- Canada

- /

- Oil and Gas

- /

- TSX:VET

Top Undervalued Small Caps In Canada With Insider Buying For September 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has remained flat, but it is up 19% over the past year with earnings forecast to grow by 15% annually. In such a dynamic environment, identifying undervalued small-cap stocks with insider buying can offer promising opportunities for investors looking to capitalize on potential growth.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Vermilion Energy | NA | 1.2x | 46.10% | ★★★★★★ |

| Trican Well Service | 7.6x | 0.9x | 13.36% | ★★★★★☆ |

| Nexus Industrial REIT | 3.8x | 3.8x | 21.50% | ★★★★★☆ |

| Flagship Communities Real Estate Investment Trust | 3.6x | 3.8x | 45.28% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 49.50% | ★★★★★☆ |

| Rogers Sugar | 15.7x | 0.6x | 46.99% | ★★★★☆☆ |

| Sagicor Financial | 1.2x | 0.3x | -32.58% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | -57.50% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.4x | 3.3x | 39.88% | ★★★★☆☆ |

| Hemisphere Energy | 6.1x | 2.3x | -215.70% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

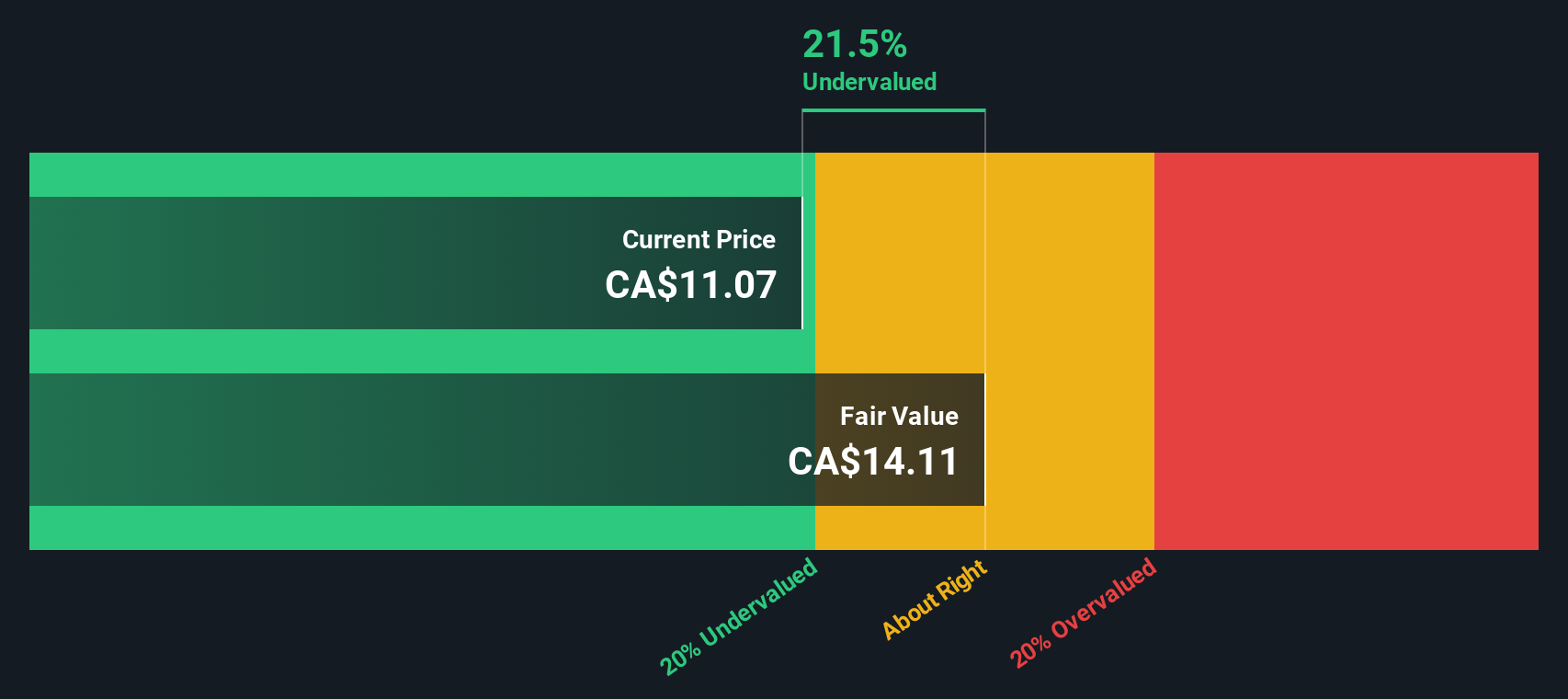

Chemtrade Logistics Income Fund (TSX:CHE.UN)

Simply Wall St Value Rating: ★★★★★★

Overview: Chemtrade Logistics Income Fund operates in the chemical industry, providing industrial chemicals and services with a market cap of approximately CA$0.84 billion.

Operations: The company's revenue streams are primarily derived from EC (CA$747.04 million) and SWC (CA$1.03 billion). For the period ending 2024-06-30, it reported a gross profit margin of 22.43% with operating expenses totaling CA$147.04 million.

PE: 8.8x

Chemtrade Logistics Income Fund, a small-cap Canadian company, recently declared a monthly cash distribution of CAD 0.055 per unit for September 2024. Despite reporting lower Q2 sales at CAD 448.1 million and net income of CAD 14.6 million, the company completed a buyback of 546,700 shares worth CAD 5.08 million from May to August 2024, indicating insider confidence in its long-term prospects. However, with earnings expected to decline by an average of 1% annually over the next three years and profit margins dropping from last year's figures (12% to current 7.8%), potential investors should weigh these factors carefully.

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates in the healthcare real estate industry, managing a portfolio of medical office buildings, clinics, and hospitals with a market cap of approximately CA$2.90 billion.

Operations: The company generates revenue primarily from the healthcare real estate industry, with a notable gross profit margin of 82.39% as of September 30, 2021. Operating expenses and non-operating expenses significantly impact net income, which has shown considerable fluctuations over the periods observed.

PE: -3.5x

NorthWest Healthcare Properties Real Estate Investment Trust, a smaller Canadian stock, has shown insider confidence with Peter Aghar purchasing 100,000 shares worth C$477,861 recently. Despite reporting a net loss of C$122.34 million for Q2 2024 compared to a loss of C$32.09 million the previous year, the company continues to declare monthly distributions of C$0.03 per unit. This consistent dividend policy might indicate management's belief in future stability and growth potential despite current financial challenges.

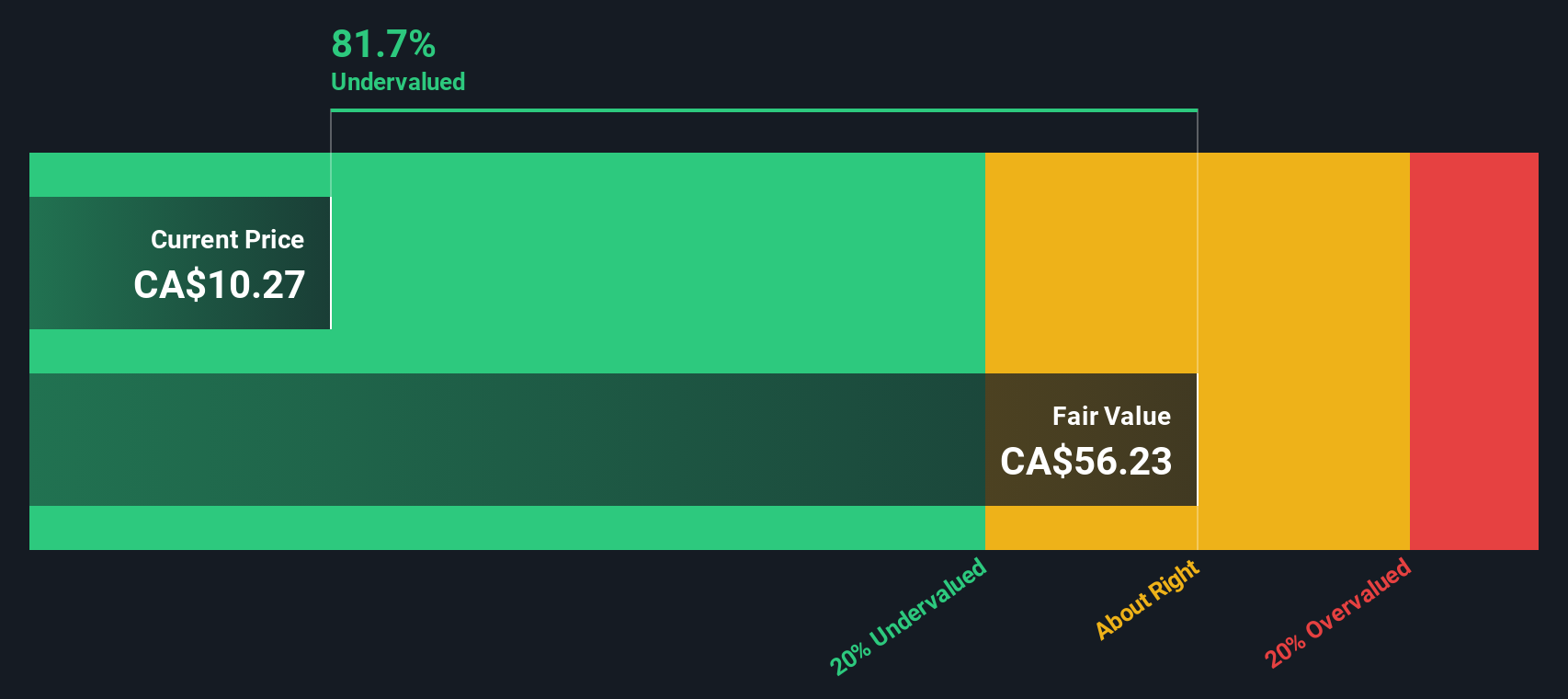

Vermilion Energy (TSX:VET)

Simply Wall St Value Rating: ★★★★★★

Overview: Vermilion Energy is an international oil and gas exploration and production company with a market cap of approximately CA$2.5 billion.

Operations: Vermilion Energy's primary revenue stream is derived from oil and gas exploration and production, generating CA$1812.94 million in the latest period. The company reported a gross profit of CA$1191.41 million with a gross profit margin of 65.72%.

PE: -2.5x

Vermilion Energy is an intriguing small-cap stock in Canada, showing signs of being undervalued. Recent insider confidence is evident with significant share purchases from April to July 2024, totaling CAD 59.8 million for 3.7 million shares. Operationally, the company achieved a notable milestone by completing its first deep gas exploration well in Germany with promising results and has started drilling a second well. Additionally, Vermilion's Croatian operations have ramped up production significantly, contributing to strong cash flow netbacks due to premium natural gas pricing. Despite reporting a net loss of CAD 80.12 million for the first half of 2024, the company remains focused on optimizing costs and enhancing project returns through strategic partnerships and operational efficiencies.

- Click here and access our complete valuation analysis report to understand the dynamics of Vermilion Energy.

Examine Vermilion Energy's past performance report to understand how it has performed in the past.

Turning Ideas Into Actions

- Access the full spectrum of 19 Undervalued TSX Small Caps With Insider Buying by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VET

Vermilion Energy

Engages in the acquisition, exploration, development, and production of petroleum and natural gas.

Very undervalued with adequate balance sheet.