- Canada

- /

- Metals and Mining

- /

- TSX:CS

Capstone Copper (TSX:CS): Exploring Valuation as Expansion Strengthens Multi-Metal Growth Strategy

Reviewed by Simply Wall St

Capstone Copper (TSX:CS) is getting attention lately as the company grows its mining operations across North and South America. Its expansion into multi-metal projects reflects a calculated approach to long-term resource development.

See our latest analysis for Capstone Copper.

Capstone Copper’s recent moves to boost production and expand its operations seem to be energizing the market, with strong momentum reflected in a 25.5% 90-day share price return and a year-to-date gain of nearly 38%. Looking further back, a remarkable 3-year total shareholder return of 165% and an impressive 524% over five years show long-term investors have been well rewarded as the company cements its leadership among diversified copper producers.

If Capstone’s growth has you keeping an eye out for the next mover, now is a perfect opportunity to discover fast growing stocks with high insider ownership

All this momentum might prompt investors to ask whether Capstone Copper’s shares are trading at a discount to their true value, or if strong future growth is already reflected in the current price. Could there still be a buying opportunity?

Most Popular Narrative: 18% Undervalued

Capstone Copper’s most popular narrative fair value of CA$15.01 stands well above its last close at CA$12.29. This considerable gap has investors focused on the financial blueprint driving analyst sentiment.

The imminent execution of the Mantoverde Optimized project, following recent permit approval, will materially increase throughput and sustain higher copper production at lower incremental cost. This is expected to positively impact both revenue and net margins as expanded volumes are realized.

Want to peek inside the numbers that built up this bullish target? The most critical narrative lever is a forecasted earnings surge paired with expanding margins, a combination few companies achieve. The secret behind this valuation lies in a bold set of assumptions you do not want to miss.

Result: Fair Value of $15.01 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, operational setbacks or unpredictable regulatory shifts could quickly challenge the upbeat outlook and result in volatile swings in Capstone Copper’s valuation story.

Find out about the key risks to this Capstone Copper narrative.

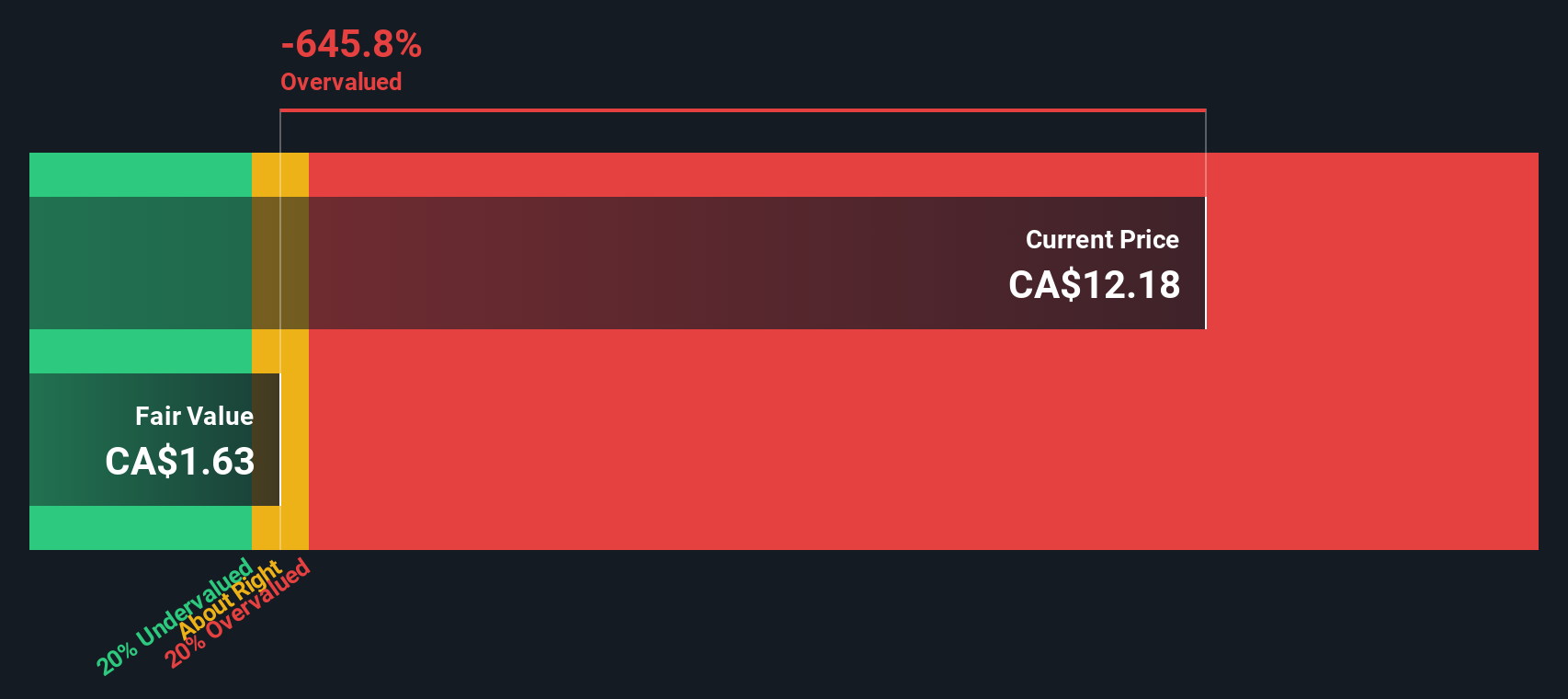

Another View: Discounted Cash Flow Sends Mixed Signals

Looking through the lens of our DCF model, a different valuation story emerges. Based on projected cash flows, Capstone Copper appears overvalued. Its CA$12.29 share price is trading well above the DCF fair value estimate of CA$1.59. Could this mean the market is pricing in too much optimism, or is there more to the narrative?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Capstone Copper for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Capstone Copper Narrative

If you think there’s another way to interpret the numbers or want to craft your own perspective, you can build a narrative in just a few minutes. Do it your way

A great starting point for your Capstone Copper research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Smart investors always stay ahead by seeking fresh opportunities. Don’t let the best ideas pass you by when there are standout contenders waiting for attention.

- Tap into tomorrow’s tech by tracking advancements and breakthroughs through these 25 AI penny stocks that are transforming entire industries.

- Zero in on growth with confidence by finding these 928 undervalued stocks based on cash flows that meet strict cash flow criteria and could offer major upside potential.

- Secure a reliable income stream and peace of mind by exploring these 14 dividend stocks with yields > 3% that consistently deliver healthy yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CS

Capstone Copper

A copper mining company, mines, explores for, and develops mineral properties in the United States, Chile, and Mexico.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026