- Canada

- /

- Metals and Mining

- /

- TSX:AG

A Look at First Majestic Silver (TSX:AG) Valuation Following San Dimas Drilling Success and Resource Upgrade

Reviewed by Simply Wall St

Most Popular Narrative: 9.4% Undervalued

According to community narrative, First Majestic Silver is currently considered to be undervalued by analysts, with significant upside potential from its present share price to the consensus fair value target.

"Robust year-over-year growth in silver production (up 76%) and record revenue (up 94%), combined with expanded exploration and accelerated mine development, position the company to capture higher sales volumes and benefit from potential increases in industrial and investment demand for silver. These factors directly support future revenue growth."

Ready for the inside scoop on what is powering this bullish valuation? Analysts are factoring in notable changes in profit margins and ambitious growth projections, all incorporated in a model that applies higher-than-typical multiples compared to the industry. Interested in how these projections compare, and what sets them apart? Take a closer look at the basis of the consensus price target and the strong assumptions underlying this narrative.

Result: Fair Value of $13.88 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.However, rising operational costs or execution delays at key assets could quickly challenge the upbeat outlook that underpins analyst projections.

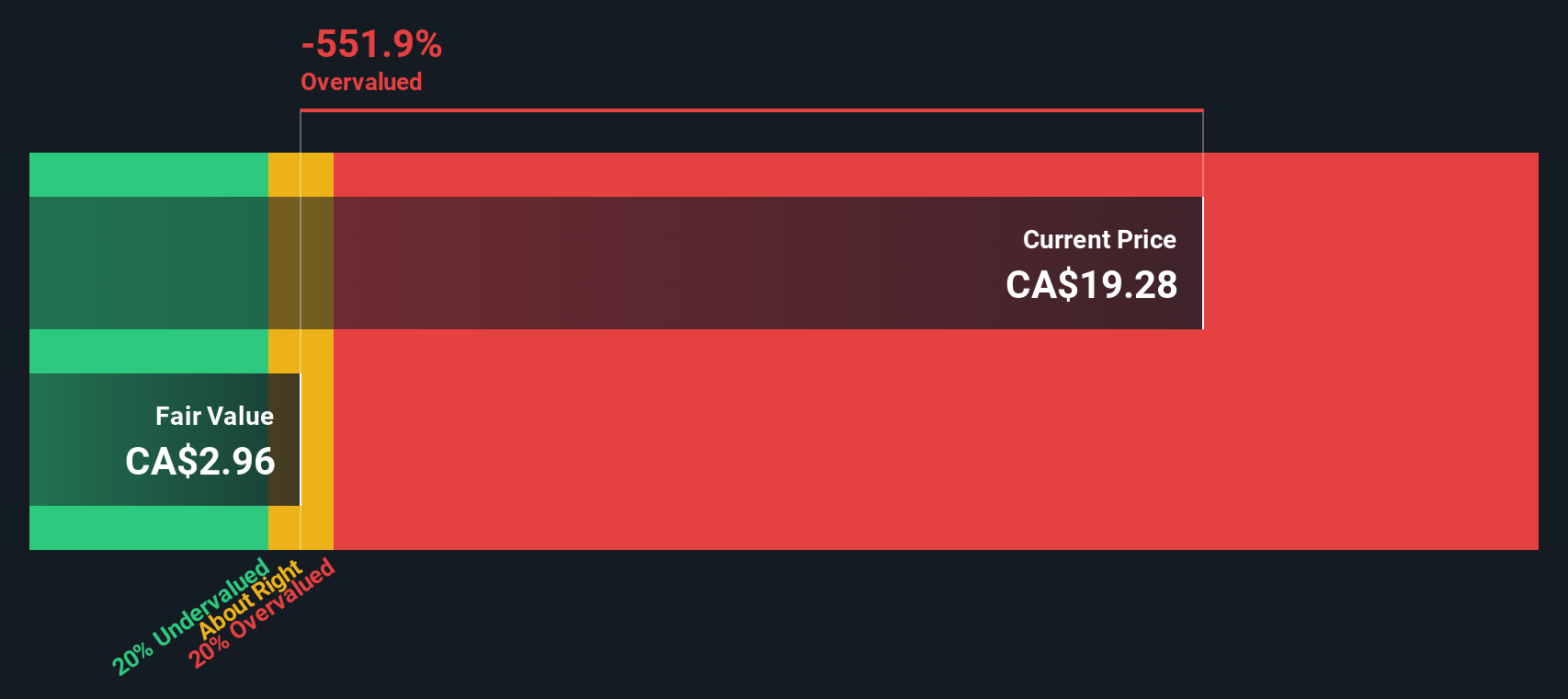

Find out about the key risks to this First Majestic Silver narrative.Another View: Our DCF Model Suggests Even More Upside

While analysts rely on earnings multiples to support their fair value, our DCF model offers an even brighter perspective. The analysis indicates First Majestic Silver could be valued significantly higher if long-term cash flows continue to strengthen. Is the market overlooking a larger opportunity?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Majestic Silver Narrative

If the current narrative does not match your perspective, or you want to dig into the numbers on your own terms, you can pull together a personal view in just a few minutes. Do it your way.

A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Unlock the full potential of your portfolio by searching beyond your watchlist. Don’t let fresh opportunities slip by when cutting-edge trends and value plays are only a click away. Seize your next advantage with these high-potential stock themes powered by our Screeners:

- Target hidden gems trading below their true worth with our tool for undervalued stocks based on cash flows: undervalued stocks based on cash flows.

- Capitalize on healthcare breakthroughs and artificial intelligence advances by exploring a handpicked group of healthcare AI stocks: healthcare AI stocks.

- Catch the latest momentum in digital assets and blockchain innovation through our curated list of cryptocurrency and blockchain stocks: cryptocurrency and blockchain stocks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives