- Canada

- /

- Metals and Mining

- /

- TSX:ELD

How Investors Are Reacting To Eldorado Gold (TSX:ELD) Surging Revenue Forecasts and Strong Analyst Optimism

Reviewed by Sasha Jovanovic

- Eldorado Gold recently reported quarterly results for the period ending September 30, 2025, with analyst estimates expecting a substantial 29.6% year-over-year increase in revenue.

- The absence of sell ratings and consistently positive analyst sentiment highlights growing confidence in the company’s operational momentum ahead of its next phase of growth.

- We’ll explore how expectations of strong revenue growth and analyst optimism may influence Eldorado Gold’s investment narrative moving forward.

Find companies with promising cash flow potential yet trading below their fair value.

Eldorado Gold Investment Narrative Recap

To own Eldorado Gold, you generally need to believe that higher gold prices, disciplined project execution, and production volumes from major assets like Skouries can outweigh cost pressures and jurisdictional risks. The expectation for a near 30% jump in quarterly revenue is the biggest immediate catalyst, but persistently high all-in sustaining costs remain the most important short-term risk; the recent results do not appear to materially change this equation, as margin pressure is still a concern.

Among recent announcements, the share buyback program stands out. As of July 31, Eldorado had repurchased over three million shares for CA$87.15 million, reducing the share count into a period of expected top-line growth. This action seeks to enhance per-share earnings metrics as the company aims to deliver on its revenue forecasts.

However, despite these positives, investors should also be aware that if current cost inflation persists or intensifies, margin pressures could quickly outweigh the benefit of headline revenue growth...

Read the full narrative on Eldorado Gold (it's free!)

Eldorado Gold's outlook points to $3.2 billion in revenue and $1.0 billion in earnings by 2028. This reflects a 26.5% annual revenue growth and a $579.7 million increase in earnings from the current $420.3 million.

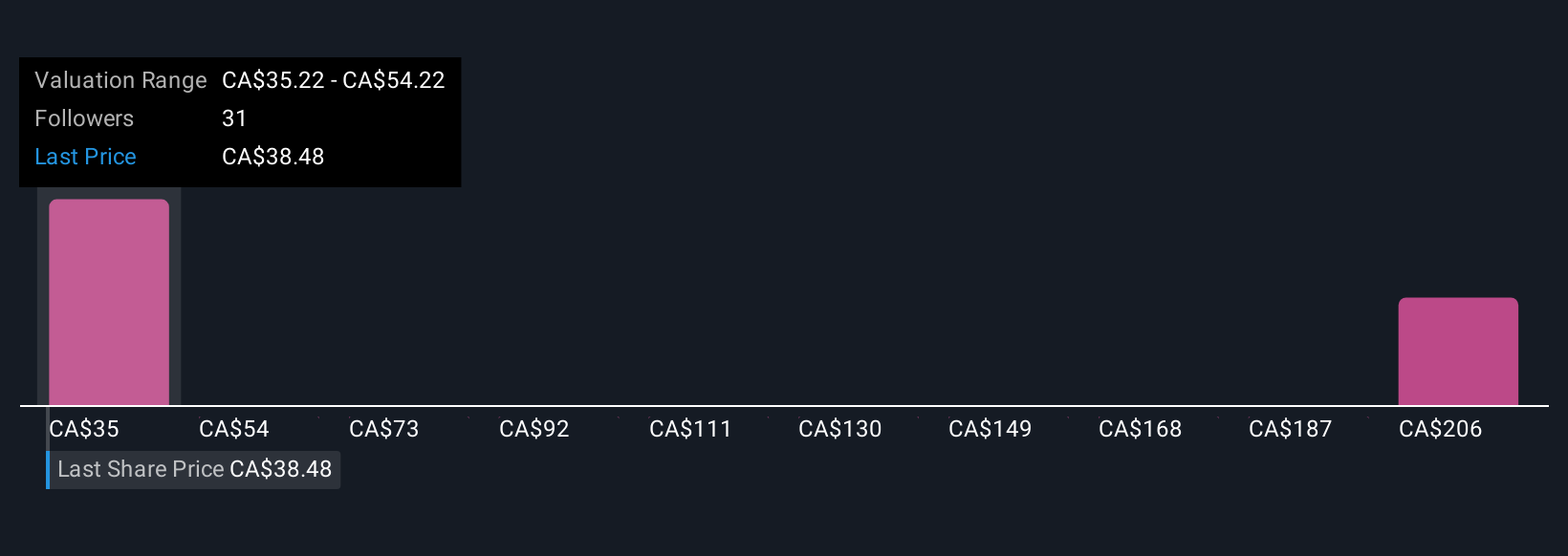

Uncover how Eldorado Gold's forecasts yield a CA$45.20 fair value, a 29% upside to its current price.

Exploring Other Perspectives

Retail fair value estimates from the Simply Wall St Community range from CA$35.35 to CA$359.53 across six submissions, showing wide divergence. With cost control challenges still topical, you may find a range of viewpoints worth considering before drawing conclusions on long-term returns.

Explore 6 other fair value estimates on Eldorado Gold - why the stock might be worth just CA$35.35!

Build Your Own Eldorado Gold Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Eldorado Gold research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Eldorado Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Eldorado Gold's overall financial health at a glance.

Want Some Alternatives?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- AI is about to change healthcare. These 34 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eldorado Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELD

Eldorado Gold

Engages in the mining, exploration, development, and sale of mineral products primarily in Turkey, Canada, and Greece.

Very undervalued with high growth potential.

Similar Companies

Market Insights

Community Narratives