- Canada

- /

- Metals and Mining

- /

- TSX:AGI

Has Alamos Gold’s 89% Surge Made Its Shares Too Pricey in 2025?

Reviewed by Bailey Pemberton

- Wondering if Alamos Gold is actually worth what the market's paying? You're not alone, with curiosity running high as gold stocks make headlines.

- Alamos Gold has seen some impressive price moves lately, climbing 9.3% in just the last week and soaring an eye-catching 89.0% over the past year.

- Market momentum has been shaped by a flurry of positive industry updates and increased interest in gold as an inflation hedge, as well as M&A activity fueling fresh optimism. News about strategic investments and resource expansions has also caught investor attention, adding context to recent price surges.

- The company currently scores 4 out of 6 on our valuation checks, suggesting it passes most tests for undervaluation, though not all. Let’s break down these methods and set the scene for a more dynamic approach to understanding the real value of Alamos Gold.

Approach 1: Alamos Gold Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model works by projecting a company’s future cash flows and discounting them back to today’s value. This method gives a grounded estimate of what a business is really worth, regardless of wild swings in its share price.

For Alamos Gold, current Free Cash Flow stands at $223 million. Analysts forecast significant growth over the next few years, with cash flows projected to reach $2.19 billion by 2029. Estimates up to five years ahead are direct from analysts, while numbers further out are extrapolations designed to give a long-term perspective on the company’s earning power.

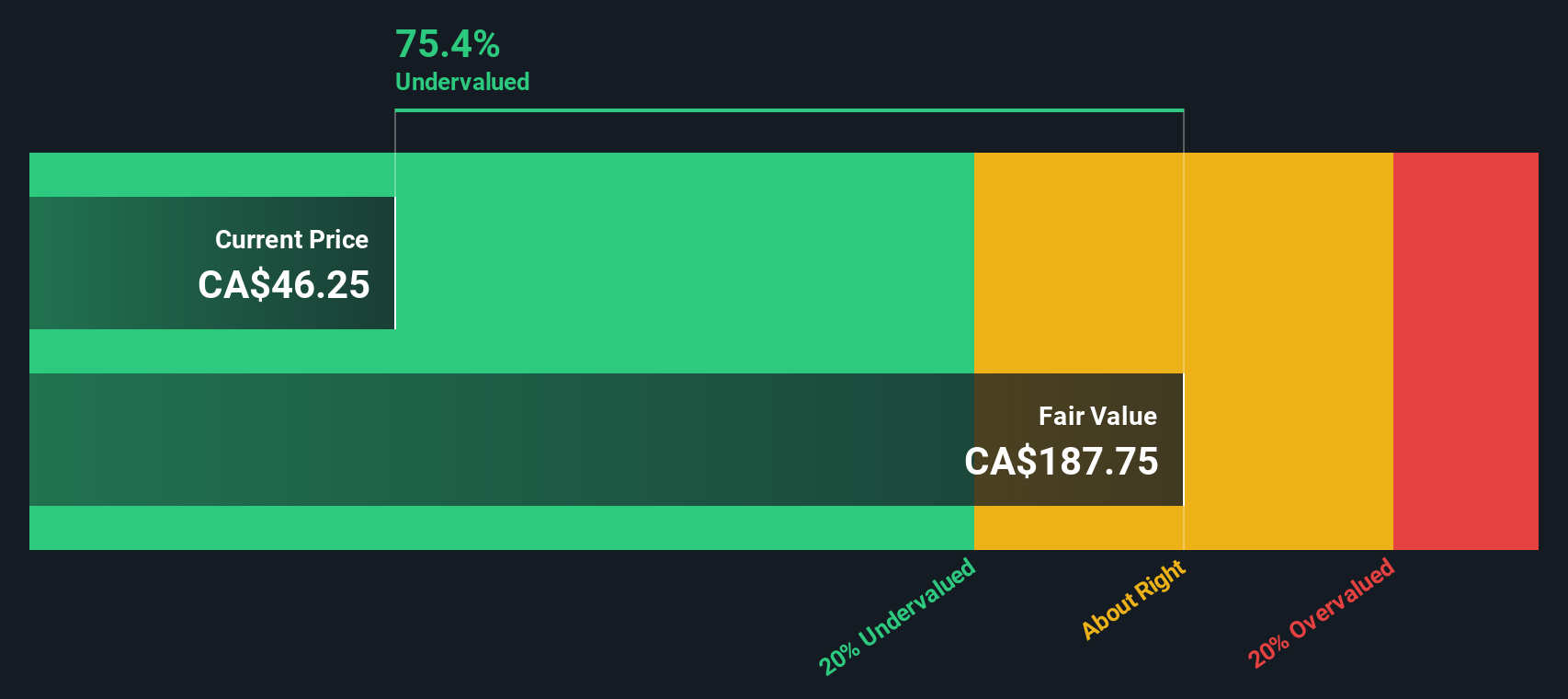

Running these cash flows through the DCF model generates an estimated intrinsic value of $216.68 per share. Compared to the current market valuation, this analysis implies the stock is trading at a 78.3 percent discount to its fair value. This places it in undervalued territory according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Alamos Gold is undervalued by 78.3%. Track this in your watchlist or portfolio, or discover 884 more undervalued stocks based on cash flows.

Approach 2: Alamos Gold Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Alamos Gold, as it directly relates a company’s share price to its actual earnings. For businesses generating strong profits, the PE ratio is especially relevant because it quickly signals how much investors are willing to pay for every dollar of earnings.

Growth prospects and risk are key drivers of what counts as a “normal” or “fair” PE ratio. Companies expected to grow faster or with more resilient earnings typically command higher PE ratios, while those facing more uncertainty or slower growth rates trade at lower ones.

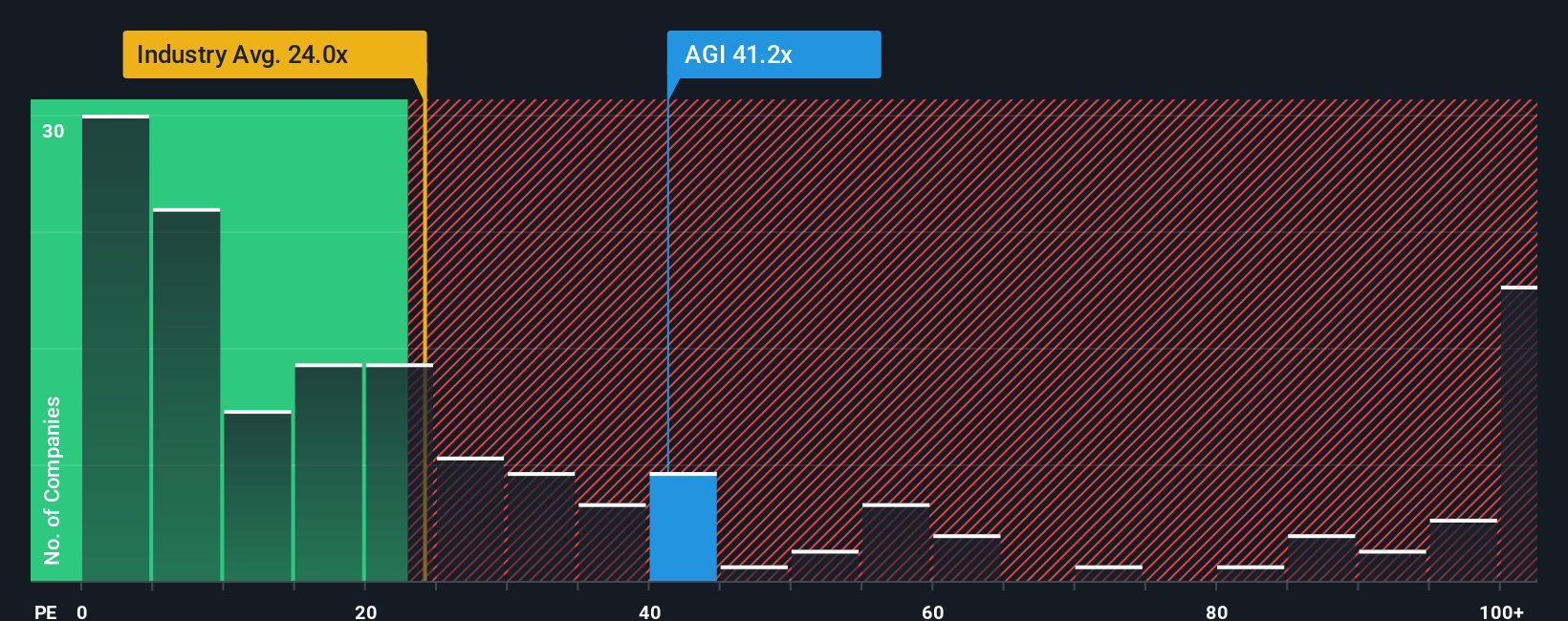

As of now, Alamos Gold trades on a 26.1x PE ratio. This is above the Metals and Mining industry average of 20.5x, but well below the peer group average of 65.7x. Simply Wall St’s proprietary “Fair Ratio” model, which goes a step further by factoring in metrics like projected earnings growth, market cap, profit margins, and company-specific risks, suggests a fair PE ratio of 25.9x for Alamos Gold.

The Fair Ratio is a more holistic benchmark than simple peer or industry comparisons because it captures the nuances behind a company’s financial profile and market position. In this case, Alamos Gold’s current PE is almost identical to its Fair Ratio, indicating that the stock is valued about where it should be, given its fundamentals and future outlook.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1405 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Alamos Gold Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is your unique perspective on a company, connecting the story you believe, such as new mine expansions or shifting gold demand, with clear financial forecasts and your own estimate of fair value.

This approach transforms analysis from just crunching numbers to combining your real-world view with what the future might look like on paper. Narratives are easy and accessible, built into Simply Wall St's Community page where millions of investors share and compare their insights.

With Narratives, you can easily see if your fair value, the number you believe the company is truly worth, says "buy," "hold," or "sell" by comparing it directly to the current market price. In addition, Narratives are updated dynamically in response to the latest news, earnings, or industry events, so your thinking stays current as the story evolves.

For example, one Narrative about Alamos Gold expects robust growth fueled by new mining projects and sustained high gold prices, forecasting earnings of $1.0 billion and a fair value significantly above today's price. Another, more cautious perspective sees risks in cost pressures and production challenges, forecasting $597.6 million in earnings and a much lower fair value.

Do you think there's more to the story for Alamos Gold? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AGI

Alamos Gold

Operates as a gold producer in Canada, Mexico, and the United States.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives