- Canada

- /

- Oil and Gas

- /

- TSX:SCR

Strathcona Resources (TSX:SCR): Valuation Spotlight After Special Dividend Approval

Reviewed by Simply Wall St

Strathcona Resources (TSX:SCR) is moving ahead with a substantial special dividend after both the Court of King's Bench of Alberta and company shareholders approved a $10.00 per share payout.

See our latest analysis for Strathcona Resources.

This special dividend caps off a stretch of strong momentum for Strathcona Resources, with the stock’s 1-year total shareholder return sitting at a robust 35.9%. After a lively 12.95% jump in the past 30 days, the company’s share price has been trending higher year to date, hinting at building optimism from investors around recent developments and future potential.

If you’re interested in discovering more opportunities beyond oil and gas, consider checking out fast growing stocks with high insider ownership next.

With shares surging and a headline-making special dividend on the way, some investors are asking whether Strathcona Resources is undervalued at current levels or if the market has already priced in all the good news, leaving limited potential for further upside.

Most Popular Narrative: 8.9% Overvalued

With Strathcona Resources recently closing at CA$41.79, the most tracked narrative estimates fair value at CA$38.38. This sets up an intriguing debate between current market enthusiasm and more cautious, consensus expectations.

The company's acquisition-driven model, culminating in the pursuit of MEG, increases financial leverage and operational concentration. In a scenario of global underinvestment failing to offset future demand erosion or if energy policy headwinds materialize faster than anticipated, earnings could become more volatile than current market expectations reflect.

Wondering what ambitious financial forecasts justify this pricing? There is a hidden mix of estimated earnings drops and margin changes that is shaping this narrative’s view. Only the full story reveals which bold assumptions drive this fair value.

Result: Fair Value of $38.38 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, unexpected success in organic production growth or timely execution of capital returns could challenge current analyst expectations and significantly shift future valuations.

Find out about the key risks to this Strathcona Resources narrative.

Another View: Market Multiples Send a Mixed Message

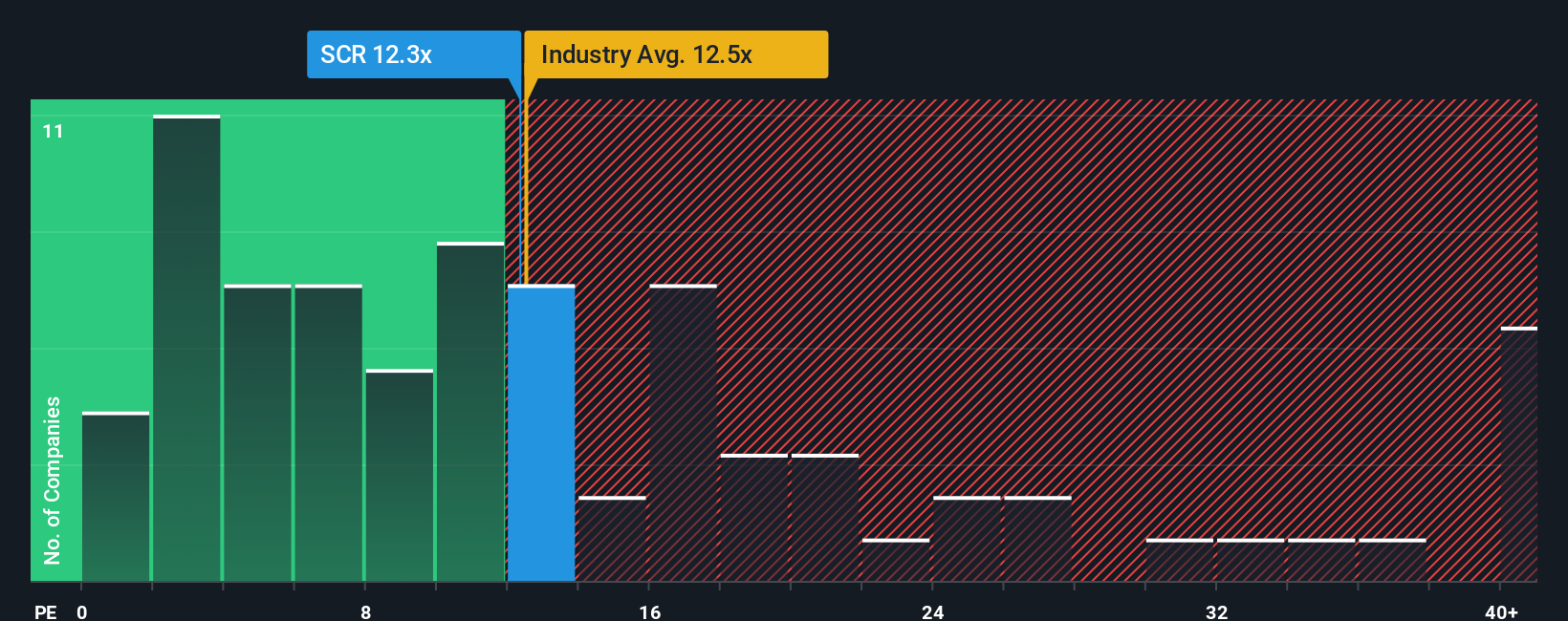

While the previous fair value was set using analyst forecasts, a quick look at the company’s price-to-earnings ratio tells a different story. Strathcona trades at 14.9x earnings, below the Canadian market average (16.3x) but matching its industry at 14.9x. However, this is well above the fair ratio of 9.4x. This signals the market might be assigning a premium that could shrink if sentiment shifts. Should investors be cautious about this disconnect?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Strathcona Resources Narrative

If this perspective doesn’t quite resonate or you’d rather dig into the numbers on your own, you can build your personal analysis in just a few minutes. Do it your way

A great starting point for your Strathcona Resources research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the next wave of profit opportunities pass you by. Expand your watchlist with high-potential stocks using Simply Wall Street’s screeners.

- Discover opportunities for rapid financial growth by checking out these 3561 penny stocks with strong financials with strong fundamentals shaking up the market right now.

- Explore options for powerful, long-term returns by targeting these 15 dividend stocks with yields > 3% that consistently reward shareholders with yielding payouts above 3%.

- Stay at the forefront of innovation by focusing on these 30 healthcare AI stocks making headlines with artificial intelligence breakthroughs in medicine and care.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SCR

Strathcona Resources

Acquires, explores, develops, and produces petroleum and natural gas reserves in Canada.

Flawless balance sheet unattractive dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026