- Canada

- /

- Energy Services

- /

- TSX:PHX

Will Slower Profit Growth Despite Rising Sales Reshape PHX Energy Services' (TSX:PHX) Narrative?

Reviewed by Sasha Jovanovic

- PHX Energy Services recently announced its third quarter and nine-month financial results, revealing higher sales of C$164.33 million and C$525.71 million respectively, but lower net income and earnings per share compared to the previous year.

- An additional company update confirmed that no shares were repurchased under the 2025 buyback tranche, following the completion of share repurchases in the 2024 program.

- With sales growth outpacing profit gains, we'll explore how this development informs PHX Energy Services' investment narrative.

This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

What Is PHX Energy Services' Investment Narrative?

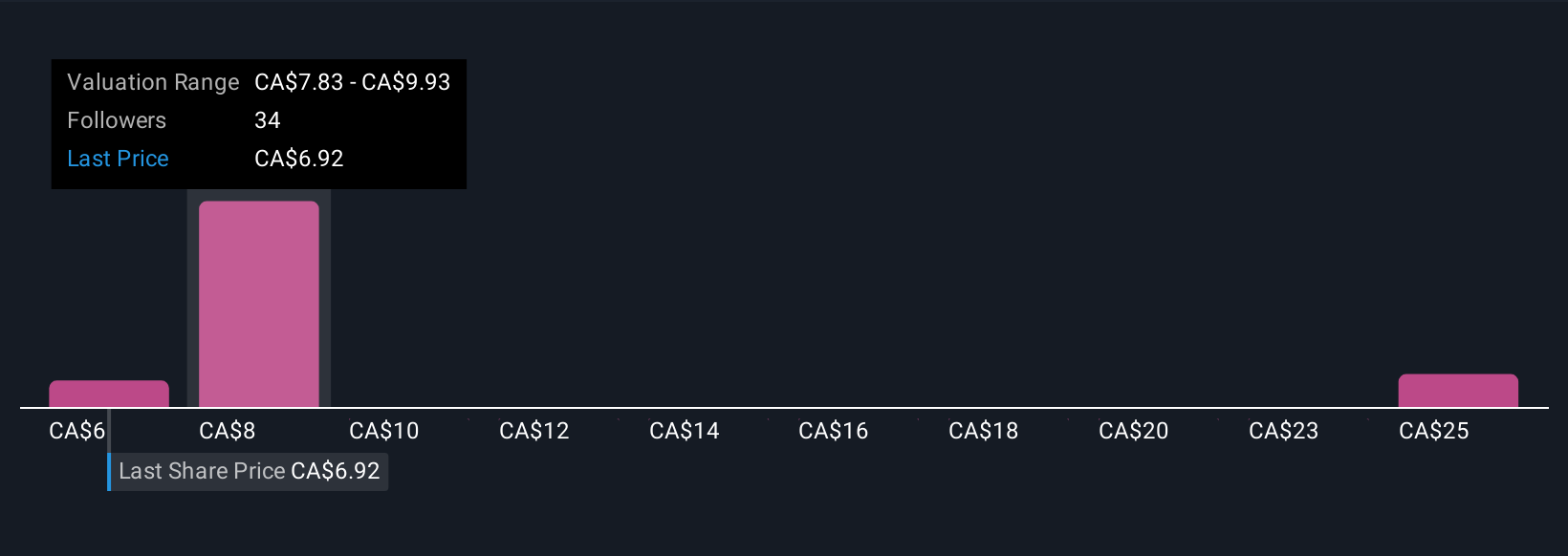

Being a PHX Energy Services shareholder today means believing in value and relative stability more than explosive growth. While the recent earnings report showed higher sales, profit margins narrowed, with net income and earnings per share declining year over year. The just-completed share buyback under the 2024 authorization moved the needle only marginally and the follow-up 2025 tranche has so far seen no action, signaling that buybacks may not be a near-term catalyst. For now, the most important drivers are likely to be operational efficiency and market demand, rather than capital returns. Dividends remain attractive but with coverage flagged as a concern, and the business continues to trade well below consensus fair value estimates. Fresh news hasn’t shifted the key risks: muted earnings momentum and industry underperformance still need watching. On the flip side, sustaining such a high dividend yield could become a pressure point.

PHX Energy Services' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 9 other fair value estimates on PHX Energy Services - why the stock might be worth over 3x more than the current price!

Build Your Own PHX Energy Services Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your PHX Energy Services research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

- Our free PHX Energy Services research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate PHX Energy Services' overall financial health at a glance.

Contemplating Other Strategies?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PHX

PHX Energy Services

Provides horizontal and directional drilling services, rents performance drilling motors, and sells motor equipment and parts to oil and natural gas exploration and development companies in Canada, the United States, Albania, the Middle East regions, and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives