- Canada

- /

- Metals and Mining

- /

- TSX:ARIS

Will Aris Mining’s New Board Appointment Reflect a Deeper ESG Shift for TSX:ARIS Investors?

Reviewed by Sasha Jovanovic

- Aris Mining Corporation announced in late October the appointment of Brigitte Baptiste, a renowned Colombian biologist and sustainability advocate, to its Board of Directors.

- Baptiste’s expertise in biodiversity and sustainable development brings additional environmental and stakeholder insight to the company’s leadership at a time of ongoing production growth.

- We’ll explore how this leadership change highlights Aris Mining’s increased focus on ESG stewardship in its overall investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

Aris Mining Investment Narrative Recap

To believe in Aris Mining, an investor must have confidence in the company's ability to expand gold production efficiently while managing significant geopolitical, regulatory, and ESG-related risks tied to its Colombian operations. The addition of Brigitte Baptiste to the Board further aligns Aris with sustainability goals, but the most critical near-term catalyst, execution of the Segovia and Marmato expansions, remains largely unaffected by this news, as the key risk continues to be operational and policy challenges within Colombia.

Among recent developments, the expansion at Segovia, which increased processing capacity by 50%, stands out as directly relevant to Aris Mining’s targeted production growth. This operational milestone underpins the company's growth narrative, with the ongoing challenge now focused on delivering consistent results from expansion projects amid evolving local and regulatory dynamics.

However, investors should not overlook the uncertainty tied to future policy decisions in Colombia and their potential to...

Read the full narrative on Aris Mining (it's free!)

Aris Mining's narrative projects $1.5 billion revenue and $695.3 million earnings by 2028. This requires 32.4% yearly revenue growth and a $690.2 million increase in earnings from the current $5.1 million.

Uncover how Aris Mining's forecasts yield a CA$23.57 fair value, a 49% upside to its current price.

Exploring Other Perspectives

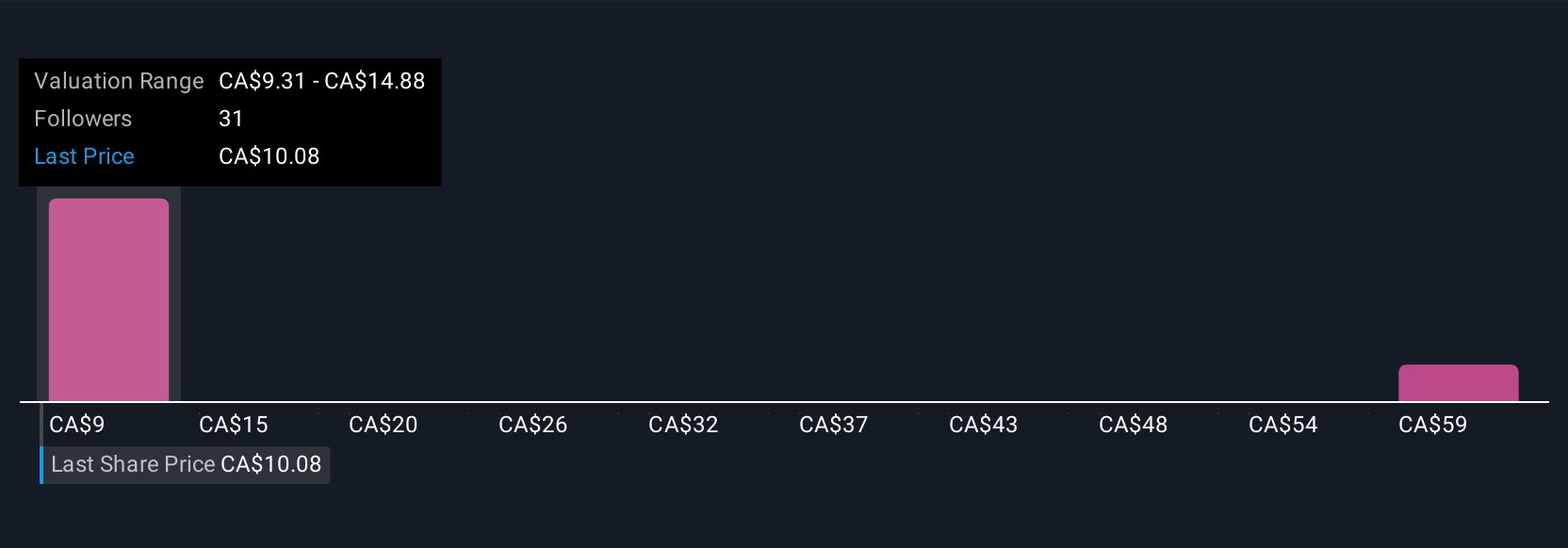

Seven private investors in the Simply Wall St Community estimate Aris Mining’s fair value between US$9.31 and US$65 per share. While some expect robust production growth, ongoing regulatory and social risks in Colombia may limit upside potential, see how investor expectations compare and why views differ.

Explore 7 other fair value estimates on Aris Mining - why the stock might be worth over 4x more than the current price!

Build Your Own Aris Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Aris Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Aris Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Aris Mining's overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ARIS

Aris Mining

Engages in the acquisition, exploration, development, and operation of gold properties in Canada, Colombia, and Guyana.

Exceptional growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives