- Canada

- /

- Metals and Mining

- /

- TSX:ASM

Avino Silver & Gold Mines (TSX:ASM): Evaluating Valuation After Recent Share Price Swings

Reviewed by Simply Wall St

See our latest analysis for Avino Silver & Gold Mines.

Despite a turbulent drop of over 22% in the past month, Avino Silver & Gold Mines is still riding a wave of momentum. The company is boasting a 325.9% year-to-date share price return and a five-year total shareholder return of more than 330%. Recent swings suggest investors are recalibrating their outlook, weighing both renewed growth potential and changing risk perceptions as the stock consolidates its exceptional annual gains.

Curious about what else the market is rewarding? This is a perfect time to expand your radar and explore fast growing stocks with high insider ownership

With such impressive recent gains, but shares now trading near analyst price targets, is Avino Silver & Gold Mines still undervalued? Or have markets already factored in its future prospects, leaving investors to weigh if there is a true buying opportunity?

Most Popular Narrative: 11.7% Overvalued

With Avino Silver & Gold Mines' most followed narrative assigning a fair value of CA$5.30 per share, the recent closing price of CA$5.92 stands 11.7% above that mark. This raises questions about whether current optimism is running ahead of fundamentals.

The company’s robust performance and low all-in sustaining costs could be leading the market to assume net margins will structurally expand. At the same time, rising interest rates and increased regulatory pressure (ESG compliance, permitting, environmental standards) are likely to drive up operating and compliance costs and may potentially compress future profitability.

Want to know precisely what is powering this high valuation? This narrative hinges on ambitious future earnings, surging revenues, and profit margins worthy of industry standouts. The fair value case is built on bold numbers and aggressive targets that may surprise you. Click through for the full breakdown and see what financial projections the market is watching.

Result: Fair Value of $5.30 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, robust production gains or significant cost declines could quickly shift the outlook. This could challenge assumptions that have driven recent overvaluation concerns.

Find out about the key risks to this Avino Silver & Gold Mines narrative.

Another View: Deep Value or Just Risk?

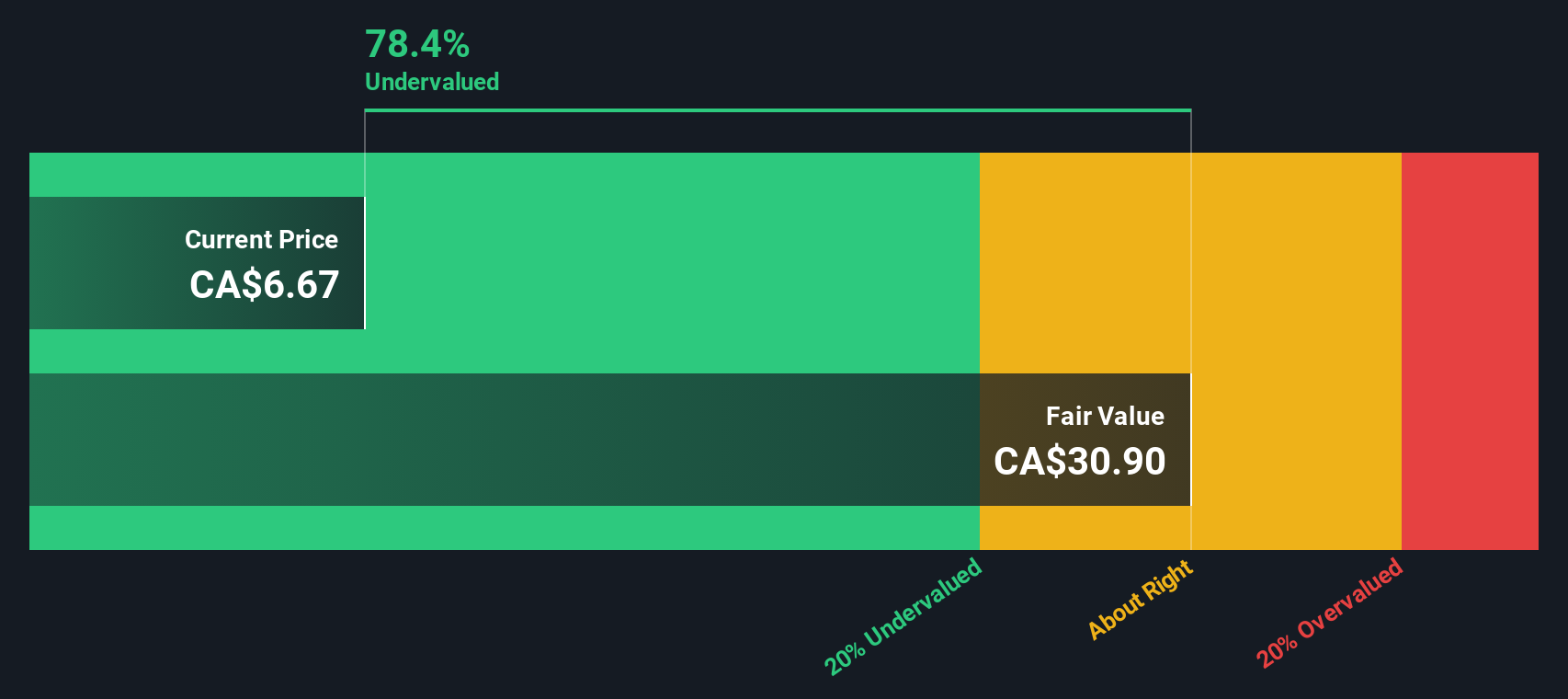

While analyst targets suggest the stock is overvalued based on projected earnings, our SWS DCF model presents a very different picture. It estimates Avino Silver & Gold Mines is heavily undervalued compared to its future cash flows. But can long-term fundamentals outweigh short-term market sentiment?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Avino Silver & Gold Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 842 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Avino Silver & Gold Mines Narrative

If you see the story differently, or want to dive deeper with your own research, it's simple to build a personalized narrative yourself in just a few minutes. Do it your way

A great starting point for your Avino Silver & Gold Mines research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

You owe it to yourself to seize every edge in today’s market. Uncover the most exciting opportunities others are missing with tailored strategies that match your style.

- Capture high potential in early-stage companies by checking out these 3604 penny stocks with strong financials and see which names are drawing the market’s attention right now.

- Capitalize on the AI boom by scanning these 26 AI penny stocks which could be the next breakthrough winners in artificial intelligence and automation.

- Pursue outstanding value with these 842 undervalued stocks based on cash flows that the market may have overlooked and position yourself ahead of the crowd.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ASM

Avino Silver & Gold Mines

Engages in the acquisition, exploration, and advancement of mineral properties in Mexico.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives