- Canada

- /

- Construction

- /

- TSX:ATRL

3 TSX Stocks That Could Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

Recent market swings in Canada have increased as anxiety over a slowing economy and persistent inflation has sparked pullbacks. However, despite these fluctuations, stocks have delivered strong gains and sit near record highs. In this environment, identifying undervalued stocks can be particularly rewarding for investors looking to capitalize on potential growth opportunities amidst the volatility. Here are three TSX stocks that could be trading below their estimated value.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.71 | CA$22.16 | 47.2% |

| Savaria (TSX:SIS) | CA$20.92 | CA$41.29 | 49.3% |

| Kinaxis (TSX:KXS) | CA$155.71 | CA$283.31 | 45% |

| Calian Group (TSX:CGY) | CA$44.20 | CA$72.59 | 39.1% |

| Africa Oil (TSX:AOI) | CA$1.88 | CA$3.74 | 49.8% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Endeavour Mining (TSX:EDV) | CA$33.33 | CA$53.45 | 37.6% |

| Blackline Safety (TSX:BLN) | CA$5.31 | CA$10.20 | 48% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

| Boyd Group Services (TSX:BYD) | CA$213.03 | CA$340.25 | 37.4% |

Let's explore several standout options from the results in the screener.

AtkinsRéalis Group (TSX:ATRL)

Overview: AtkinsRéalis operates as an integrated professional services and project management company worldwide, with a market cap of CA$8.79 billion.

Operations: AtkinsRéalis generates revenue from several segments, including Capital (CA$127.40 million), Nuclear (CA$1.20 billion), and LSTK Projects (CA$318.44 million).

Estimated Discount To Fair Value: 34.1%

AtkinsRéalis Group is trading at CA$50.17, significantly below its estimated fair value of CA$76.16, indicating it may be undervalued based on cash flows. Earnings are forecast to grow 26.3% annually, outpacing the Canadian market's 15.3%. Despite a strong earnings growth outlook and recent strategic appointments bolstering leadership, debt coverage by operating cash flow remains a concern. Recent contract wins and raised earnings guidance for 2024 further support its potential for future growth.

- Our earnings growth report unveils the potential for significant increases in AtkinsRéalis Group's future results.

- Take a closer look at AtkinsRéalis Group's balance sheet health here in our report.

Savaria (TSX:SIS)

Overview: Savaria Corporation, with a market cap of CA$1.49 billion, offers accessibility solutions for the elderly and physically challenged individuals in Canada, the United States, Europe, and internationally.

Operations: Patient Care generated CA$183.98 million in revenue, while Segment Adjustment accounted for CA$673.74 million.

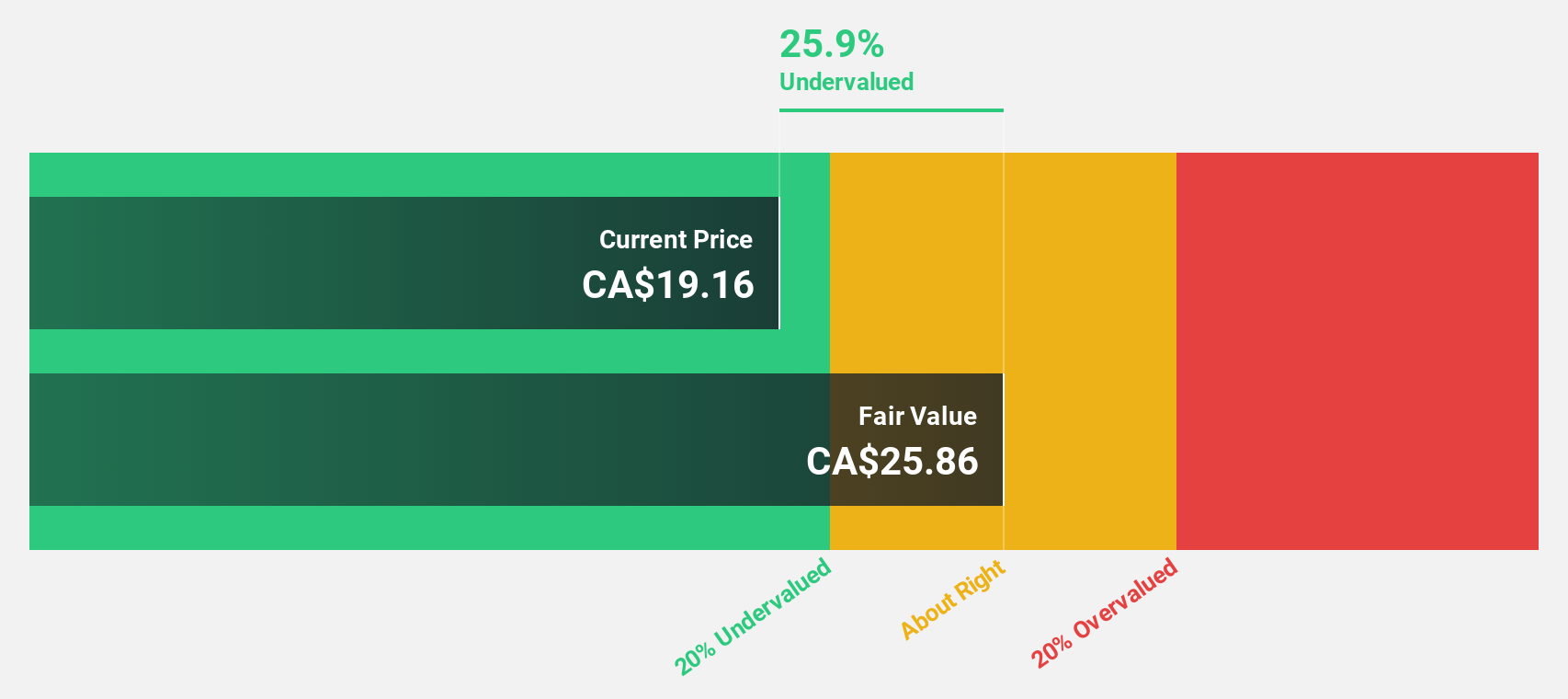

Estimated Discount To Fair Value: 49.3%

Savaria Corporation, trading at CA$20.92, is significantly undervalued with an estimated fair value of CA$41.29 and trades 49.3% below this estimate. Earnings grew by 22.8% last year and are forecast to grow nearly 30% annually, outpacing the Canadian market's growth rate of 15.3%. Despite shareholder dilution over the past year, recent earnings reports show solid performance with net income rising to CA$22 million for six months ended June 2024 from CA$14.83 million a year ago.

- The analysis detailed in our Savaria growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Savaria stock in this financial health report.

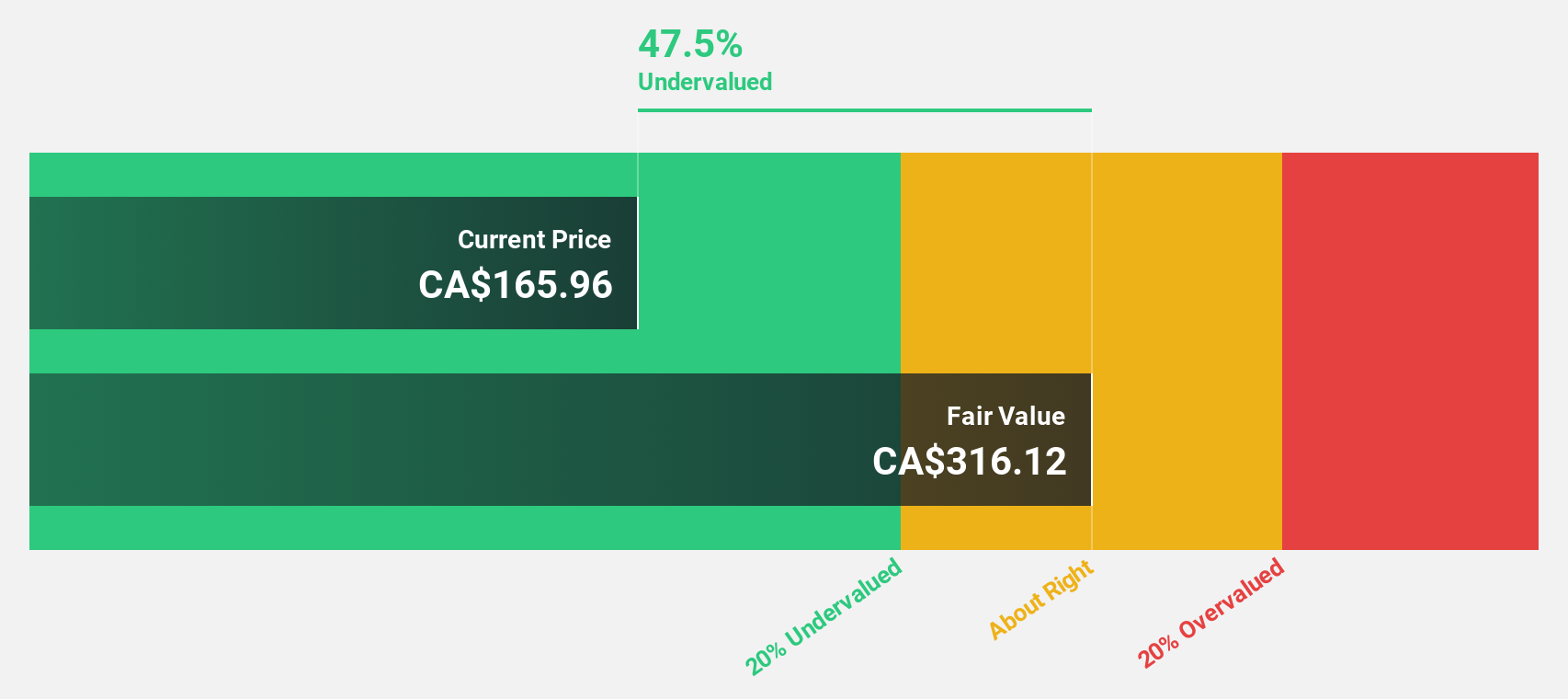

TerraVest Industries (TSX:TVK)

Overview: TerraVest Industries Inc. manufactures and sells goods and services to the energy, agriculture, mining, transportation, and other markets in Canada and the United States with a market cap of CA$1.92 billion.

Operations: The company's revenue segments include Service (CA$201.78 million), Processing Equipment (CA$117.58 million), Compressed Gas Equipment (CA$243.77 million), and HVAC and Containment Equipment (CA$292.90 million).

Estimated Discount To Fair Value: 24.7%

TerraVest Industries, trading at CA$98.69, is undervalued with an estimated fair value of CA$131.12, trading 24.7% below this estimate. Recent earnings show robust growth with net income rising to CA$51.66 million for nine months ended June 2024 from CA$28.77 million a year ago. Despite significant insider selling and high debt levels, the company’s earnings are forecast to grow significantly at 21% annually, surpassing the market average of 15%.

- Insights from our recent growth report point to a promising forecast for TerraVest Industries' business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of TerraVest Industries.

Key Takeaways

- Explore the 28 names from our Undervalued TSX Stocks Based On Cash Flows screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ATRL

AtkinsRéalis Group

AtkinsRéalis operates as an integrated professional services and project management company worldwide.

Undervalued with solid track record.