Membership More Golf brand in Canada and the United States.

Operations: TWC generates revenue primarily from its Canadian Golf Club Operations, which account for CA$162.99 million, followed by US Golf Club Operations at CA$24.81 million.

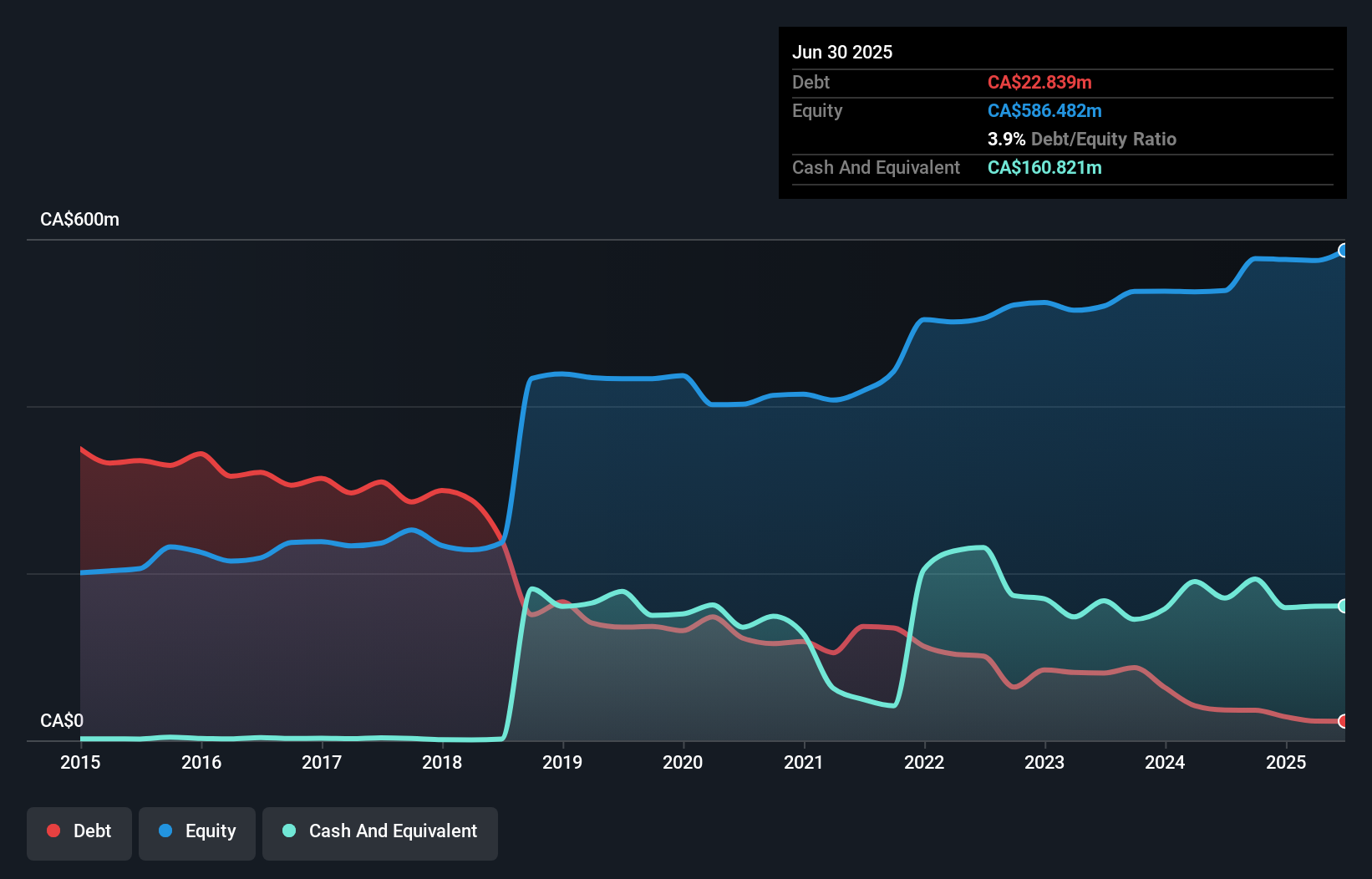

TWC Enterprises, a smaller player in the hospitality sector, has shown notable financial resilience. Over the past year, earnings surged by 140.7%, significantly outpacing the industry average of -0.2%. A one-off gain of CA$23.9M influenced recent results, contributing to a net income jump from CA$3.16M to CA$21.48M for Q2 2025 compared to last year. The company trades at 8.8% below its estimated fair value and has reduced its debt-to-equity ratio from 30.4% to just 3.9% over five years, highlighting effective debt management while maintaining positive free cash flow and sufficient interest coverage capabilities.

- Dive into the specifics of TWC Enterprises here with our thorough health report.

Examine TWC Enterprises' past performance report to understand how it has performed in the past.

Itafos (TSXV:IFOS)

Simply Wall St Value Rating: ★★★★★★

Overview: Itafos Inc. operates as a phosphate and specialty fertilizer company with a market cap of CA$529.46 million.

Operations: Itafos generates revenue primarily from its Conda and Arraias segments, with Conda contributing $488.06 million and Arraias adding $32.65 million.

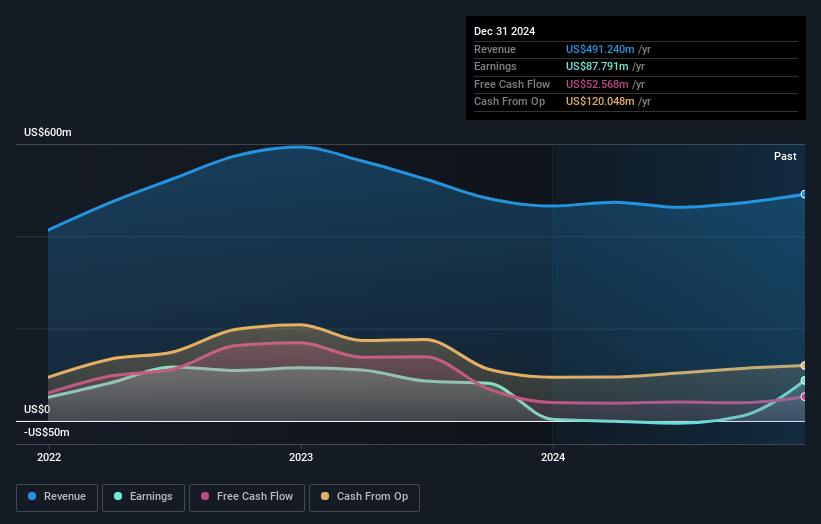

Itafos, a nimble player in the chemicals industry, has shown promising strides with its recent profitability. The company reported a net income of US$24.82 million for Q2 2025, up from US$16.21 million the previous year, driven by sales climbing to US$126.8 million from US$105.06 million. Its debt-to-equity ratio impressively dropped from 211% to just over 23% in five years, highlighting effective financial management. Trading at nearly 41% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities in this sector while maintaining strong interest coverage at 43x EBIT over interest payments.

- Click to explore a detailed breakdown of our findings in Itafos' health report.

Review our historical performance report to gain insights into Itafos''s past performance.

Turning Ideas Into Actions

- Access the full spectrum of 50 TSX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSXV:IFOS

Flawless balance sheet with solid track record.

Market Insights

Community Narratives