Can E-L Financial’s (TSX:ELF) Dividend Strategy Reveal Its True Long-Term Priorities?

Reviewed by Sasha Jovanovic

- E-L Financial Corporation Limited has announced quarterly financial results and declared cash dividends for both its common and preferred shares, with dividends payable in January 2026 to shareholders of record as of December 31, 2025.

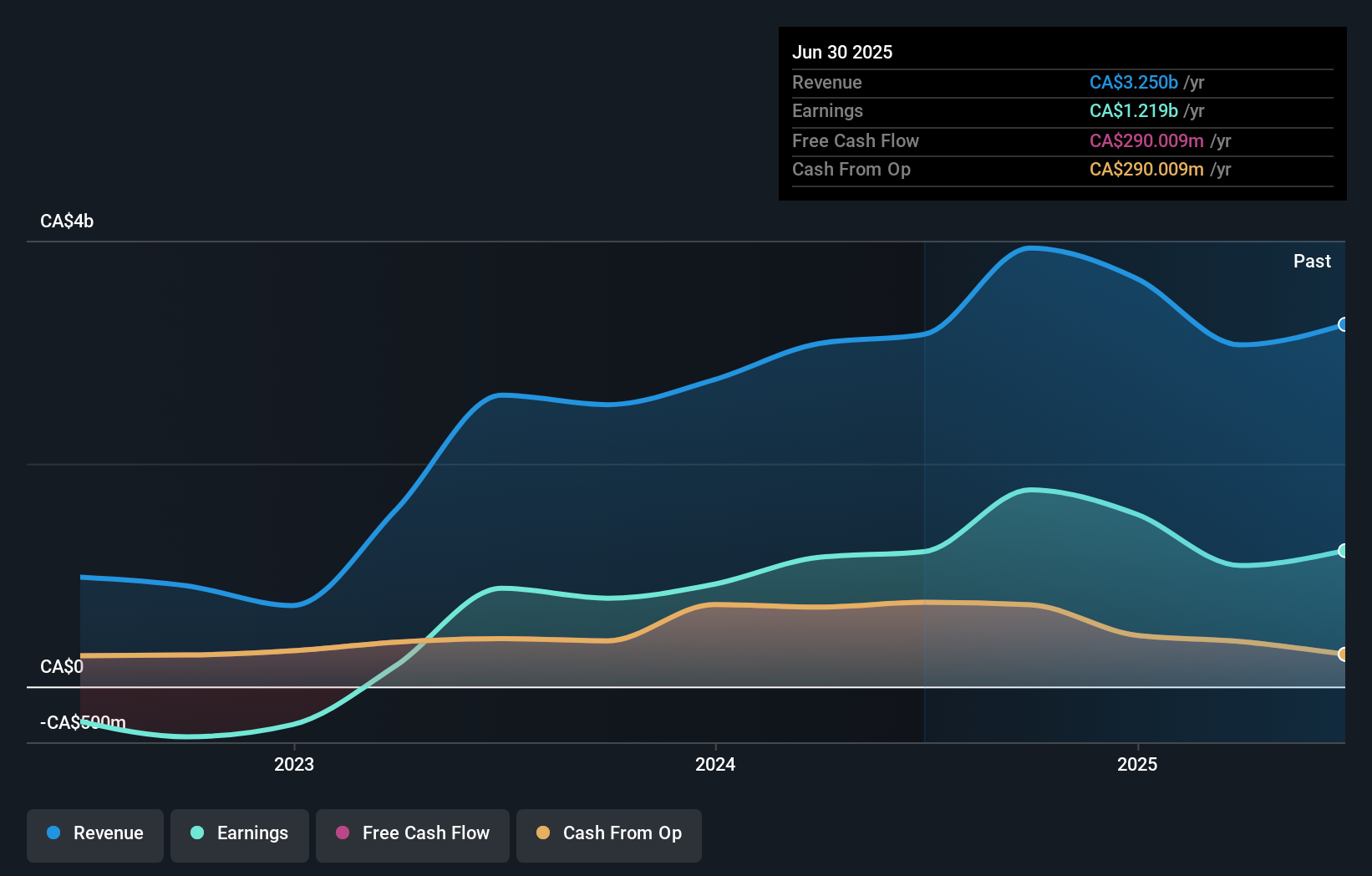

- The quarterly results revealed a 6% increase in net equity value per common share and strong income growth in the E-L Corporate segment, while Empire Life maintained robust capital adequacy despite lower net income.

- We'll explore how the company's continued dividend payments reinforce its long-term commitment to delivering value for shareholders.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is E-L Financial's Investment Narrative?

To be a shareholder in E-L Financial, you have to believe in the company's ability to manage through earnings volatility, benefit from steady dividend payments, and leverage its experienced leadership to create long-term value. The latest quarterly results, showing a 6% rise in net equity value per common share and a solid cash dividend declaration, signal stability in the company's core operations. These announcements fit the pattern of consistent dividend payments but do not meaningfully change the short-term outlook or immediate catalysts, such as the impact of capital markets on investment income or shifts in Empire Life’s insurance performance. Risks remain around earnings consistency, particularly given volatility in recent quarterly results and below-industry growth rates. While management remains seasoned and the board brings experience, continued underperformance against industry and market benchmarks highlights uncertainty for shareholders as markets digest these updates.

But, compared to its peers, E-L's softer growth profile is something investors should watch closely. E-L Financial's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on E-L Financial - why the stock might be worth just CA$62.49!

Build Your Own E-L Financial Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your E-L Financial research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free E-L Financial research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate E-L Financial's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Find companies with promising cash flow potential yet trading below their fair value.

- This technology could replace computers: discover 28 stocks that are working to make quantum computing a reality.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if E-L Financial might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ELF

E-L Financial

Operates as an investment and insurance holding company in Canada.

Excellent balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives