- Canada

- /

- Energy Services

- /

- TSX:TVK

TSX Growth Companies With High Insider Ownership

Reviewed by Simply Wall St

Despite the challenges posed by rising tariff rates, the Canadian market has demonstrated resilience, with inflation and economic data remaining stable. As investors navigate potential volatility in the months ahead, focusing on growth companies with high insider ownership can offer insights into businesses where leadership is confident about long-term prospects.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Tenaz Energy (TSX:TNZ) | 10.4% | 151.2% |

| SolarBank (NEOE:SUNN) | 15.9% | 52.1% |

| Robex Resources (TSXV:RBX) | 24.4% | 90.6% |

| Propel Holdings (TSX:PRL) | 36.3% | 31.1% |

| Orla Mining (TSX:OLA) | 11.2% | 65.7% |

| Enterprise Group (TSX:E) | 32.2% | 70.3% |

| Discovery Silver (TSX:DSV) | 15.1% | 42.6% |

| Burcon NutraScience (TSX:BU) | 15.3% | 125.9% |

| Aritzia (TSX:ATZ) | 17.3% | 27.6% |

| Allied Gold (TSX:AAUC) | 16% | 59.4% |

Let's dive into some prime choices out of the screener.

TerraVest Industries (TSX:TVK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TerraVest Industries Inc. manufactures and sells products and services across various sectors including agriculture, mining, energy, chemicals, utilities, transportation, and construction in Canada, the United States, and internationally with a market cap of CA$3.55 billion.

Operations: The company's revenue segments include CA$216.52 million from services, CA$104.18 million from processing equipment, CA$336.15 million from compressed gas equipment, and CA$363.00 million from HVAC and containment equipment.

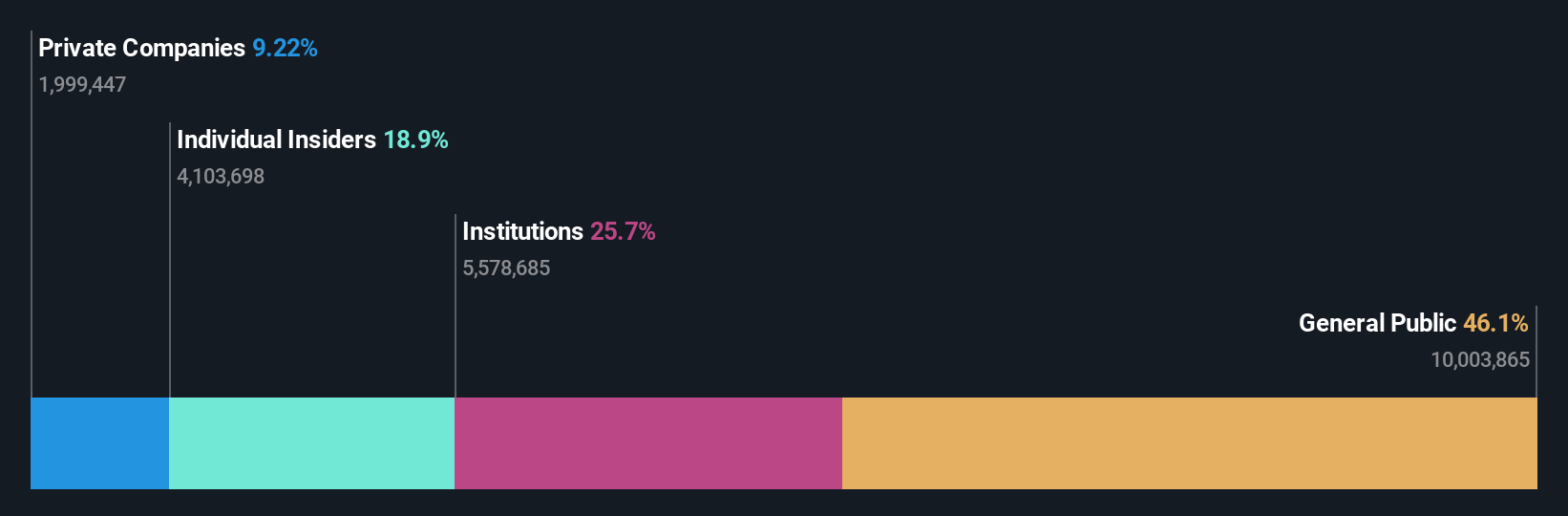

Insider Ownership: 18.9%

Earnings Growth Forecast: 26.8% p.a.

TerraVest Industries has demonstrated strong revenue growth, with a recent 28.5% annual forecast surpassing the Canadian market's average. Despite concerns over debt coverage by operating cash flow, earnings are expected to grow significantly at 26.8% annually, outpacing the market. Recent insider activity shows more shares sold than bought over three months, amidst a CAD 278.92 million equity offering completion in May 2025 that could impact ownership dynamics and financial positioning going forward.

- Click to explore a detailed breakdown of our findings in TerraVest Industries' earnings growth report.

- Our valuation report unveils the possibility TerraVest Industries' shares may be trading at a premium.

Vitalhub (TSX:VHI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Vitalhub Corp. offers technology and software solutions for health and human service providers across Canada, the United States, the United Kingdom, Australia, Western Asia, and internationally with a market cap of CA$698.84 million.

Operations: The company generates revenue from its Healthcare Software segment, amounting to CA$75.01 million.

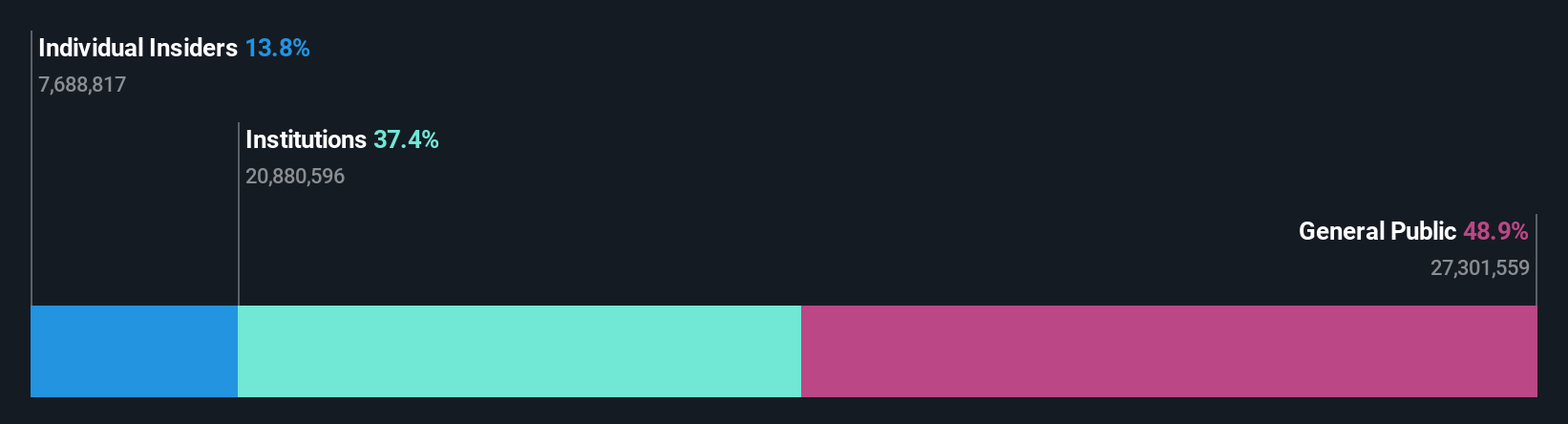

Insider Ownership: 13.5%

Earnings Growth Forecast: 55.6% p.a.

Vitalhub's growth trajectory is underscored by a strong forecasted earnings growth of 55.6% annually, significantly outpacing the Canadian market. Despite recent challenges with profit margins decreasing from 10.3% to 3.8%, insiders have shown confidence by purchasing more shares in the past three months. The company trades at a discount, being 19.4% below its estimated fair value, and has filed a CAD 250 million shelf registration for potential capital raising activities, which could influence future expansion efforts.

- Navigate through the intricacies of Vitalhub with our comprehensive analyst estimates report here.

- According our valuation report, there's an indication that Vitalhub's share price might be on the expensive side.

Robex Resources (TSXV:RBX)

Simply Wall St Growth Rating: ★★★★★★

Overview: Robex Resources Inc. is involved in the exploration, development, and production of gold in West Africa, with a market cap of CA$748.44 million.

Operations: The company generates revenue from its gold mining operations at the Nampala site, amounting to CA$168.58 million.

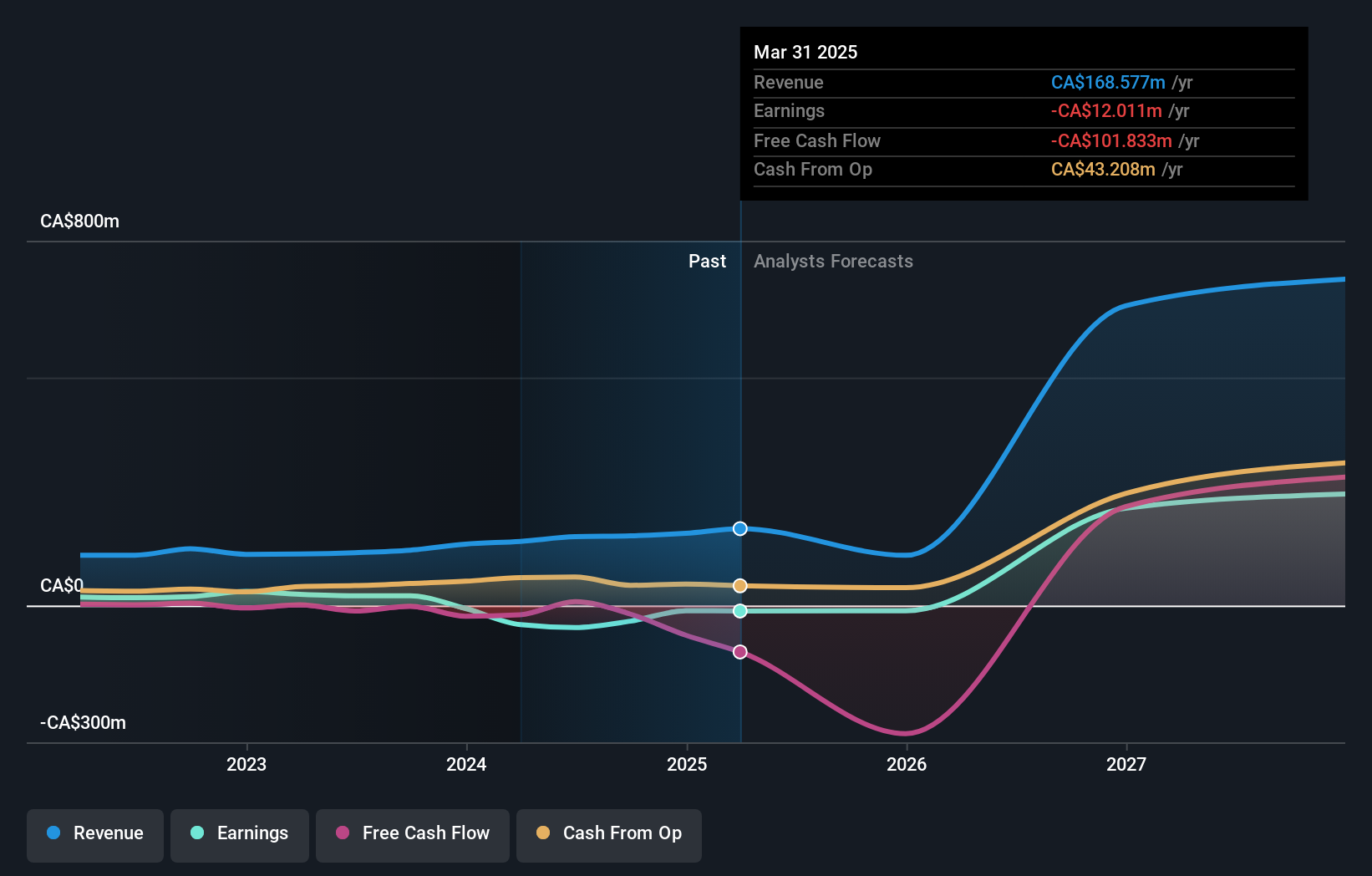

Insider Ownership: 24.4%

Earnings Growth Forecast: 90.6% p.a.

Robex Resources is on track to deliver first gold at its Kiniero Gold Project by Q4 2025, with construction progressing well. The company's revenue is forecasted to grow significantly faster than the market, and it is expected to become profitable within three years. Insiders have been net buyers recently, though not in substantial volumes. Despite past shareholder dilution, Robex trades at a significant discount to its estimated fair value and has secured additional funding for project development.

- Get an in-depth perspective on Robex Resources' performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that Robex Resources is trading behind its estimated value.

Where To Now?

- Investigate our full lineup of 47 Fast Growing TSX Companies With High Insider Ownership right here.

- Ready For A Different Approach? Uncover 17 companies that survived and thrived after COVID and have the right ingredients to survive Trump's tariffs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if TerraVest Industries might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TVK

TerraVest Industries

Manufactures and sells goods and services to agriculture, mining, energy production and distribution, chemical, utilities, transportation and construction, and other markets in Canada, the United States, and internationally.

Proven track record and fair value.

Market Insights

Community Narratives