- Canada

- /

- Metals and Mining

- /

- TSX:AYA

Top TSX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

As markets have welcomed easing inflation and better-than-expected economic data, the Canadian TSX has rebounded by over 5%, signaling a return of positive sentiment. In this environment, growth companies with high insider ownership can be particularly attractive as they often demonstrate strong alignment between management and shareholder interests, potentially driving robust performance.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Vox Royalty (TSX:VOXR) | 12.6% | 70.7% |

| Allied Gold (TSX:AAUC) | 22.5% | 73.6% |

| Artemis Gold (TSXV:ARTG) | 30.8% | 47.4% |

| Almonty Industries (TSX:AII) | 17.7% | 117.6% |

| goeasy (TSX:GSY) | 21.4% | 17.1% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 72.4% |

| Aya Gold & Silver (TSX:AYA) | 10.2% | 60.9% |

| Medicenna Therapeutics (TSX:MDNA) | 15.4% | 57.2% |

| Alpha Cognition (CNSX:ACOG) | 17.9% | 69.5% |

| ROK Resources (TSXV:ROK) | 16.6% | 184.5% |

Let's review some notable picks from our screened stocks.

Aya Gold & Silver (TSX:AYA)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Aya Gold & Silver Inc. (TSX:AYA) is involved in the exploration, evaluation, and development of precious metals projects in Morocco and has a market cap of CA$2.10 billion.

Operations: Aya Gold & Silver generates revenue primarily from the production at the Zgounder Silver Mine in Morocco, amounting to $41.54 million.

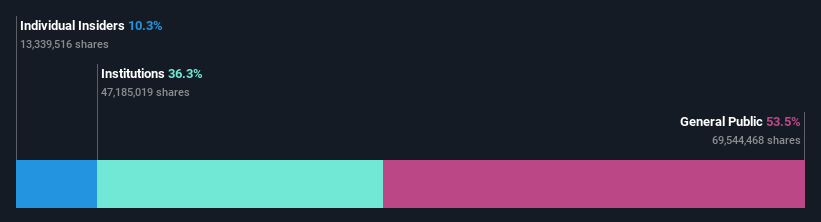

Insider Ownership: 10.2%

Aya Gold & Silver has seen significant insider buying over the past three months, indicating strong internal confidence. The company reported a substantial earnings turnaround with a net income of US$6.84 million in Q2 2024 compared to a loss last year. Revenue is forecasted to grow significantly faster than the Canadian market, supported by high-quality earnings and ongoing expansion projects like the Zgounder Silver Mine in Morocco.

- Click here and access our complete growth analysis report to understand the dynamics of Aya Gold & Silver.

- According our valuation report, there's an indication that Aya Gold & Silver's share price might be on the expensive side.

Colliers International Group (TSX:CIGI)

Simply Wall St Growth Rating: ★★★★☆☆

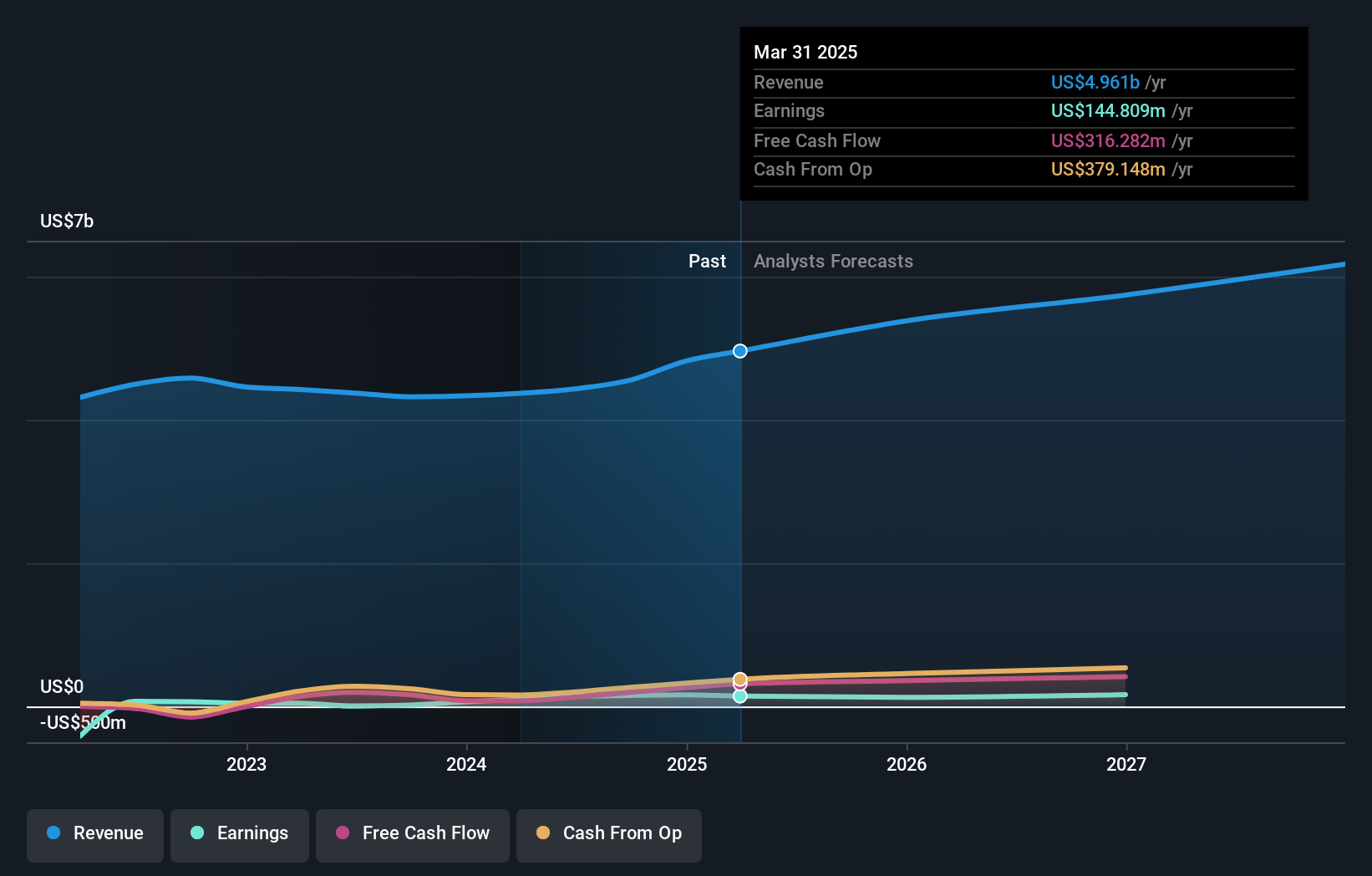

Overview: Colliers International Group Inc. offers commercial real estate professional and investment management services to corporate and institutional clients across the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of CA$9.63 billion.

Operations: Revenue segments for Colliers International Group Inc. include the Americas at $2.59 billion, Asia Pacific at $614.55 million, Investment Management at $496.42 million, and Europe, Middle East & Africa (EMEA) at $734.93 million.

Insider Ownership: 14.2%

Colliers International Group has demonstrated strong growth, with Q2 2024 earnings showing a net income of US$36.72 million compared to a net loss the previous year. Revenue for the first half of 2024 increased to US$2.14 billion from US$2.04 billion in 2023. Despite some insider selling recently, Colliers' revenue and earnings are forecasted to grow faster than the Canadian market, bolstered by strategic partnerships and acquisitions like Englobe and SPGI Zurich AG.

- Click here to discover the nuances of Colliers International Group with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Colliers International Group is priced higher than what may be justified by its financials.

Ivanhoe Mines (TSX:IVN)

Simply Wall St Growth Rating: ★★★★★☆

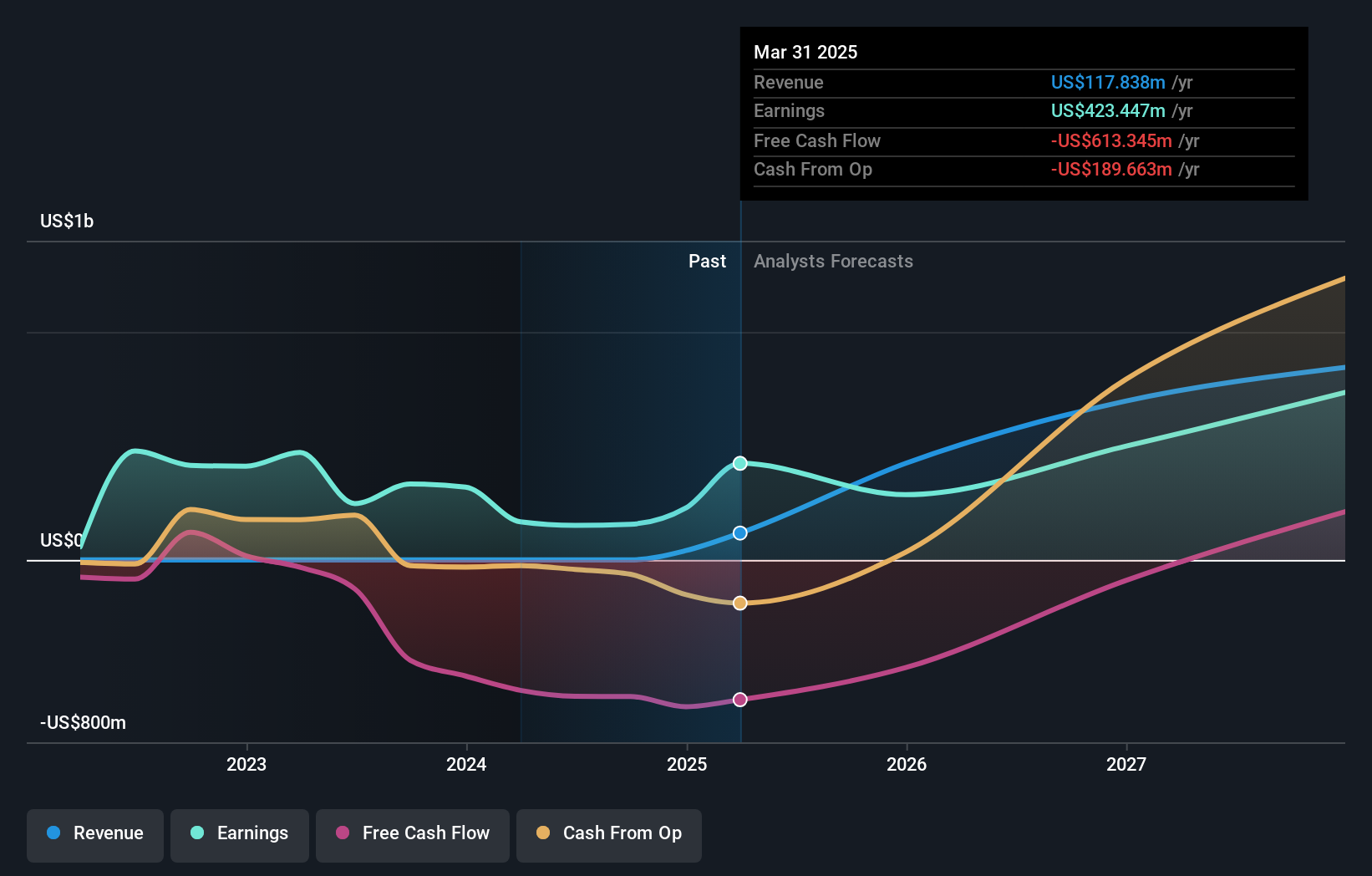

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$24.64 billion.

Operations: Ivanhoe Mines Ltd. generates revenue through the mining, development, and exploration of minerals and precious metals in Africa.

Insider Ownership: 12.4%

Ivanhoe Mines has shown significant growth potential with high insider ownership. Despite recent earnings showing a decline in net income to US$76.4 million for Q2 2024, the company's revenue and earnings are forecasted to grow substantially faster than the Canadian market. The completion of the Phase 3 concentrator at Kamoa-Kakula ahead of schedule is set to boost copper production, positioning it as one of the world's largest copper mining complexes.

- Get an in-depth perspective on Ivanhoe Mines' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Ivanhoe Mines shares in the market.

Next Steps

- Navigate through the entire inventory of 36 Fast Growing TSX Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AYA

Aya Gold & Silver

Engages in the exploration, evaluation, and development of precious metals projects in Morocco.

High growth potential with proven track record.