- Canada

- /

- Oil and Gas

- /

- TSX:TOU

Tourmaline Oil (TSX:TOU) Valuation Check After Quarterly Dividend Confirmation

Reviewed by Simply Wall St

Tourmaline Oil (TSX:TOU) just reaffirmed its income story, declaring a CAD 0.50 quarterly cash dividend payable December 31 to shareholders on record as of December 15, designated as an eligible dividend for Canadian tax purposes.

See our latest analysis for Tourmaline Oil.

The dividend affirmation lands while Tourmaline’s share price has climbed around 13% over the past quarter to about CA$65.50. However, its year to date share price return is still slightly negative, and long term total shareholder returns remain very strong, suggesting momentum may be rebuilding as investors re-rate its income and growth profile.

If this income story has you thinking more broadly about opportunities in energy and beyond, it could be a good moment to explore fast growing stocks with high insider ownership.

With shares still down year to date, trading about 11% below consensus targets, and boasting robust earnings growth, should investors view Tourmaline as undervalued, or is the market already pricing in its future expansion?

Most Popular Narrative: 9.9% Undervalued

With Tourmaline’s shares last closing at CA$65.50 against a narrative fair value of about CA$72.71, this framework points to meaningful upside potential driven by long term growth.

Strategic build-out of low-cost, high-margin inventory in the Northeast BC Montney, with associated infrastructure owned by Tourmaline, positions the company for meaningful production growth to 850,000 BOE/d by early next decade. At flat pricing, this will more than double annual free cash flow, supporting higher future dividend payments and potential buybacks.

Curious how this growth plan turns today’s cash flows into a higher fair value, built on faster revenue expansion, shifting margins, and a richer future earnings multiple? Click through to see which assumptions really move the needle.

Result: Fair Value of $72.71 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, sustained gas price weakness or delays to LNG infrastructure and export capacity could blunt Tourmaline’s growth, putting pressure on cash flows and valuation assumptions.

Find out about the key risks to this Tourmaline Oil narrative.

Another Take on Value

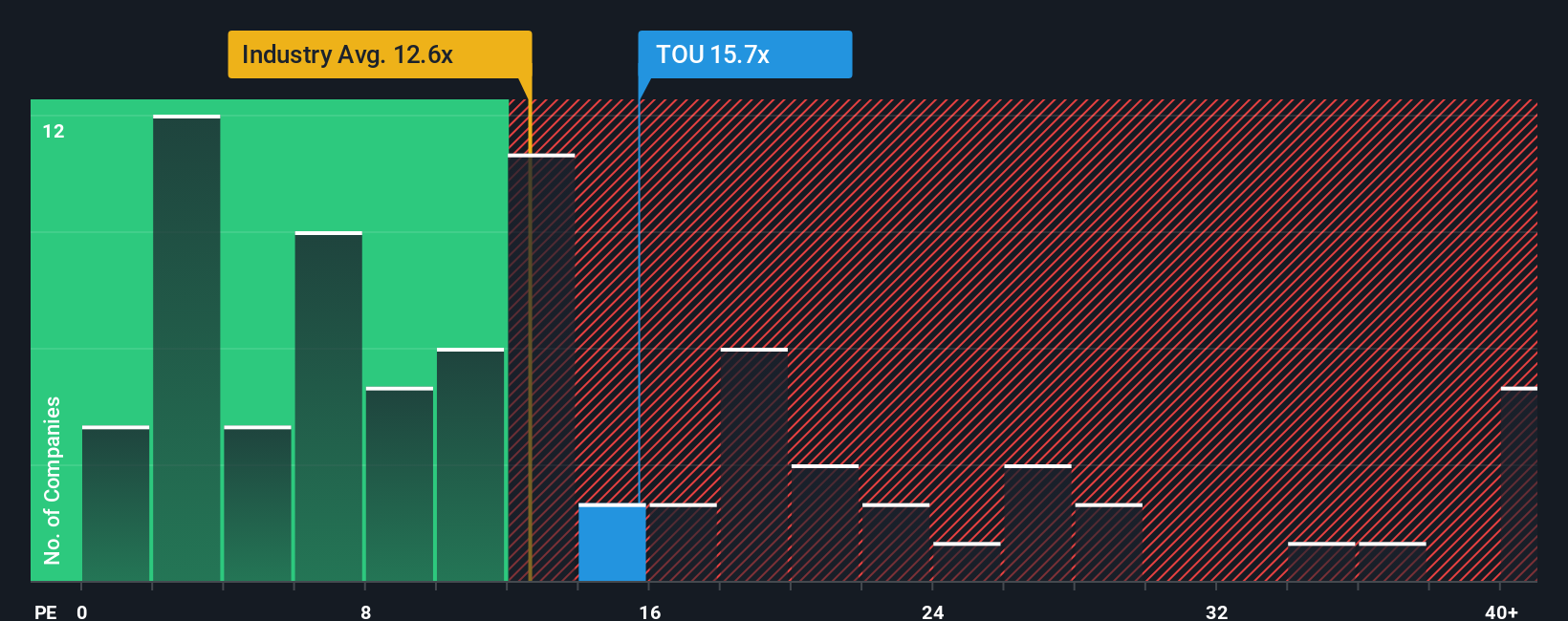

On earnings, Tourmaline looks pricey, trading on a 19.1x price to earnings ratio versus 15.2x for the Canadian Oil and Gas industry and 17.1x for peers. Yet its fair ratio sits nearer 21.1x, hinting the market could still rerate higher if growth delivers, or de rate if sentiment turns.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Tourmaline Oil Narrative

If you would rather dig into the numbers yourself instead of relying on these views, you can quickly build a personalized thesis in just minutes: Do it your way.

A great starting point for your Tourmaline Oil research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in your next potential opportunity by scanning targeted stock ideas on Simply Wall St, where data driven screens surface stand out candidates.

- Capture potential price misalignments by reviewing these 906 undervalued stocks based on cash flows, which may trade below their intrinsic cash flow value.

- Position for transformative innovation by assessing these 26 AI penny stocks, which are at the forefront of machine learning and automation.

- Strengthen your income strategy by checking these 15 dividend stocks with yields > 3%, which can support long term total returns with reliable payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tourmaline Oil might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOU

Tourmaline Oil

Engages in the acquisition, exploration, development, and production of petroleum and natural gas properties in the Western Canadian Sedimentary Basin.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026