- Canada

- /

- Metals and Mining

- /

- TSX:AG

A Look at First Majestic Silver (TSX:AG) Valuation After Its New US$300 Million Convertible Notes Offering

Reviewed by Simply Wall St

First Majestic Silver (TSX:AG) just shook up its capital structure with a fresh US$300 million convertible notes deal, aiming to refinance 2027 debt and free up flexibility for future strategic moves.

See our latest analysis for First Majestic Silver.

That refinancing push comes after a powerful run in the shares, with a 30 day share price return of about 30% and year to date gains above 140%, alongside a 1 year total shareholder return above 140%, suggesting bullish momentum is still very much in play.

If this kind of momentum has your attention, it could be a good moment to look beyond precious metals and discover fast growing stocks with high insider ownership for other fast moving opportunities.

With the stock now hovering near analyst targets yet still trading at a steep discount to some intrinsic value estimates, investors have to ask: is this a genuine buying window, or are markets already pricing in the next leg of growth?

Most Popular Narrative Narrative: 80% Undervalued

With First Majestic Silver closing at CA$20.83 against a narrative fair value of CA$21.00, the story hinges on robust growth projections and richer margins ahead.

Substantial ongoing investment in exploration (e.g., 255,000 meters drilled, addition of drilling rigs, and development of large new ore bodies like Navidad and Santo Niño) is expected to extend reserve life, increase production capacity, and drive long-term revenue and cash flow growth.

Want to see what justifies such a punchy valuation for a traditional miner? The narrative leans on aggressive production growth, fatter margins, and a future earnings multiple more often seen in market darlings than cyclicals. Curious which forecasts really carry the weight in that fair value math? Explore the full narrative to unpack the assumptions driving this call.

Result: Fair Value of $21.0 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, stubbornly high operating costs and Mexico-specific risks, such as regulatory changes or labor unrest, could quickly undermine the growth story investors are buying.

Find out about the key risks to this First Majestic Silver narrative.

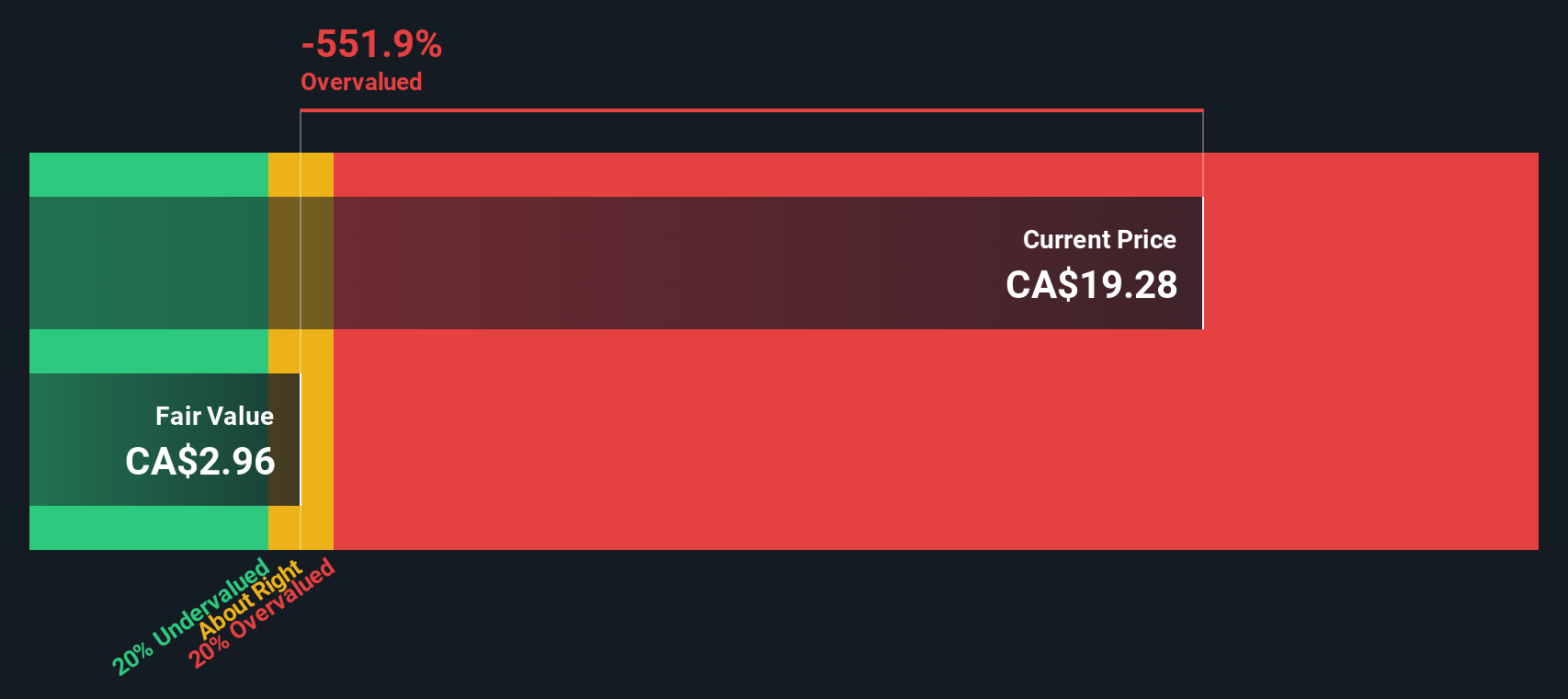

Another Lens on Valuation

Our SWS DCF model paints a far more optimistic picture, putting fair value near CA$42.36, over double today price. If the cash flows play out, that gap looks like opportunity, but if margins or production stumble, could it instead be a warning about DCF optimism?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own First Majestic Silver Narrative

If you are not fully aligned with this view or prefer to dig into the numbers yourself, you can build a personalized narrative in just a few minutes: Do it your way.

A great starting point for your First Majestic Silver research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single silver story. Use the Simply Wall St Screener now to explore fresh ideas before other investors rush in ahead of you.

- Look for potential mispriced opportunities by targeting these 908 undervalued stocks based on cash flows that could offer a different risk and return profile than widely followed names.

- Follow long-term thematic trends by focusing on these 26 AI penny stocks that are involved in the artificial intelligence space.

- Identify potential income streams by scanning these 15 dividend stocks with yields > 3% that may contribute to total returns in a range of market conditions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:AG

First Majestic Silver

Engages in the acquisition, exploration, development, and production of mineral properties in North America.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026