Intact Financial (TSX:IFC) Margin Expansion Reinforces Bullish Narrative Despite Forecast Earnings Decline

Reviewed by Simply Wall St

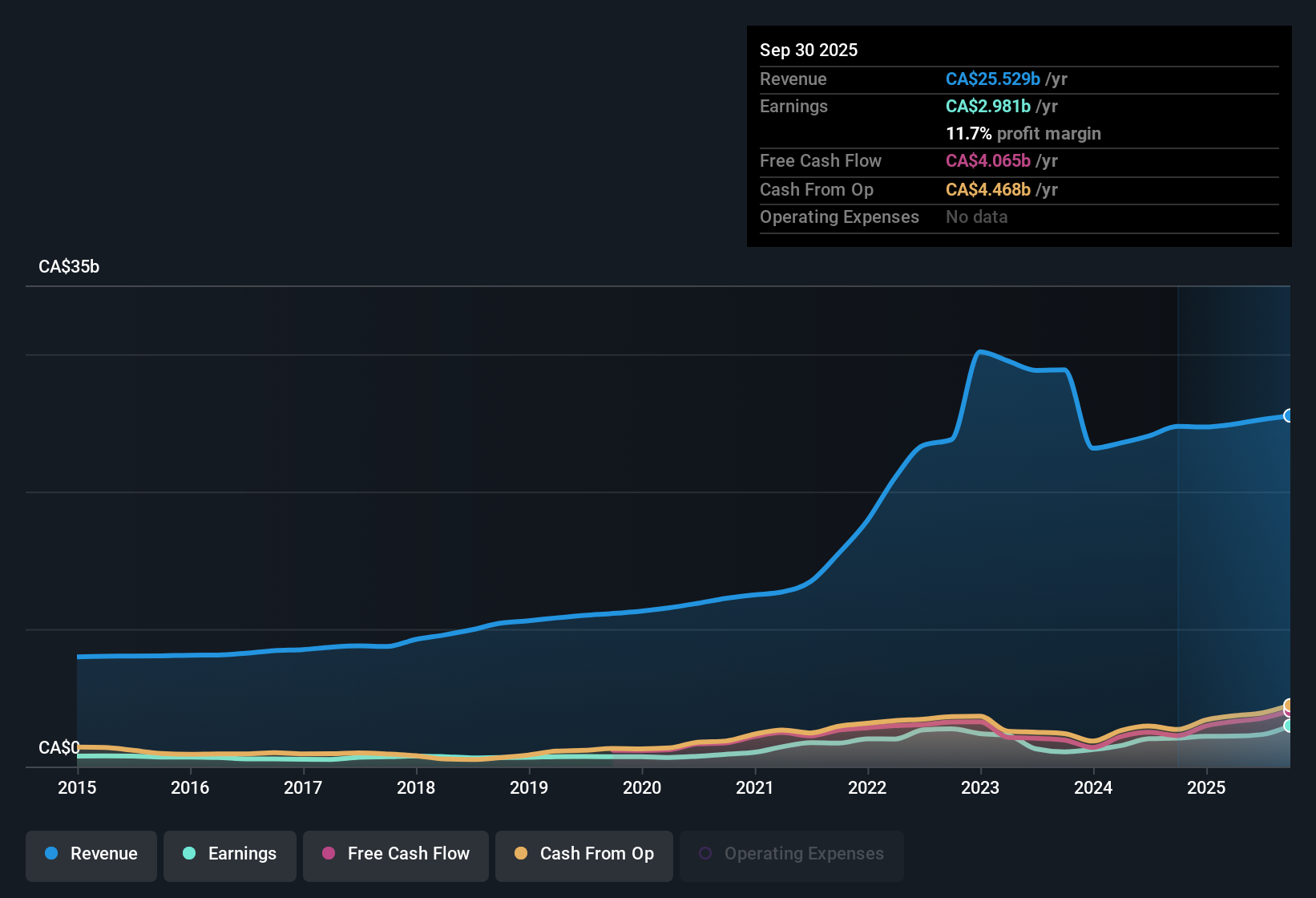

Intact Financial (TSX:IFC) posted a 44.4% jump in earnings over the past year, with profit margins rising to 10% from 6.8% twelve months ago. While the company averaged earnings growth of 9.2% per year over the past five years, revenues and earnings are now expected to decline by 3.1% and 1.8% per year over the next three years. This leaves investors weighing robust historical results against a more cautious outlook.

See our full analysis for Intact Financial.Now, let's see how these headline numbers compare to the key narratives driving discussion. Some popular views may get reinforced, while others might get put to the test.

See what the community is saying about Intact Financial

Margins Expected to Widen Despite Revenue Drop

- Analysts project profit margins rising from 7.9% today to 12.6% in three years, even as annual revenue is forecast to fall by 7.0% over that period.

- According to the analysts' consensus view, top-line headwinds such as greater competition and softening premium rates may weigh on revenue in markets like the U.S. and UK. However, cost discipline and improving underwriting efficiency are still expected to bolster overall margins.

- Expansion in technology use, especially in pricing and risk, is cited as a driver for more resilient margin performance.

- Ongoing geographic diversification and acquisition execution also contribute to earnings stability despite sector volatility.

Analysts see these figures as a sign that Intact is better able to control costs and risks, even while revenues are forecast to come under pressure. This highlights a distinct contrast between operational execution and topline trends.

Catastrophe Losses Remain a Profit Threat

- Persistently high catastrophe-related claims and regulatory constraints, such as Alberta auto rate caps, are flagged as key risks threatening future profitability and loss ratios.

- In the consensus narrative, bears highlight that while climate resiliency investments and diversified operations help cushion some of these risks, rising natural disaster frequency and challenges integrating recent acquisitions leave Intact exposed to earnings swings.

- Integration risks, especially with Direct Line in the UK, may impact expected synergy realization if loss activity remains high.

- Continued regulatory pressure and elevated claims volatility could undermine recent improvements in net margin and return on equity.

Valuation Discount to DCF, Premium to Peers

- Despite trading above industry and peer averages on a P/E basis (16x vs. industry 13.9x, peer 14.4x), Intact’s CA$268.13 share price stands at a 44% discount to its DCF fair value estimate of CA$481.37.

- Consensus narrative notes a tension in valuation logic: the analyst price target of CA$318.69 implies 18.8% upside from current levels, but realizing this target assumes both continued high profit margins and improvement in revenue and earnings, which remain at risk given industry headwinds.

- The company’s premium valuation might be justified if current margin forecasts materialize, but its price may face pressure if top-line declines accelerate.

- Persistent sector volatility, especially from catastrophe exposure, could challenge achievement of both the DCF fair value and analyst targets.

Results continue to divide opinion. Recent margin gains and valuation upside counterbalance material risks, making Intact one of the more debated names in insurance this year. See what the community is saying and how the consensus narrative is evolving. 📊 Read the full Intact Financial Consensus Narrative.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Intact Financial on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the data with a different lens? In just a few minutes, you can craft your own take and share how you see things. Do it your way

A great starting point for your Intact Financial research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Intact’s solid recent margin gains are offset by the risk of falling revenue and earnings, as well as ongoing exposure to sector volatility and catastrophe events.

If you want more dependable growth and less earnings uncertainty, use our stable growth stocks screener (2078 results) to discover companies delivering strong, stable results across changing markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:IFC

Intact Financial

Through its subsidiaries, provides property and casualty insurance products to individuals and businesses in Canada, the United States, the United Kingdom, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives