- Canada

- /

- Metals and Mining

- /

- TSX:AG

First Majestic Silver (TSX:AG): Valuation Insights Following Silver Price Decline and Easing Trade Tensions

Reviewed by Simply Wall St

Shares of First Majestic Silver (TSX:AG) are under pressure as silver prices fall, following renewed optimism around a potential U.S.-China trade deal. President Trump's latest comments have eased trade tensions and prompted a shift out of precious metals.

See our latest analysis for First Majestic Silver.

Despite today’s pullback, First Majestic Silver's momentum has been impressive lately, with a 6.7% 1-month share price return and a staggering 112% share price gain year-to-date. The 1-year total shareholder return stands at 78%, indicating that even amid shifting sentiment around precious metals, long-term holders have seen sizable rewards.

If you're scanning for stocks with breakaway momentum, now is a great time to broaden your search and discover fast growing stocks with high insider ownership

The big question facing investors now is whether all this strong performance means First Majestic Silver is undervalued, or if expectations for further growth are already fully reflected in the share price. This could leave limited upside from here.

Most Popular Narrative: 21.6% Undervalued

With the current share price at CA$18.23 and the most followed narrative setting fair value at CA$23.25, the gap is drawing fresh attention. The stage is set for a closer look at what is driving this optimistic outlook.

Robust year-over-year growth in silver production (up 76%) and record revenue (up 94%), combined with expanded exploration and accelerated mine development, position the company to capture higher sales volumes and benefit from potential increases in industrial and investment demand for silver. This directly supports future revenue growth.

Want to see why this narrative calls for a premium? The projection relies on game-changing growth rates, bold margin improvements, and a future profit multiple that breaks convention. Curious which unknowns could swing the numbers and whether expectations are too lofty? The full story reveals the forecast triggers and pivotal metrics that underpin this bullish outlook.

Result: Fair Value of $23.25 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistently high operating costs or regional setbacks in Mexico could quickly erode earnings if silver prices or production volumes turn out to be disappointing.

Find out about the key risks to this First Majestic Silver narrative.

Another View: Multiples-Based Valuation

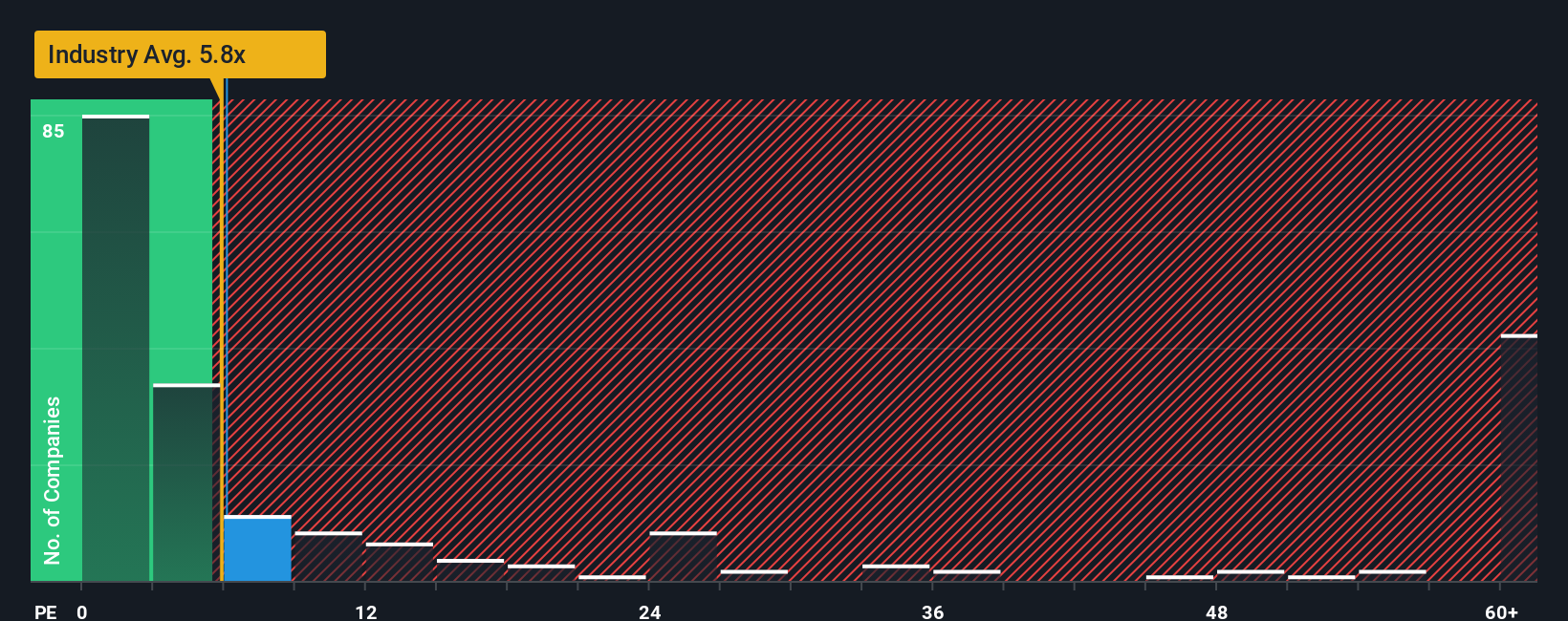

Looking at First Majestic Silver's share price through the lens of sales multiples tells a different story. The company's current price-to-sales ratio of 7.7x sits well above the Canadian Metals and Mining industry average of 5.7x. However, it remains below the peer average of 10.6x. Interestingly, it is also trading just below the fair ratio of 8.2x, which is the level the market could shift toward based on underlying fundamentals. This raises a key question: Is the premium justified by future growth prospects, or could high expectations spell disappointment if momentum slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own First Majestic Silver Narrative

Prefer to chart your own path? Dive into the data and assemble your own perspective. It's quick and straightforward to form your unique outlook. Do it your way

A great starting point for your First Majestic Silver research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Unlock investing opportunities you might not have considered. Take the lead by screening for stocks tailored to your goals and get a head start on the next big trend.

- Target steady income with attractive yields by checking out these 24 dividend stocks with yields > 3%.

- Tap into the market’s potential with these 834 undervalued stocks based on cash flows that our analysis shows could be trading below their intrinsic worth.

- Ride the innovation wave by uncovering these 26 AI penny stocks which are revolutionizing industries through artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives