Assessing Sun Life After Recent 5% Price Slip and Sector Volatility

Reviewed by Bailey Pemberton

- Wondering whether Sun Life Financial is genuinely a good buy, or if the recent noise is clouding what it’s really worth? You’re not alone. Let’s dig into what’s actually moving the needle for this stock.

- The share price has slipped by 4.2% over the last week and is down 5.2% over the past month, hinting at shifting growth expectations or heightened risk perceptions among investors.

- One of the drivers behind these moves has been a wave of new interest in the insurance sector, as analysts consider how changing economic conditions could impact underwriting and investment returns. Recent headlines about global market volatility and increased regulatory discussion are adding another layer to the conversation for Sun Life’s future prospects.

- Currently, Sun Life Financial scores 2 out of 6 on our valuation checks, suggesting both limitations and opportunities through the common approaches. There may be a smarter way to really judge value, which we’ll reveal at the end of the article.

Sun Life Financial scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Sun Life Financial Excess Returns Analysis

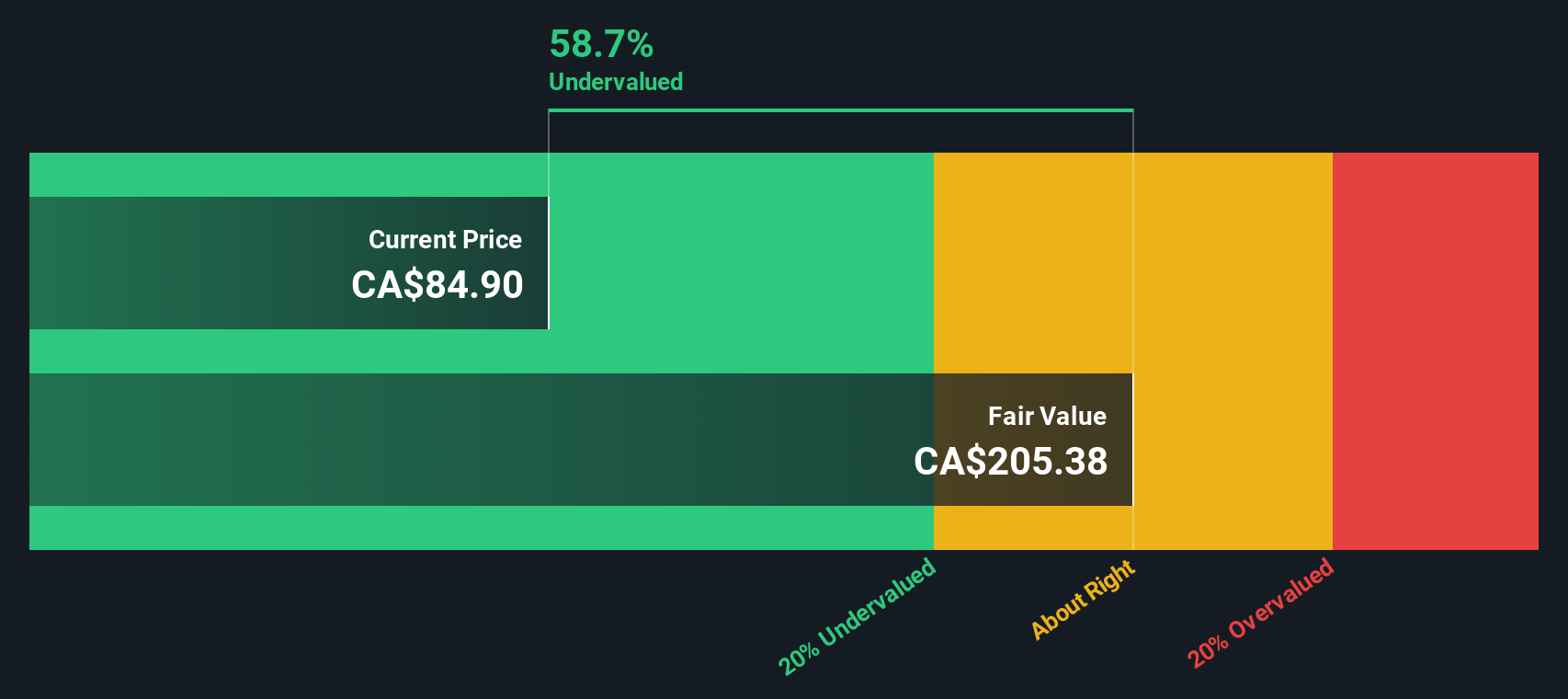

The Excess Returns model focuses on how much value a company generates above its cost of capital, with particular attention to return on invested equity. For Sun Life Financial, this approach uses projections for both future earnings and book value to assess whether long-term returns are likely to justify the current share price.

Based on weighted future analyst estimates, Sun Life's average return on equity is 17.83%, with a stable earnings per share of CA$8.21. The company's book value per share is CA$42.01, rising to an estimated stable level of CA$46.04. With a cost of equity at CA$2.82 per share, the resulting modeled excess return per share is CA$5.39. These figures suggest that Sun Life is consistently earning well above its actual cost of capital, which is a positive signal for long-term shareholders.

Using this methodology, the intrinsic value for Sun Life is CA$206.05 per share, which is approximately 60.8% higher than its current market price. This substantial discount indicates meaningful upside potential based on excess returns.

Result: UNDERVALUED

Our Excess Returns analysis suggests Sun Life Financial is undervalued by 60.8%. Track this in your watchlist or portfolio, or discover 932 more undervalued stocks based on cash flows.

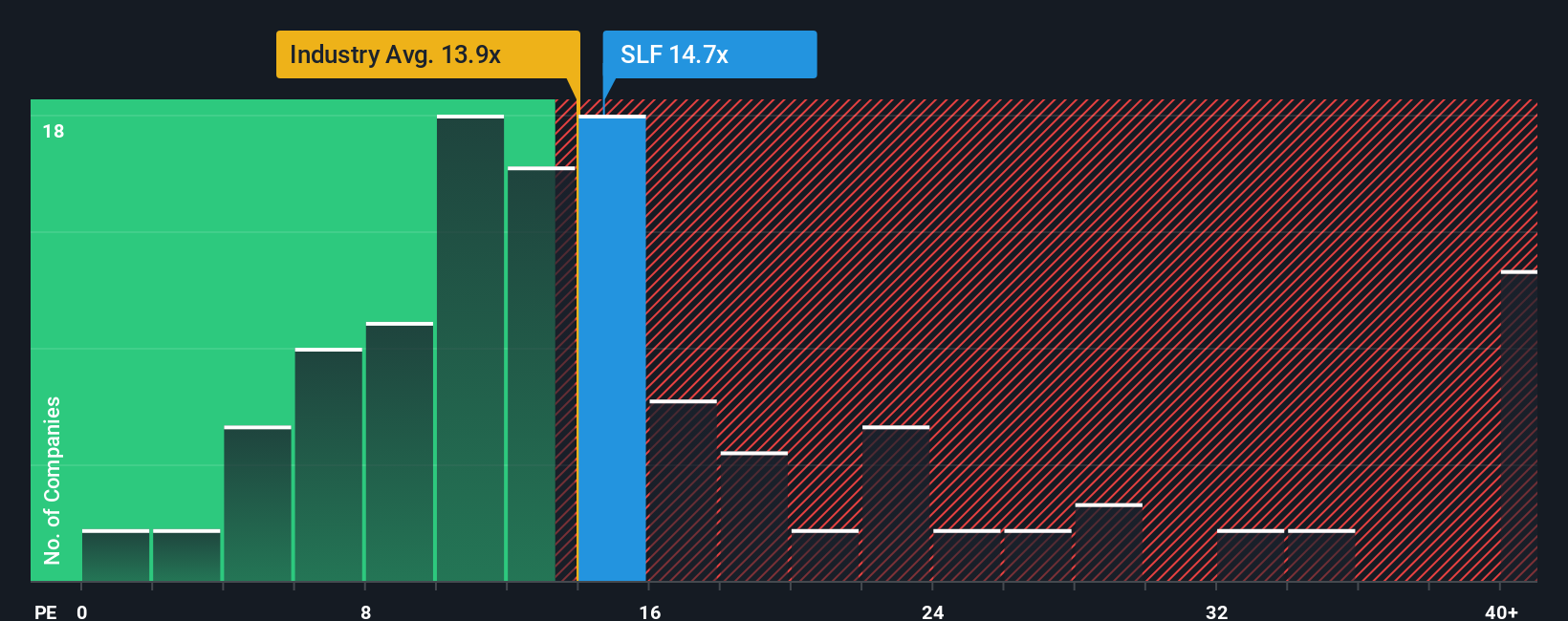

Approach 2: Sun Life Financial Price vs Earnings

The Price-to-Earnings (PE) ratio is a widely used valuation tool for profitable companies like Sun Life Financial because it directly reflects how much investors are willing to pay for each dollar of earnings. Since Sun Life generates stable profits, the PE ratio serves as a reliable baseline for assessing the stock’s relative value.

A company’s “normal” or “fair” PE ratio is influenced by its future growth prospects and risk profile. Higher expected growth or lower perceived risk tends to support a higher PE, while lower growth or higher risk generally pulls the ratio down. This context is essential when comparing Sun Life Financial’s valuation to others in the insurance industry.

Currently, Sun Life Financial trades at a PE ratio of 15.08x. This is somewhat higher than the insurance industry average of 11.51x and just above its peer average of 14.67x. A more nuanced way to evaluate the company’s value is through Simply Wall St’s proprietary “Fair Ratio.” This estimate suggests a justifiable multiple of 14.63x, based on factors such as earnings growth, profit margins, industry trends, company size, and risk profile.

Unlike traditional benchmarks, the Fair Ratio does not rely solely on broad peer or industry averages. Instead, it tailors the valuation for Sun Life’s specific situation and provides a more informed comparison that considers both opportunities and risks unique to the business.

With Sun Life’s actual PE ratio at 15.08x and its Fair Ratio at 14.63x, the difference is minimal. This suggests that, at current prices, the stock is trading in line with what would be expected given its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1445 companies where insiders are betting big on explosive growth.

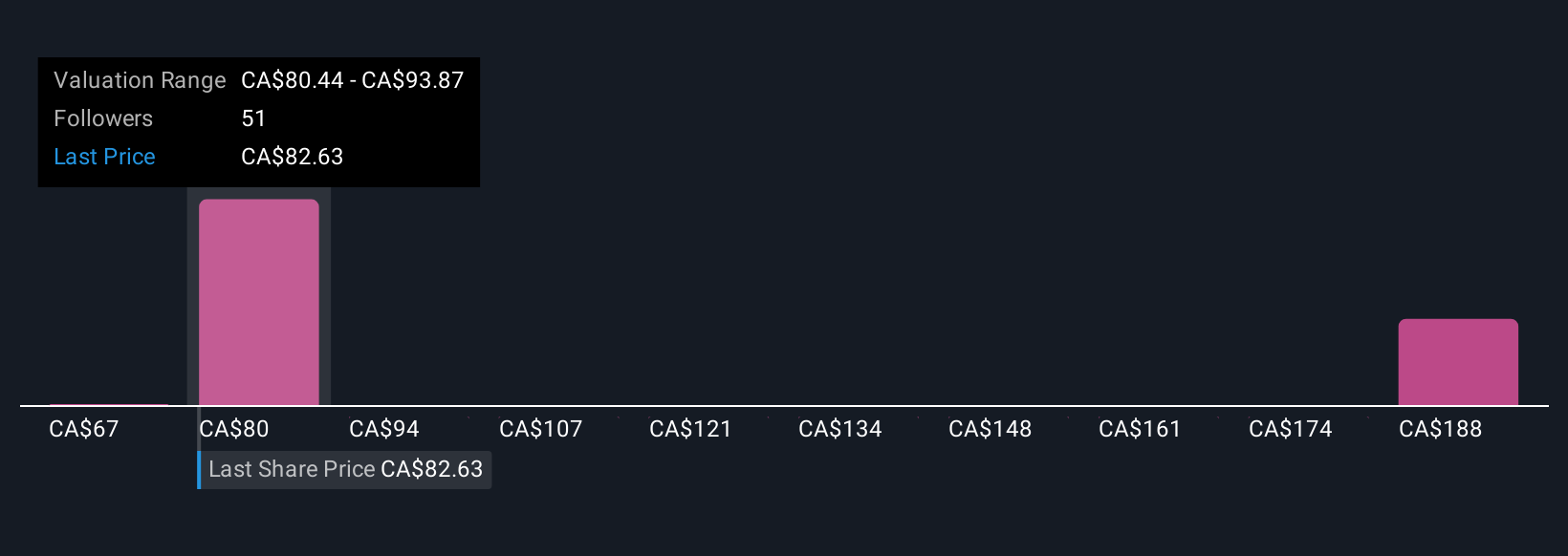

Upgrade Your Decision Making: Choose your Sun Life Financial Narrative

Earlier we mentioned that there's an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, powerful tool that helps you frame your own story about Sun Life Financial by combining your perspective on its business outlook with underlying financial forecasts and linking that directly to an estimate of fair value. Instead of just relying on historical ratios or broad sector averages, Narratives allow you to blend your views on Sun Life’s strategy, future revenue, profitability, and risks into a forward-looking fair value calculation. This can make it easier to judge if the current price represents a good buying or selling opportunity.

Available to millions of investors via the Simply Wall St Community page, Narratives are dynamic and automatically update as new information, earnings, or market news emerges. This adaptability helps you stay on top of changes and make decisions with the most current data. For example, some Sun Life investors may build a Narrative seeing strong future growth and expanding margins, supporting a bullish fair value near CA$95.00. Others may focus on sector uncertainties or margin risks, leading to a more cautious view around CA$74.00. Narratives empower you to make investment choices that fit your view by linking the company’s evolving story directly to its numbers.

Do you think there's more to the story for Sun Life Financial? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SLF

Sun Life Financial

A financial services company, provides asset management, wealth, insurance and health solutions to individual and institutional customers in Canada, the United States, the United Kingdom, Ireland, Hong Kong, the Philippines, Japan, Indonesia, India, China, Australia, Singapore, Vietnam, Malaysia, and Bermuda.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026