- Canada

- /

- Metals and Mining

- /

- TSX:AG

Is First Majestic Silver Still Attractive After a 90% Rally in 2025?

Reviewed by Bailey Pemberton

- Curious if First Majestic Silver is a smart buy at today's price? You're not alone. Let's dig into whether the stock's current value lives up to the buzz.

- The stock has been on quite a run, rising nearly 90% year-to-date and 71% over the past 12 months, even as it pulled back 8.5% this week.

- Much of this recent price action comes on the heels of mining sector momentum and positive sentiment around silver prices, which have lifted many peer stocks. Investor optimism has also been fueled by supply constraints making headlines across the precious metals industry.

- Our valuation framework gives First Majestic Silver a score of 4 out of 6 for being undervalued in key areas, but there’s more to the story. Let's examine the usual approaches to valuation, and stick around for what could be an even better way to judge if the stock is truly a bargain.

Approach 1: First Majestic Silver Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company's stock is really worth by projecting future cash flows and discounting them back to today's value. This method offers a grounded approach, focusing on the actual money the business is expected to generate rather than just market sentiment.

For First Majestic Silver, the current Free Cash Flow stands at $65.35 Million. Analyst estimates predict significant growth over the next decade, with Free Cash Flow expected to reach $1.40 Billion by 2035. The projections start with $631.88 Million in 2027, increasing annually as silver sector momentum builds and expansion plans mature. While only the next five years are guided by analysts, additional years are extrapolated based on recent trends and sector dynamics.

Using these forecasts, the model calculates an intrinsic value of $67.06 per share. At today's prices, this suggests the stock is trading at a substantial 75.7% discount to its intrinsic value, making it appear deeply undervalued based on cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests First Majestic Silver is undervalued by 75.7%. Track this in your watchlist or portfolio, or discover 840 more undervalued stocks based on cash flows.

Approach 2: First Majestic Silver Price vs Sales

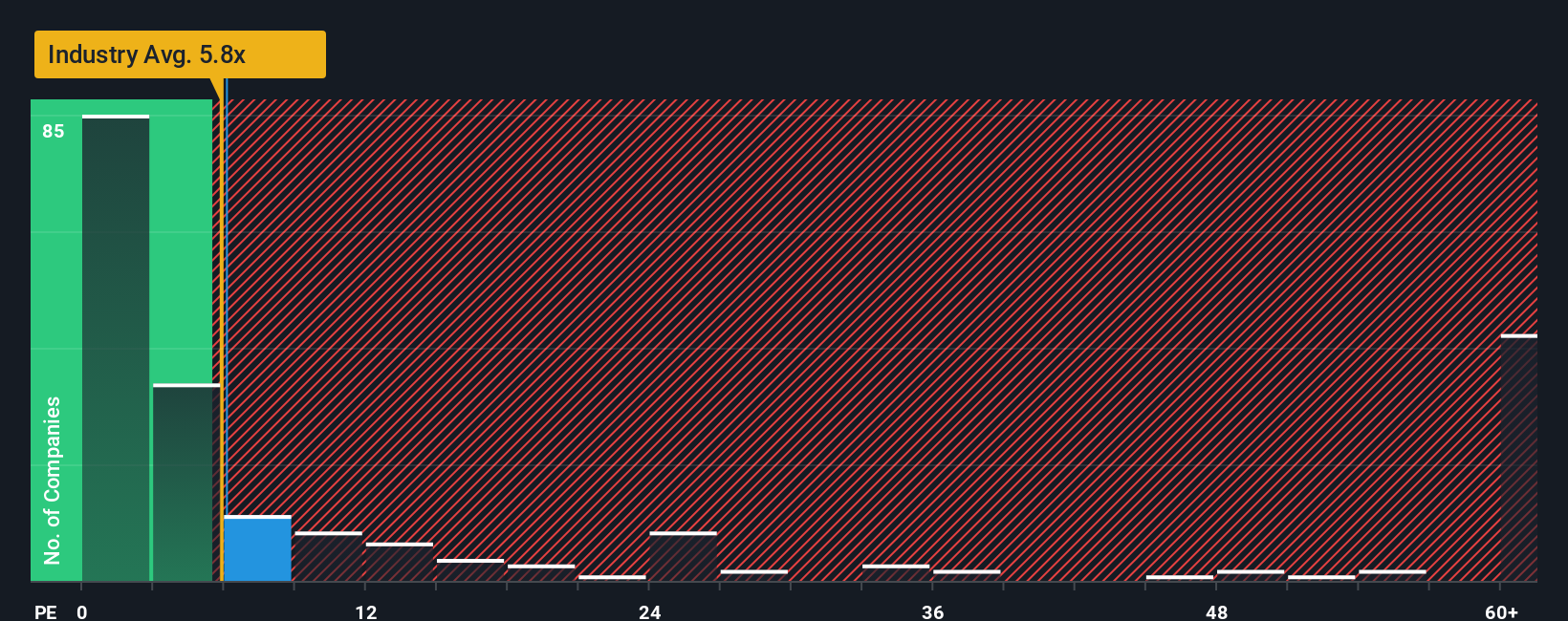

The price-to-sales (P/S) ratio is a widely used valuation metric, especially for companies like First Majestic Silver where profitability may swing but sales provide a stable view of the business’s scale. This multiple is well suited for commodity companies, as revenue is typically less volatile than earnings due to sector cycles and accounting treatments.

Growth expectations and risk profile play a big role in what is considered a “normal” or “fair” P/S ratio. Fast-growing or lower-risk companies often command higher ratios, while more cyclical or slower-growing businesses typically trade at lower multiples.

Currently, First Majestic Silver trades at a P/S ratio of 6.85x. For context, this sits above the broader Metals and Mining industry average of 5.49x but below the average of its closest peers, which is 9.56x. On the surface, this places First Majestic Silver in the middle of the pack.

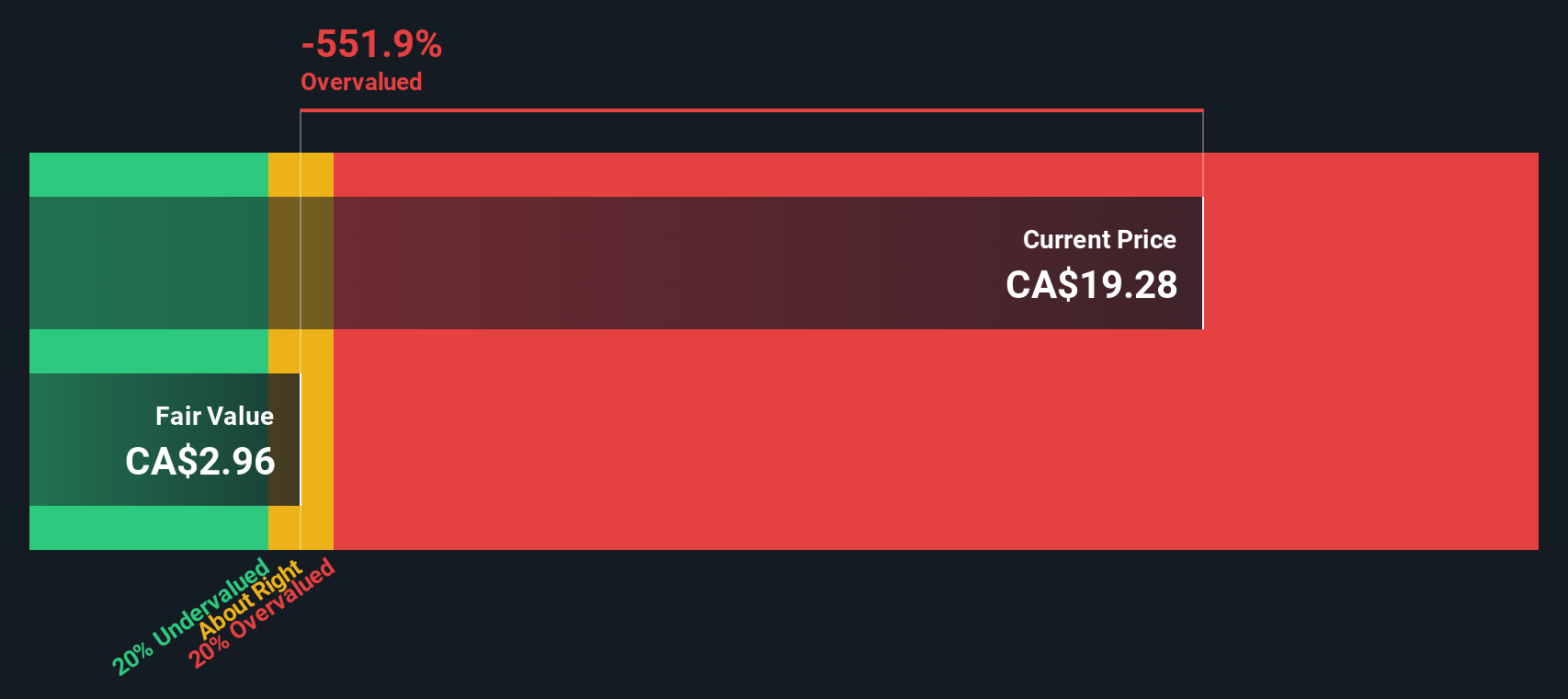

To go deeper, Simply Wall St’s proprietary “Fair Ratio” considers not just industry and size, but also company-specific factors like profit margins, projected growth, and risk. For First Majestic Silver, the Fair Ratio is calculated at 6.04x. This approach provides a tailored benchmark, making it more reliable than a raw comparison to peers or industry averages as it adjusts for the company’s unique strengths and challenges.

With First Majestic Silver’s P/S at 6.85x versus a Fair Ratio of 6.04x, the stock is trading a little higher than its custom-fit value, suggesting it may be modestly overvalued on this measure.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1410 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your First Majestic Silver Narrative

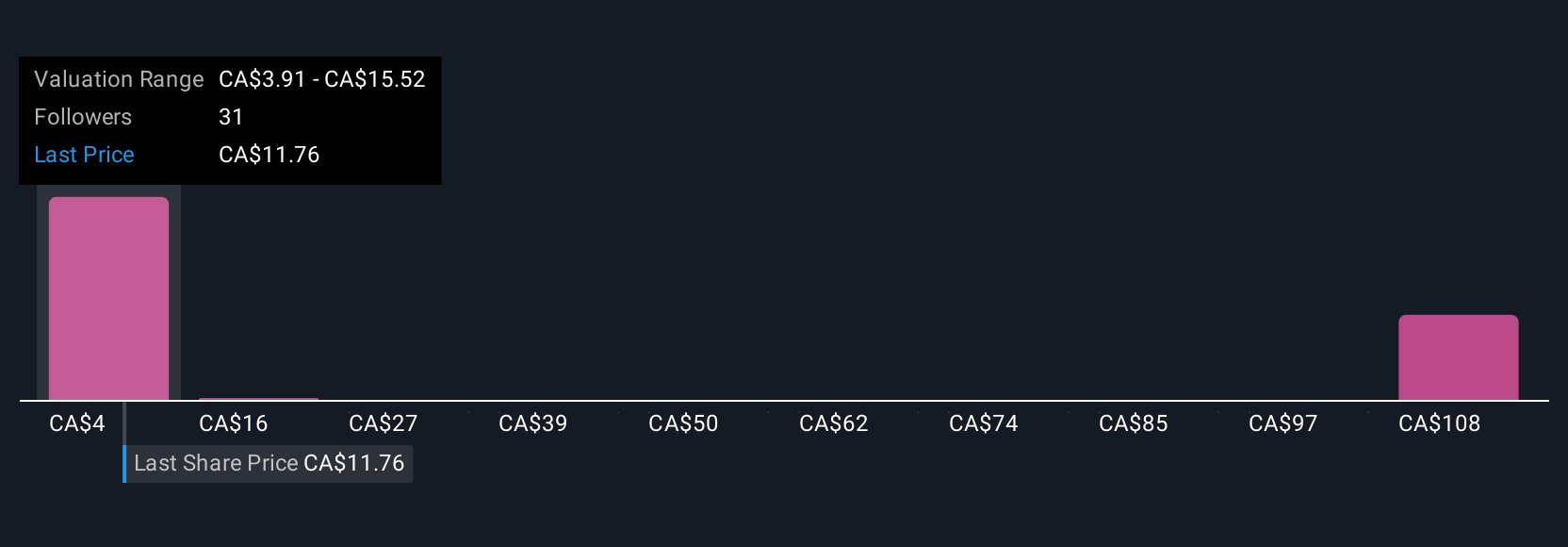

Earlier, we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a way for investors to build a story, a set of real-world beliefs about a company’s future revenue, earnings, margins, and risks, and then connect those assumptions directly to forecasts, leading to a custom fair value. Narratives make investing more approachable because they combine your own perspective with the company’s data, letting you see exactly why your view matters.

On Simply Wall St’s Community page, millions of investors use Narratives to articulate and share their outlooks for companies like First Majestic Silver, compare Fair Value to the actual share price, and decide whether to buy or sell. Unlike static models, Narratives update automatically when important news or company results are released. This helps your investment thesis stay relevant week to week.

For example, one investor’s Narrative for First Majestic Silver might focus on the company’s expanding silver production and upgraded long-term growth prospects, resulting in a high fair value estimate. Meanwhile, another investor could highlight operational risks and elevated costs, leading to a lower fair value. Narratives make it easy to explore these different scenarios yourself so you can invest with clarity and confidence.

Do you think there's more to the story for First Majestic Silver? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives