- Canada

- /

- Healthcare Services

- /

- TSX:EXE

Extendicare (TSX:EXE) Valuation in Focus After Robust Q3 Earnings and Closing the Gap Acquisition

Reviewed by Simply Wall St

Extendicare (TSX:EXE) attracted investor attention after its third quarter earnings report showed strong growth in both revenue and net income. The company also completed the acquisition of Closing the Gap.

See our latest analysis for Extendicare.

It has been an eventful stretch for Extendicare, as the share price has soared 88.5% so far this year and 32.5% in the past month alone, reflecting renewed optimism after standout financial results and strategic moves. The impressive 1-year total shareholder return of 101.4% shows that momentum is firmly on the upswing, rewarded by both recent and long-term investors.

If strong momentum in one healthcare stock has you curious, it could be the perfect time to explore further opportunities. See what’s moving with the See the full list for free.

But with such a rapid run-up in the share price and excitement around recent results, investors may wonder whether Extendicare is still undervalued at current levels or if the market has already priced in all the future growth potential.

Price-to-Earnings of 18.1x: Is it justified?

Extendicare trades at a price-to-earnings (P/E) ratio of 18.1x, which is noticeably lower than the average P/E of its industry peers. With a recent share price of CA$19.64, the stock currently appears undervalued compared to other companies in the healthcare space.

The price-to-earnings ratio reflects how much investors are willing to pay for each dollar of earnings. For Extendicare, the lower P/E may indicate the market is skeptical about the sustainability of recent growth or is not fully recognizing the company’s expansion efforts and earnings momentum.

Among its peers, Extendicare’s 18.1x ratio stands out against the North American Healthcare industry average of 22x. This comparison highlights that the company’s shares may offer compelling value, especially considering earnings have grown faster than both the broader industry and market. If the market re-rates Extendicare in line with sector norms, further upside could be possible.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 18.1x (UNDERVALUED)

However, risks such as a pullback from elevated highs or the market pricing in optimistic forecasts could lessen the bullish outlook for Extendicare.

Find out about the key risks to this Extendicare narrative.

Another View: Discounted Cash Flow Tells a Different Story

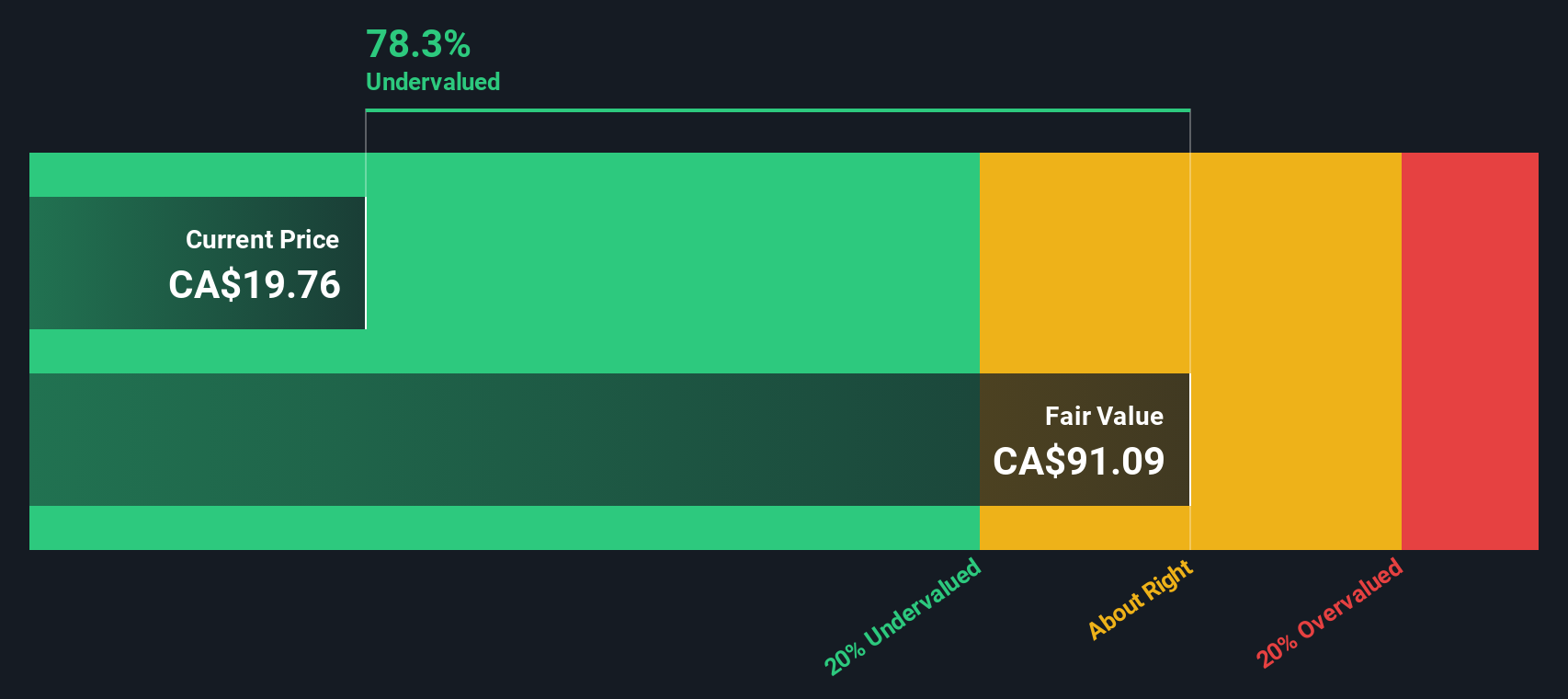

While Extendicare looks undervalued against industry peers based on its P/E ratio, our DCF model suggests an even bigger gap. According to this approach, the stock trades well below its estimated fair value, raising the question: could the market still be overlooking Extendicare’s true potential?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Extendicare for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 879 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Extendicare Narrative

If you have a different perspective or want to dig deeper into the numbers, you can easily build your own story around Extendicare in just a few minutes. Do it your way

A great starting point for your Extendicare research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Eager to get ahead of the curve? Now is the time to act before the crowd catches on. Smart investors always have their eyes on fresh opportunities. Don’t miss out on the trends others will soon be chasing.

- Tap into future potential with these these 879 undervalued stocks based on cash flows thriving on strong fundamentals and overlooked value.

- Reap the rewards of regular payouts by checking out these 16 dividend stocks with yields > 3% offering market-beating yields above 3%.

- Invest early in breakthrough companies riding the AI wave. See these 25 AI penny stocks poised to reshape industries and drive new growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Extendicare might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:EXE

Extendicare

Through its subsidiaries, provides care and services for seniors in Canada.

Solid track record established dividend payer.

Market Insights

Community Narratives