- Canada

- /

- Energy Services

- /

- TSX:TOT

Undiscovered Gems in Canada Promising Stocks for September 2025

Reviewed by Simply Wall St

As the Canadian market navigates through a landscape marked by elevated inflation and a softening labour market, investors are keenly watching for opportunities amidst potential volatility. With central banks poised to adjust interest rates and fiscal policies providing support, small-cap stocks can offer unique growth prospects in this environment. Identifying promising stocks involves looking for companies with strong fundamentals that can capitalize on these evolving economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Pulse Seismic | NA | 13.84% | 33.31% | ★★★★★★ |

| Clairvest Group | NA | -8.94% | -11.82% | ★★★★★★ |

| TWC Enterprises | 3.89% | 13.21% | 11.52% | ★★★★★★ |

| Itafos | 23.13% | 10.69% | 44.01% | ★★★★★★ |

| Mako Mining | 5.45% | 22.24% | 62.70% | ★★★★★★ |

| BMTC Group | NA | -4.13% | -8.71% | ★★★★★☆ |

| Grown Rogue International | 26.48% | 33.74% | 4.14% | ★★★★★☆ |

| Corby Spirit and Wine | 58.35% | 10.79% | -4.77% | ★★★★☆☆ |

| Soma Gold | 142.85% | 31.11% | 38.09% | ★★★★☆☆ |

| Dundee | 1.89% | -35.40% | 52.34% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Total Energy Services (TSX:TOT)

Simply Wall St Value Rating: ★★★★★★

Overview: Total Energy Services Inc. is an energy services company operating in Canada, the United States, Australia, and internationally with a market capitalization of CA$488.99 million.

Operations: Total Energy Services generates revenue from four primary segments: Well Servicing (CA$114.23 million), Contract Drilling Services (CA$332.82 million), Compression and Process Services (CA$466.41 million), and Rentals and Transportation Services (CA$77.62 million). The Compression and Process Services segment contributes the largest share to the company's revenue stream, highlighting its significance within the overall business model.

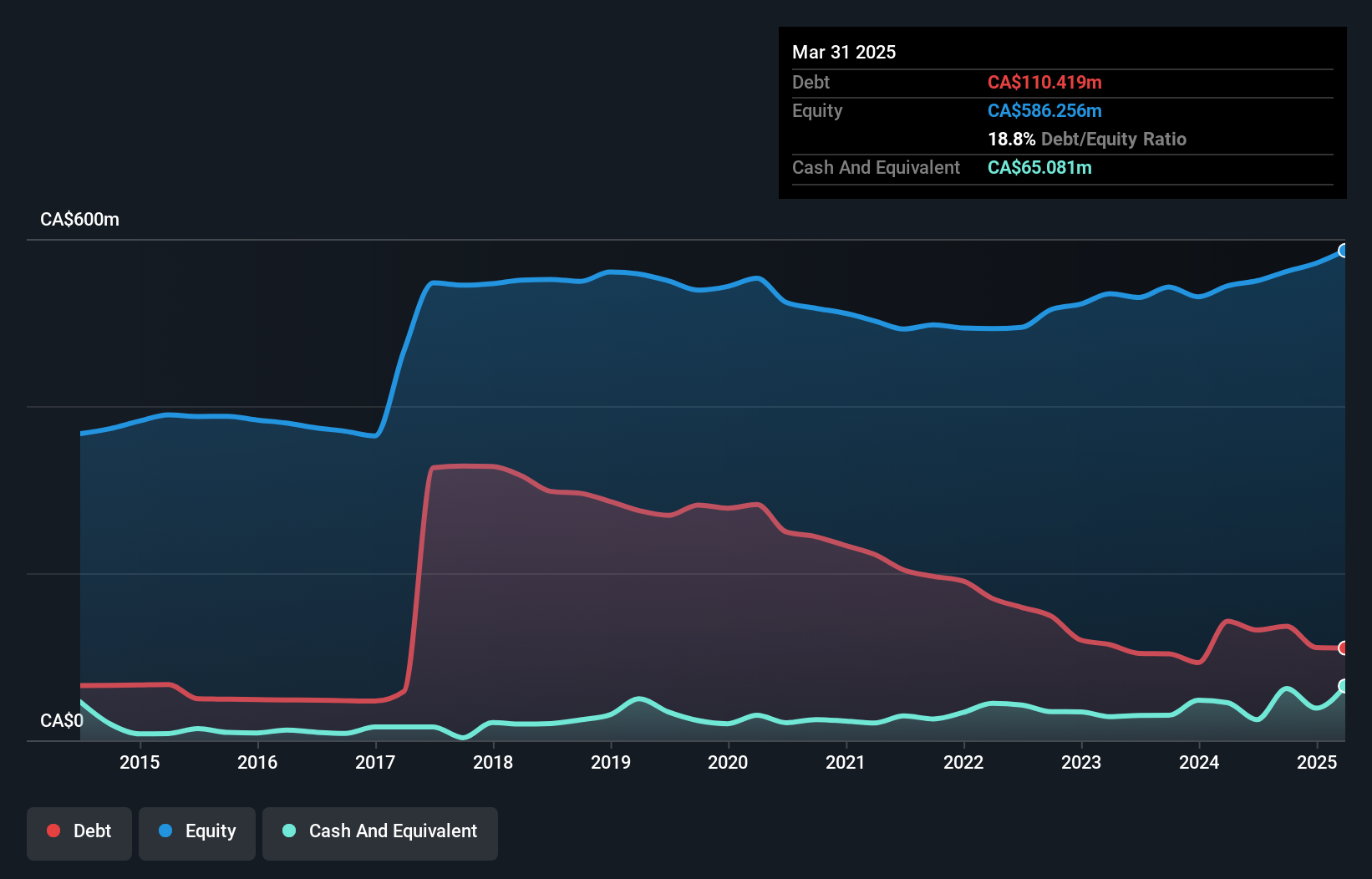

Total Energy Services, a dynamic player in the energy services sector, has demonstrated notable financial resilience and strategic growth. The company achieved a 55.7% earnings growth over the past year, significantly outpacing the industry average of -17%. Its debt to equity ratio impressively decreased from 47.6% to 17.2% over five years, while maintaining a satisfactory net debt to equity ratio of 11.3%. Trading at approximately 84.7% below its estimated fair value suggests potential upside for investors considering its high-quality earnings and strong interest coverage at 13x EBIT compared to interest payments.

Tamarack Valley Energy (TSX:TVE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Tamarack Valley Energy Ltd. is involved in the exploration, development, production, and sale of oil, natural gas, and natural gas liquids in the Western Canadian sedimentary basin with a market cap of CA$2.58 billion.

Operations: Tamarack Valley Energy generates revenue primarily from its oil and gas exploration and production activities, with reported revenues of CA$1.40 billion.

Tamarack Valley Energy, a notable player in Canada's oil and gas sector, has made strides in reducing its debt to equity ratio from 42.5% to 34.6% over five years, reflecting financial discipline. The company achieved an impressive earnings growth of 95.6% last year, outpacing the industry's 7.8%. Despite trading at a discount of 35.8% below its estimated fair value and maintaining well-covered interest payments with EBIT at 5.6 times coverage, Tamarack faces challenges including potential declines in profit margins from 18% to 4.9%. Recent strategic moves include share repurchases worth CAD41.77 million and securing CAD325 million through senior unsecured notes due by July 2030 for debt restructuring purposes.

ShaMaran Petroleum (TSXV:SNM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: ShaMaran Petroleum Corp., along with its subsidiaries, is involved in the exploration and production of oil and gas, with a market capitalization of CA$588.20 million.

Operations: ShaMaran generates revenue primarily from the exploration and development of oil and gas assets, amounting to $135.44 million.

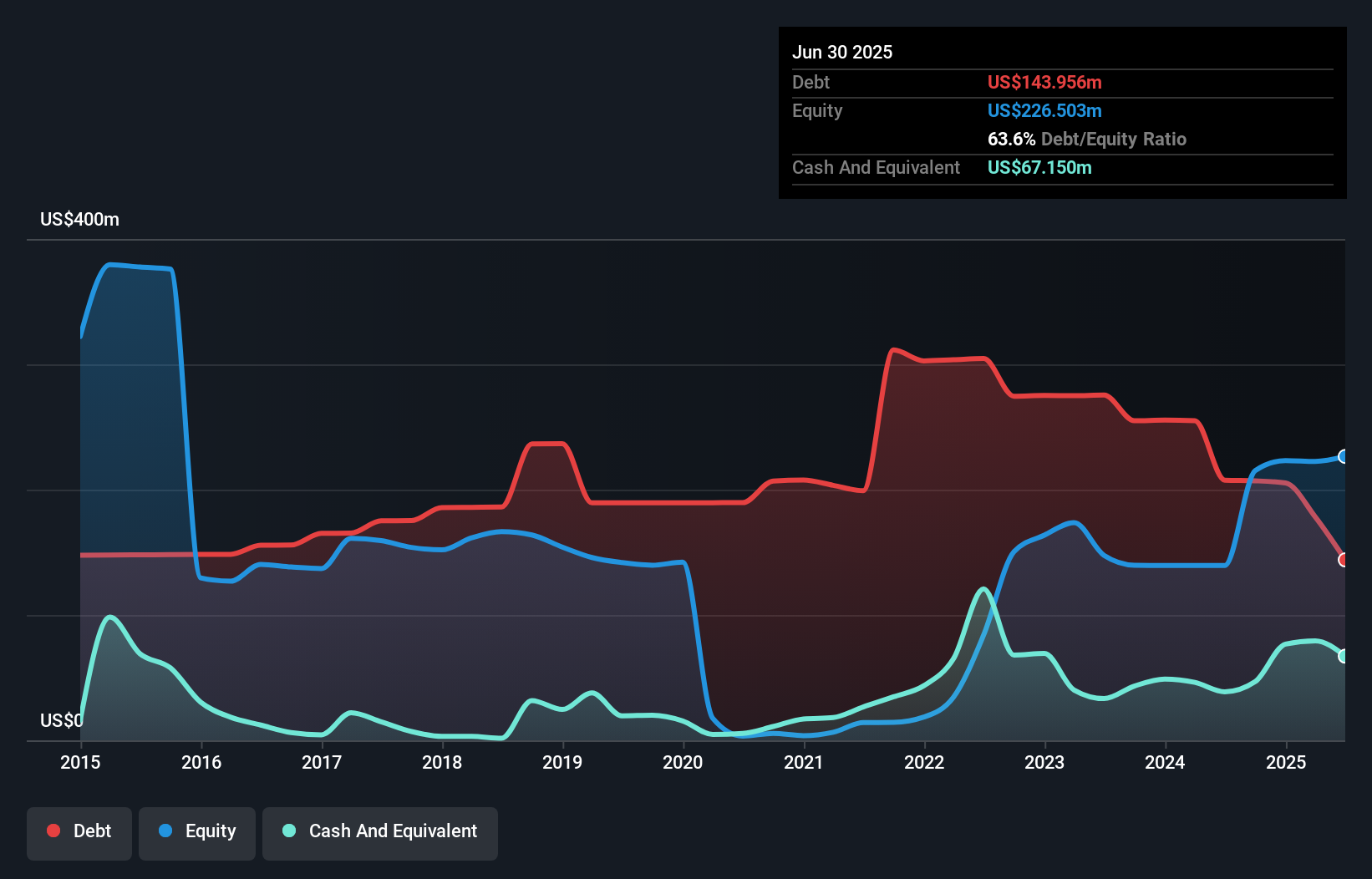

ShaMaran Petroleum, a player in the oil and gas sector, recently turned profitable, setting it apart from industry peers with a net debt to equity ratio of 33.9%, which is considered satisfactory. Trading at 70.8% below its estimated fair value suggests potential for growth despite forecasted earnings declines of 5.5% annually over the next three years. Recent production results show an impressive increase in average company net daily oil production to 22.7 Mbopd from Atrush and Sarsang fields, up by 88% compared to last year’s figures, while sales climbed to US$35 million with a US$3 million net income turnaround this quarter.

Next Steps

- Gain an insight into the universe of 51 TSX Undiscovered Gems With Strong Fundamentals by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Total Energy Services might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TOT

Total Energy Services

Operates as an energy services company primarily in Canada, the United States, Australia, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives