- Canada

- /

- Oil and Gas

- /

- TSX:TOU

Tourmaline Oil (TSX:TOU) Valuation: How Lower Earnings and a Special Dividend Are Shaping Investor Perspectives

Reviewed by Simply Wall St

Tourmaline Oil (TSX:TOU) just released its third quarter financials, revealing a dip in revenue and net income from last year. At the same time, the company boosted production, declared a special dividend, and reaffirmed its base dividend and future guidance.

See our latest analysis for Tourmaline Oil.

Tourmaline Oil’s recent special dividend and strong production gains have helped the company regain momentum, even as earnings came in lighter this quarter. After a choppy stretch, the 90-day share price return of 8.7% signals that confidence is building again and investors who held on have seen a 1-year total shareholder return of just over 3%. The real outperformance, however, is evident in the five-year total return of more than 400%.

If Tourmaline’s resilience has you wondering what other leaders might be making moves, now's a good time to broaden your horizons with fast growing stocks with high insider ownership

With shares still trading below analyst targets while production and dividends are surging, the question remains: is Tourmaline Oil currently undervalued, or is the market already pricing in its robust long-term growth story?

Most Popular Narrative: 15% Undervalued

Tourmaline Oil’s most-followed narrative calculates a fair value well above the latest share price, suggesting analysts see considerable upside as LNG-driven growth accelerates. The fair value is built on rigorous expectations for revenue expansion, margin shifts, and the company’s aggressive capital strategy.

Strategic build-out of low-cost, high-margin inventory in the Northeast BC Montney, with associated infrastructure owned by Tourmaline, positions the company for meaningful production growth to 850,000 BOE/d by early next decade. At flat pricing, this will more than double annual free cash flow, supporting higher future dividend payments and potential buybacks.

Curious how Tourmaline’s massive production ambitions factor into this bullish target? The narrative’s math hinges on one surprising forecast that most investors wouldn’t dare plug into their models. Click and find out what drives this lofty valuation. The details may change your take on the stock.

Result: Fair Value of $73.57 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weakness in natural gas prices or delays in export infrastructure could quickly challenge even the most optimistic growth scenario for Tourmaline.

Find out about the key risks to this Tourmaline Oil narrative.

Another View: Looking at Price Ratios

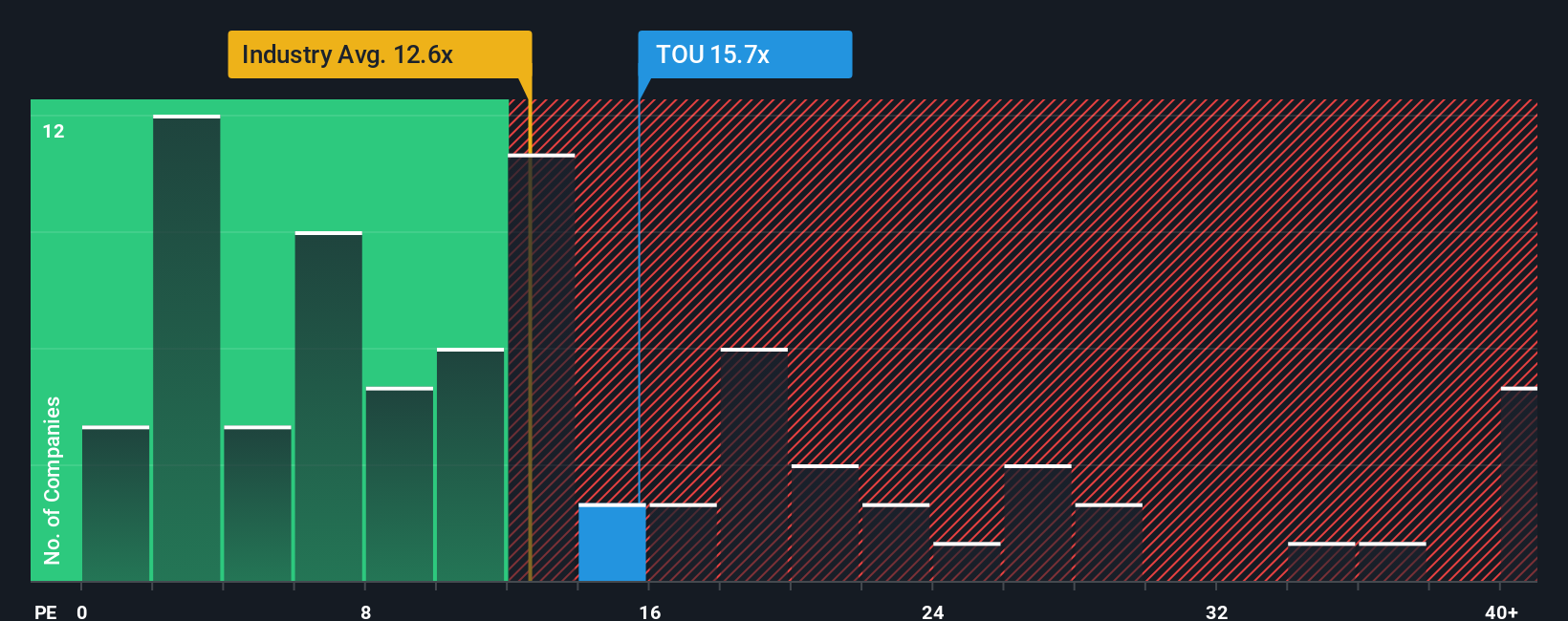

Of course, not everyone values Tourmaline Oil using future cash flows or analyst models alone. If you look at the price-to-earnings ratio, the shares trade at 18.2x earnings, making them more expensive than both the Canadian Oil and Gas industry average (14.4x) and peer average (16.4x). This puts the stock at a premium, even though the fair ratio estimate is 19.5x. Does this higher price signal deeper value, or is it a warning that expectations might be running ahead of reality?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tourmaline Oil Narrative

If you find yourself questioning the consensus or want to dig into the numbers on your own terms, it only takes a few minutes to build your own view. Do it your way

A great starting point for your Tourmaline Oil research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Want to take your portfolio to the next level? Get ahead of the crowd and find stocks set for remarkable growth using these powerful tools:

- Unlock high-yield potential by targeting opportunities in these 15 dividend stocks with yields > 3%. This approach focuses on reliable income and strong financials for long-term stability.

- Catch tomorrow's leaders early by scanning these 25 AI penny stocks. Artificial intelligence innovation in this area is turning small bets into extraordinary returns.

- Capitalize on the rise of digital finance with these 82 cryptocurrency and blockchain stocks. Connect your investments to the most promising blockchain and cryptocurrency stocks on the market.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives