- Canada

- /

- Metals and Mining

- /

- TSX:CXB

Top 3 Undervalued Small Caps With Insider Buying In Canada August 2024

Reviewed by Simply Wall St

The Canadian market has recently experienced a positive shift, with the TSX rebounding over 5% amid easing inflation and better-than-expected economic data. As central banks in both Canada and the U.S. signal potential rate cuts, investor sentiment towards small-cap stocks is improving. In this favorable environment, identifying undervalued small-cap stocks with insider buying can provide significant opportunities for investors looking to capitalize on market trends.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Calfrac Well Services | 2.6x | 0.2x | 35.94% | ★★★★★★ |

| Nexus Industrial REIT | 3.4x | 3.4x | 26.75% | ★★★★★☆ |

| Obsidian Energy | 6.4x | 1.0x | 49.43% | ★★★★★☆ |

| Bragg Gaming Group | NA | 1.2x | 18.09% | ★★★★★☆ |

| Trican Well Service | 8.0x | 1.0x | 7.33% | ★★★★☆☆ |

| Hemisphere Energy | 5.8x | 2.3x | 11.68% | ★★★★☆☆ |

| Information Services | 23.7x | 2.1x | -64.82% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -43.67% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 11.0x | 2.9x | 44.99% | ★★★★☆☆ |

| ADENTRA | 16.4x | 0.3x | 10.25% | ★★★☆☆☆ |

Let's uncover some gems from our specialized screener.

Centerra Gold (TSX:CG)

Simply Wall St Value Rating: ★★★★★☆

Overview: Centerra Gold is a mining company engaged in the exploration, development, and production of gold and copper with operations primarily at the Öksüt mine, Mount Milligan mine, and a molybdenum business segment.

Operations: Centerra Gold's revenue for the latest period was $1.27 billion, primarily from Öksüt, Mount Milligan, and Molybdenum segments. The gross profit margin stood at 44.22%.

PE: 11.4x

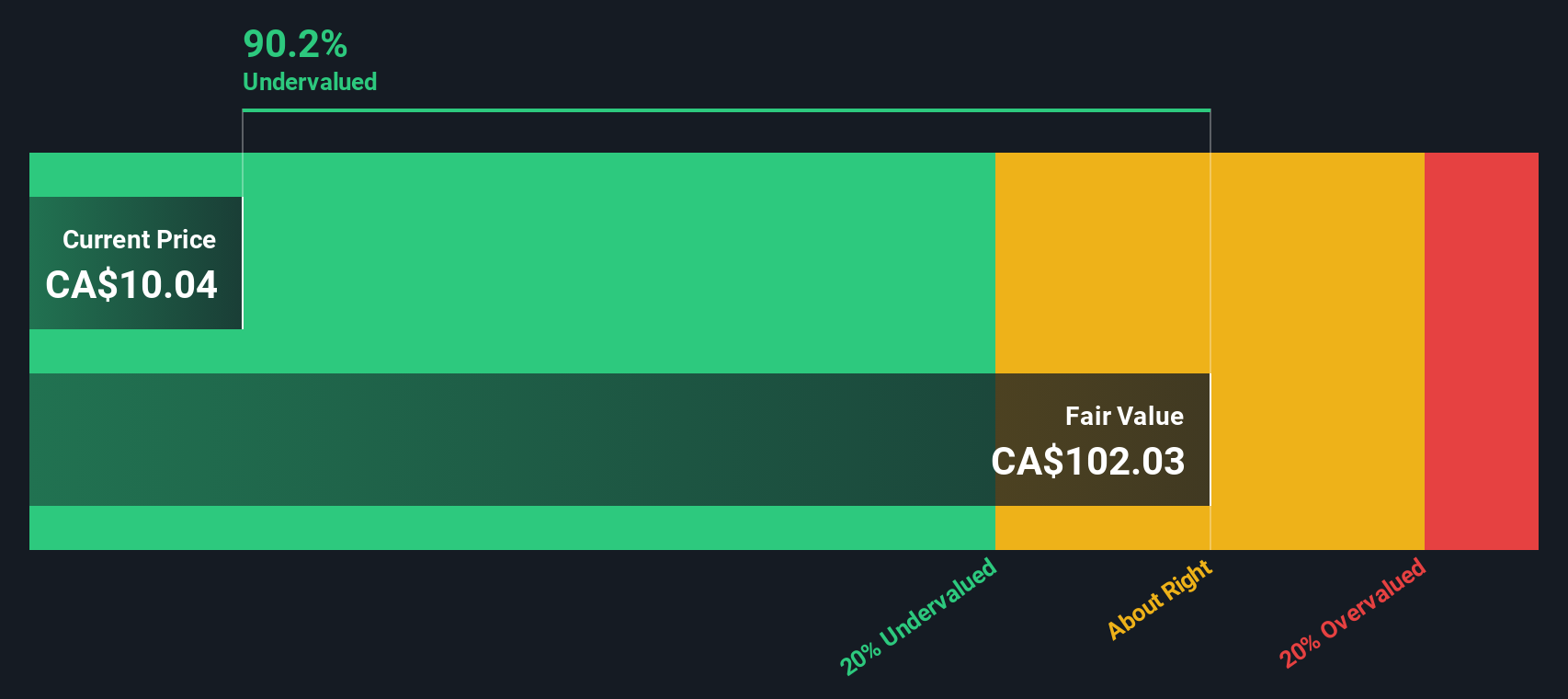

Centerra Gold, a Canadian small-cap, reported a significant turnaround in Q2 2024 with sales of US$282.31 million and net income of US$37.67 million compared to a loss last year. They also announced a quarterly dividend of CAD 0.07 per share and repurchased 1,439,700 shares for $9.8 million between April and June 2024. Despite earnings forecasted to decline by an average of 13.7% annually over the next three years, insider confidence is evident with recent purchases indicating potential value recognition within the market.

- Get an in-depth perspective on Centerra Gold's performance by reading our valuation report here.

Gain insights into Centerra Gold's historical performance by reviewing our past performance report.

Calibre Mining (TSX:CXB)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Calibre Mining is a gold mining company engaged in the exploration and production of refined gold, with a market cap of approximately C$0.88 billion.

Operations: Calibre Mining's primary revenue stream is from refined gold, with the latest reported revenue at $564.69 million. The company's gross profit margin has shown variability, reaching 42.07% in the most recent period. Operating expenses and non-operating expenses are significant cost components, with recent figures standing at $122.60 million and $62.40 million respectively. Net income margin was recorded at 9.30%.

PE: 25.5x

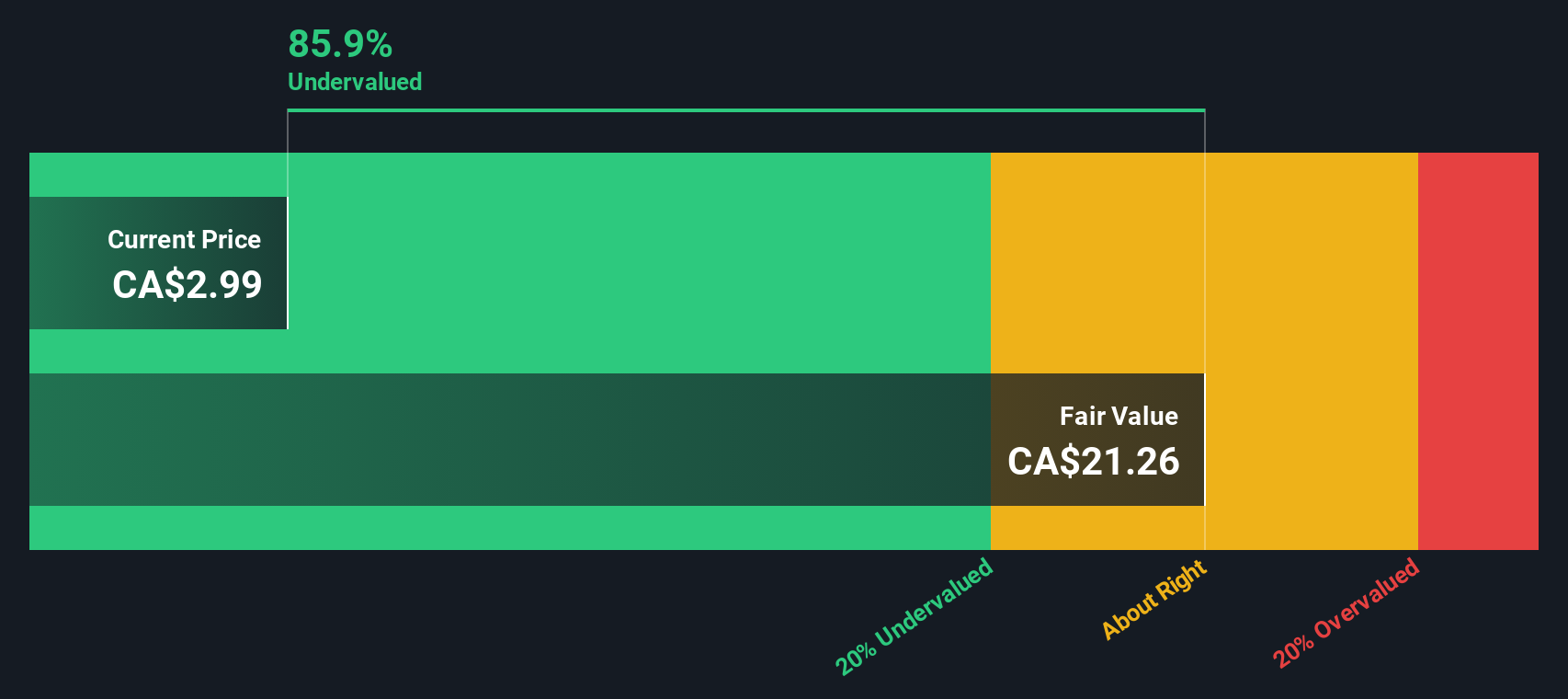

Calibre Mining, a Canadian small-cap company, has shown insider confidence with recent share purchases. Despite a dip in profit margins from 14.3% to 9.3%, the company forecasts a 22.66% annual earnings growth. Recent drill results from their Eastern Borosi Mine in Nicaragua revealed high-grade gold intercepts, such as 13.24 g/t Au over 5.8 metres ETW, indicating strong resource potential. Additionally, Calibre's consolidated production guidance for 2024 remains robust at up to 300,000 ounces of gold.

- Dive into the specifics of Calibre Mining here with our thorough valuation report.

Understand Calibre Mining's track record by examining our Past report.

NorthWest Healthcare Properties Real Estate Investment Trust (TSX:NWH.UN)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: NorthWest Healthcare Properties Real Estate Investment Trust operates in the healthcare real estate industry, managing a portfolio of properties with a market cap of approximately CA$2.63 billion.

Operations: The company generates revenue primarily from the healthcare real estate sector, with a notable gross profit margin of 77.81% as of the latest data. Operating expenses and non-operating expenses have significantly impacted net income, resulting in a net loss in recent periods.

PE: -3.2x

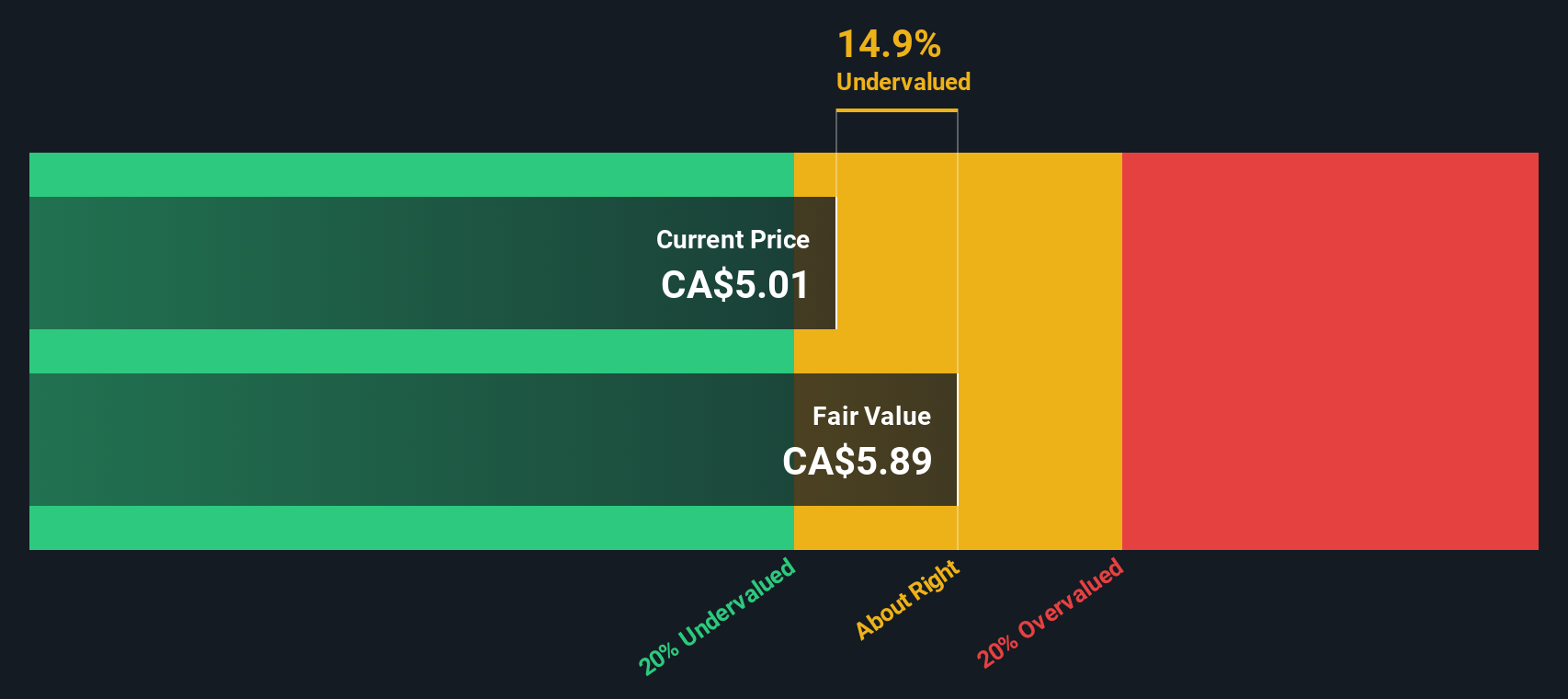

NorthWest Healthcare Properties Real Estate Investment Trust, a small-cap REIT in Canada, recently declared a monthly distribution of C$0.03 per unit for August 2024. Despite reporting a net loss of C$122.34 million for Q2 2024, insiders have shown confidence by purchasing shares over the past few months. The company’s earnings are forecasted to grow at an impressive rate of 105.4% annually, indicating potential future growth despite current financial challenges and reliance on external borrowing for funding.

Turning Ideas Into Actions

- Investigate our full lineup of 26 Undervalued TSX Small Caps With Insider Buying right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CXB

Calibre Mining

Engages in the exploration, development, and mining of gold properties in Nicaragua, the United States, and Canada.

Reasonable growth potential with adequate balance sheet.