- Canada

- /

- Oil and Gas

- /

- TSX:PEY

Peyto Exploration & Development (TSX:PEY): Does CEO’s Recent Share Sale Signal a Shift in Valuation?

Reviewed by Simply Wall St

The recent exercise and sale of 74,000 shares by Peyto Exploration & Development (TSX:PEY) CEO Jean-Paul Henri Lachance has caught the attention of investors. Insider selling can sometimes signal changes that are worth a deeper look, adding to current market discussions.

See our latest analysis for Peyto Exploration & Development.

Amid positive sentiment in the energy sector, Peyto Exploration & Development’s share price has gathered momentum, climbing nearly 20% over the last 90 days and sitting at $22.42. The company’s 12-month total shareholder return stands at 45%, and its 3-year figure tops 100%, reflecting ongoing investor confidence even as recent insider selling prompts new discussion around the stock’s trajectory.

If you're looking beyond the headlines for other compelling opportunities, now is a great time to expand your search and discover fast growing stocks with high insider ownership

With strong recent gains and robust long-term returns, investors are left to wonder if Peyto Exploration & Development’s current price is an attractive entry point or if the market is already pricing in its future growth.

Most Popular Narrative: Fairly Valued

With the fair value target now at CA$22.32 and shares closing at CA$22.42, Peyto Exploration & Development is nearly in line with consensus estimates. This sets the stage for a look at what is driving analyst convictions about the company’s prospects.

“Bullish analysts continue to view the company’s execution and operational efficiency as supportive of long-term growth. They maintain a Buy rating despite short-term adjustments.”

Think Peyto’s valuation has peaked? There is a surprising twist in the story, with high-margin growth projections and rising capital returns built into this estimate. The real catalyst might not be what you expect. Find out what makes this narrative tick and why analysts are looking past near-term noise to predict long-term value.

Result: Fair Value of $22.32 (ABOUT RIGHT)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent infrastructure constraints and geographic concentration could undermine Peyto’s current momentum. These factors may expose the company to sudden market and operational shifts.

Find out about the key risks to this Peyto Exploration & Development narrative.

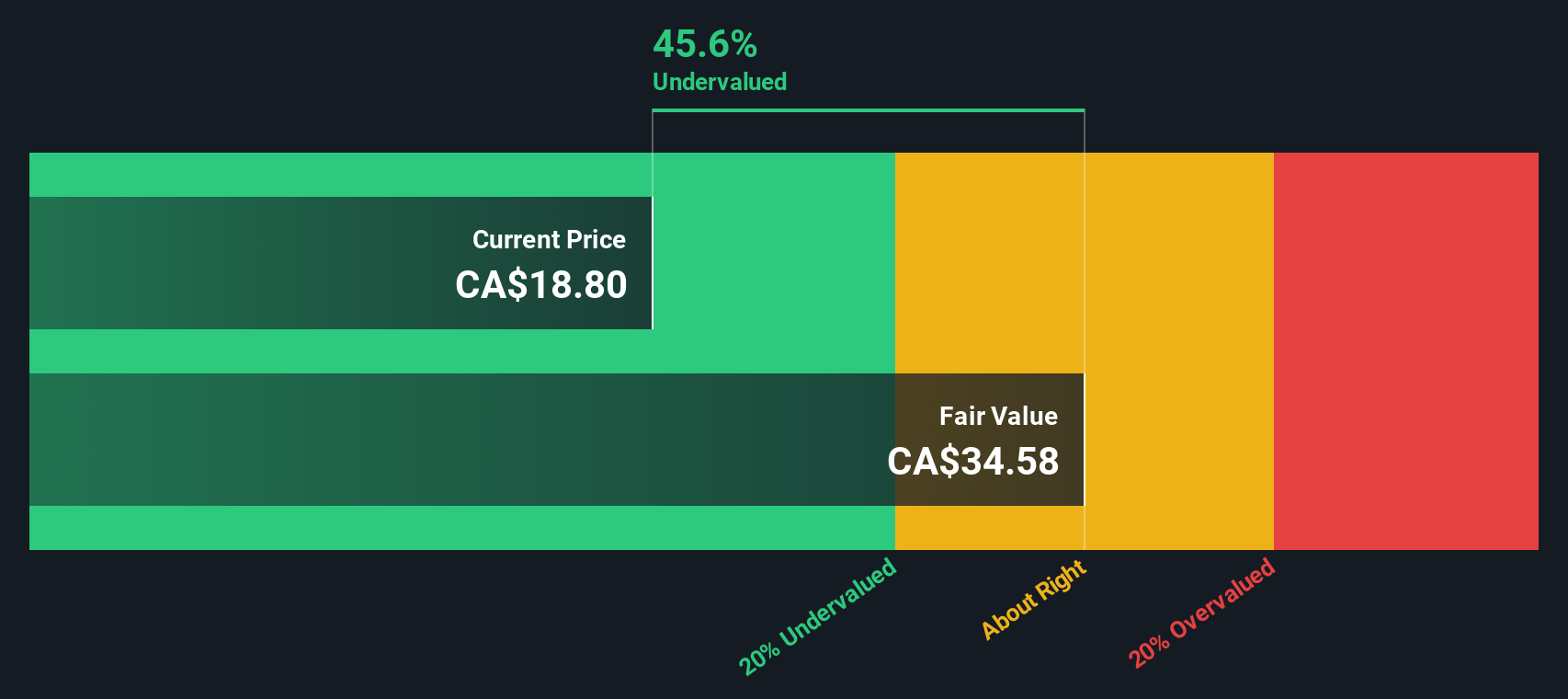

Another View: Discounted Cash Flow Model

While the market-based valuation points to Peyto Exploration & Development trading near fair value, our SWS DCF model presents a markedly different perspective. According to this approach, the stock is undervalued by a significant margin, suggesting that the shares may have much more upside than current market multiples indicate. Could the market be underestimating Peyto's true long-term value?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Peyto Exploration & Development Narrative

If you see the story unfolding differently or want to run your own numbers, creating your personalized viewpoint takes less than three minutes. Do it your way

A great starting point for your Peyto Exploration & Development research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Stay a step ahead of the market by taking action right now. Use the Simply Wall Street Screener to pinpoint new areas of opportunity and avoid missing the next breakout trend.

- Spot the next big wave of innovation by browsing these 25 AI penny stocks, which are already transforming industries with artificial intelligence breakthroughs.

- Supercharge your passive income by exploring these 15 dividend stocks with yields > 3% and find yields above 3% for stable, long-term growth.

- Get ahead of Wall Street in future tech by investigating these 28 quantum computing stocks, which are at the forefront of quantum computing advancements.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:PEY

Peyto Exploration & Development

Engages in the exploration, development, and production of natural gas, oil, and natural gas liquids in Alberta’s deep basin.

Undervalued with solid track record and pays a dividend.

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026