A Look at Great-West Lifeco (TSX:GWO) Valuation Following Strong Earnings, Dividends, and Buyback Update

Reviewed by Simply Wall St

Great-West Lifeco (TSX:GWO) delivered higher net income and earnings per share in the latest quarter, while also confirming its regular quarterly dividends and progress on share buybacks. Investors are paying attention to these steady shareholder returns.

See our latest analysis for Great-West Lifeco.

After another round of solid results, Great-West Lifeco’s recent momentum has been hard to miss. The company’s 29.8% rise in share price since the start of the year and 30.3% total shareholder return over 12 months reflect growing confidence in its earnings outlook and dependable dividends. The performance has been accelerating over multiple years.

If shareholder returns like these have you rethinking your next move, this is an ideal moment to broaden your search and discover fast growing stocks with high insider ownership

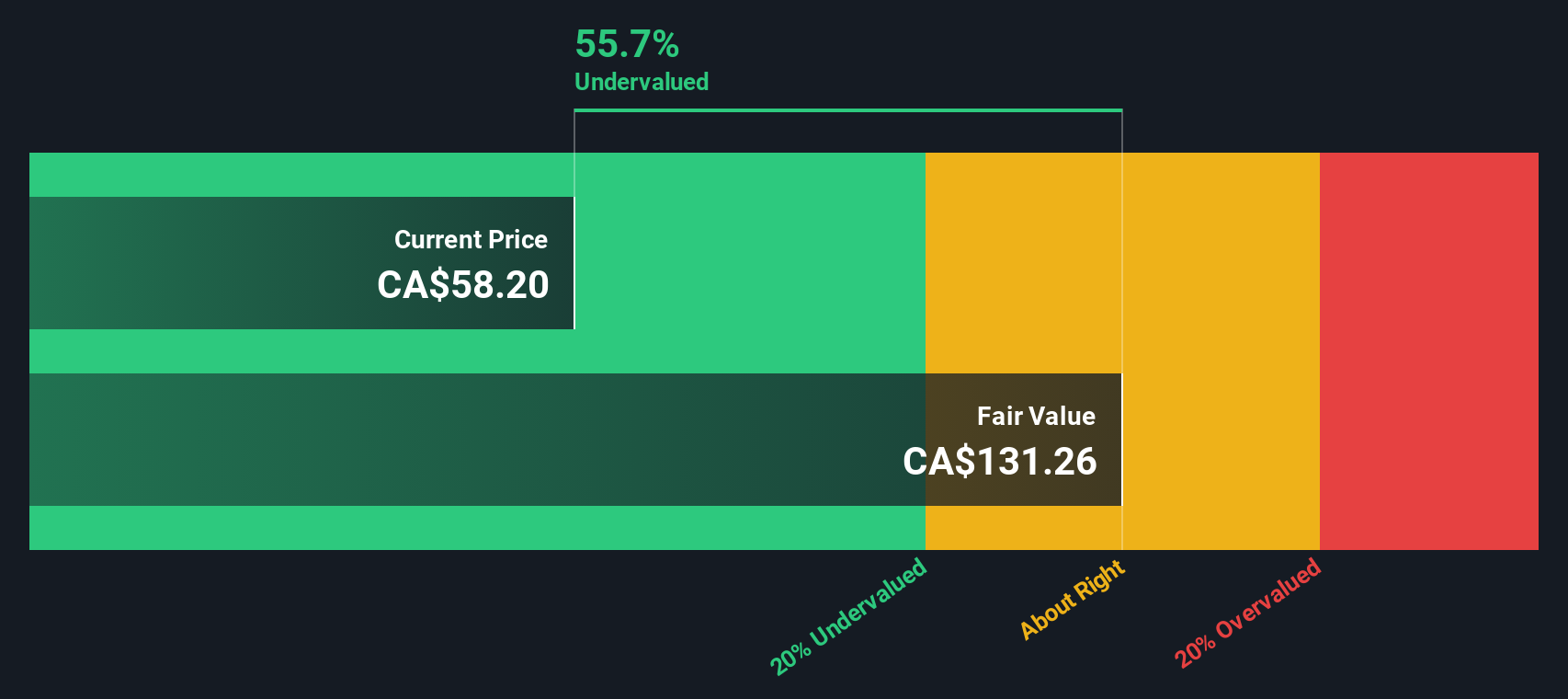

This run of strong results and rising returns raises a key question for investors: Is Great-West Lifeco still undervalued, or has the market already priced in its solid growth and consistent payouts?

Most Popular Narrative: 3.6% Overvalued

With Great-West Lifeco’s last close price of CA$60.91 just above the narrative’s fair value estimate of CA$58.82, the narrative frames shares as trading slightly ahead of their projected worth. The latest valuation moves are anchored in analysts’ evolving assumptions and recent performance trends.

Ongoing asset growth and the expansion of operational platforms are expected to fuel earnings upside and bolster profitability over the medium term. Recent upward adjustments to price targets reflect optimism around execution on strategic initiatives and sustained growth in managed assets.

Want to know the key trends behind this elevated valuation? The narrative’s fair value leans heavily on future platform expansion, balance sheet strength and ambitious profitability levers. Which growth expectations and profit forecasts are making analysts bullish? Dive in to uncover the surprising numbers shaping this fair value.

Result: Fair Value of $58.82 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent outflows from retiring participants and increasing fee competition could quickly challenge Great-West Lifeco’s growth outlook and put pressure on long-term profit margins.

Find out about the key risks to this Great-West Lifeco narrative.

Another View: Discounted Cash Flow Points to Deep Undervaluation

Looking at Great-West Lifeco through the lens of our DCF model offers a different perspective. The SWS DCF model suggests the shares are significantly undervalued, with the current price well below the estimated fair value. Why do these two approaches produce such a stark difference? Are market expectations missing something?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Great-West Lifeco for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 855 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Great-West Lifeco Narrative

If you want to put the latest numbers to the test and draw your own conclusions, you can easily build your narrative in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Great-West Lifeco.

Looking for More Winning Investment Ideas?

Don’t limit your search to just one stock when powerful new opportunities are right at your fingertips. Put your strategy ahead of the crowd with these handpicked stock screens:

- Accelerate your growth strategy by tapping into these 25 AI penny stocks, which are powering breakthroughs across artificial intelligence and transforming the landscape of tomorrow's technology.

- Capture higher income streams with these 15 dividend stocks with yields > 3%, offering yields above 3 percent and supporting more stable long-term returns in your portfolio.

- Seize tomorrow’s market leaders by targeting these 855 undervalued stocks based on cash flows, which are positioned for strong upside based on robust cash flows and overlooked potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GWO

Great-West Lifeco

Engages in the life and health insurance, retirement savings, wealth and asset management, and reinsurance businesses in Canada, the United States, and Europe.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives