- Canada

- /

- Metals and Mining

- /

- TSX:ABX

How Barrick’s Cash Flow Strength and Dividend Hike Will Impact TSX:ABX Investors

Reviewed by Sasha Jovanovic

- Barrick Mining recently reported strong free cash flow and a dividend increase, even as mixed second-quarter earnings were impacted by a US$1 billion loss at its Mali mine.

- The company also completed the sale of its Alturas Project in Chile, a move that highlights Barrick’s ongoing approach to asset optimization and portfolio discipline.

- We’ll now explore how Barrick’s resilient operational performance and increased shareholder payouts could impact its long-term investment outlook.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Barrick Mining Investment Narrative Recap

Owning Barrick Mining means believing in the company’s ability to sustain strong free cash flow and regular shareholder returns, underpinned by gold and copper demand, while managing headline risks tied to operational issues in riskier jurisdictions. The recent Mali mine loss, though substantial, appears not to materially shift the near-term outlook, as free cash flow remains solid and the company continues to increase dividends. However, persistent exposure to political and operational uncertainty in regions like Mali remains the single largest challenge, with long-term effects on revenue streams still a concern.

Among Barrick's recent moves, the sale of the Alturas Project in Chile stands out for its potential relevance. Divestment of non-core assets reflects the company’s commitment to focusing on high-quality, longer-life mines and could augment operational resilience, a critical factor given ongoing production expansion at core sites such as Lumwana and Fourmile.

By contrast, recurring operational disruptions at flagship assets in challenging regions are still a risk investors should be aware of, especially if headline events like the...

Read the full narrative on Barrick Mining (it's free!)

Barrick Mining's outlook anticipates $19.4 billion in revenue and $5.0 billion in earnings by 2028. This scenario relies on an 11.9% annual revenue growth rate and a $2.2 billion increase in earnings from the current $2.8 billion.

Uncover how Barrick Mining's forecasts yield a CA$54.72 fair value, a 18% upside to its current price.

Exploring Other Perspectives

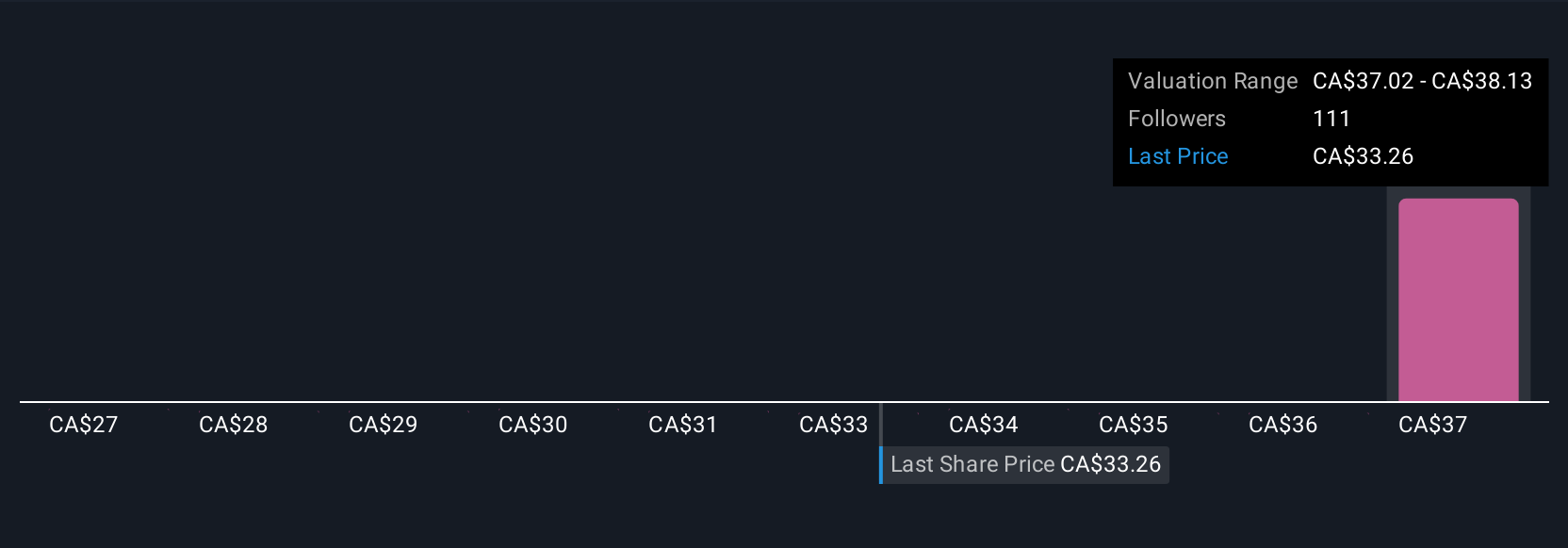

Fair value estimates from 13 Simply Wall St Community members range from US$30.55 to US$60 per share. While opinions diverge, the company’s continued asset optimization and copper expansion could significantly influence its future performance, so consider the full range of viewpoints before making up your mind.

Explore 13 other fair value estimates on Barrick Mining - why the stock might be worth 34% less than the current price!

Build Your Own Barrick Mining Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Barrick Mining research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Barrick Mining research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Barrick Mining's overall financial health at a glance.

Looking For Alternative Opportunities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barrick Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ABX

Barrick Mining

Engages in the exploration, development, production, and sale of mineral properties.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives