- Sweden

- /

- Consumer Finance

- /

- OM:HOFI

Undervalued Global Small Caps With Insider Buying In July 2025

Reviewed by Simply Wall St

As global markets navigate the complexities of new U.S. tariffs and mixed economic signals, small-cap stocks have shown resilience, with indices like the Russell 2000 posting modest gains despite broader market fluctuations. In this environment, identifying promising small-cap opportunities often involves looking for companies with strong fundamentals and potential catalysts such as insider buying, which can signal confidence in a company's future prospects amidst uncertain market dynamics.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| MCAN Mortgage | 11.1x | 6.2x | 49.35% | ★★★★★☆ |

| Daiwa House Logistics Trust | 11.4x | 6.9x | 20.04% | ★★★★★☆ |

| A.G. BARR | 19.1x | 1.8x | 47.18% | ★★★★☆☆ |

| Hemisphere Energy | 5.2x | 2.2x | 8.71% | ★★★★☆☆ |

| Nexus Industrial REIT | 6.8x | 3.0x | 13.67% | ★★★★☆☆ |

| CVS Group | 45.0x | 1.3x | 39.17% | ★★★★☆☆ |

| NSI | 207.7x | 5.6x | 49.67% | ★★★☆☆☆ |

| Saturn Oil & Gas | 2.7x | 0.5x | -122.85% | ★★★☆☆☆ |

| Morguard North American Residential Real Estate Investment Trust | 5.7x | 1.8x | 12.14% | ★★★☆☆☆ |

| DIRTT Environmental Solutions | 11.1x | 0.7x | 7.55% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

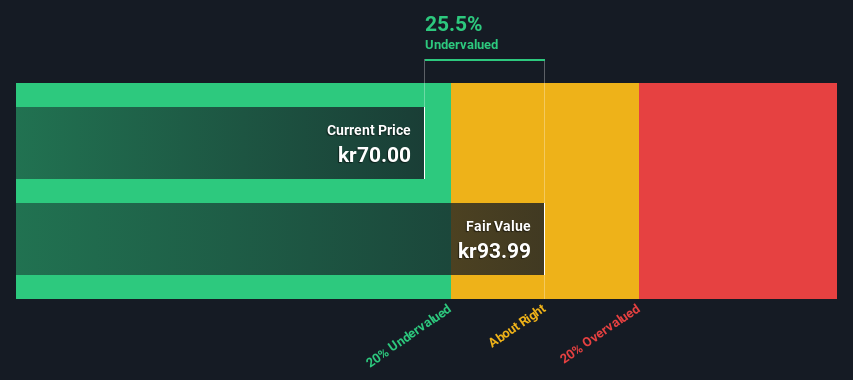

Hoist Finance (OM:HOFI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Hoist Finance is a Swedish financial services company specializing in the acquisition and management of non-performing loan portfolios, with a market capitalization of SEK 1.58 billion.

Operations: The company's revenue primarily stems from unsecured and secured segments, with the unsecured segment contributing more significantly. Over time, the gross profit margin has seen fluctuations, notably dropping from a consistent 100% to 69.44% in recent periods. Operating expenses have been a considerable part of costs, with general and administrative expenses being a significant component.

PE: 8.7x

Hoist Finance, a smaller company in the financial sector, recently completed a SEK 1 billion fixed-income offering and approved a dividend of SEK 2 per share. Despite high debt levels and reliance on external borrowing, insider confidence is evident as an individual increased their stake by nearly 20%. Earnings for Q1 2025 were SEK 203 million. With earnings projected to grow annually by over 13%, there is potential for future value appreciation.

- Dive into the specifics of Hoist Finance here with our thorough valuation report.

Understand Hoist Finance's track record by examining our Past report.

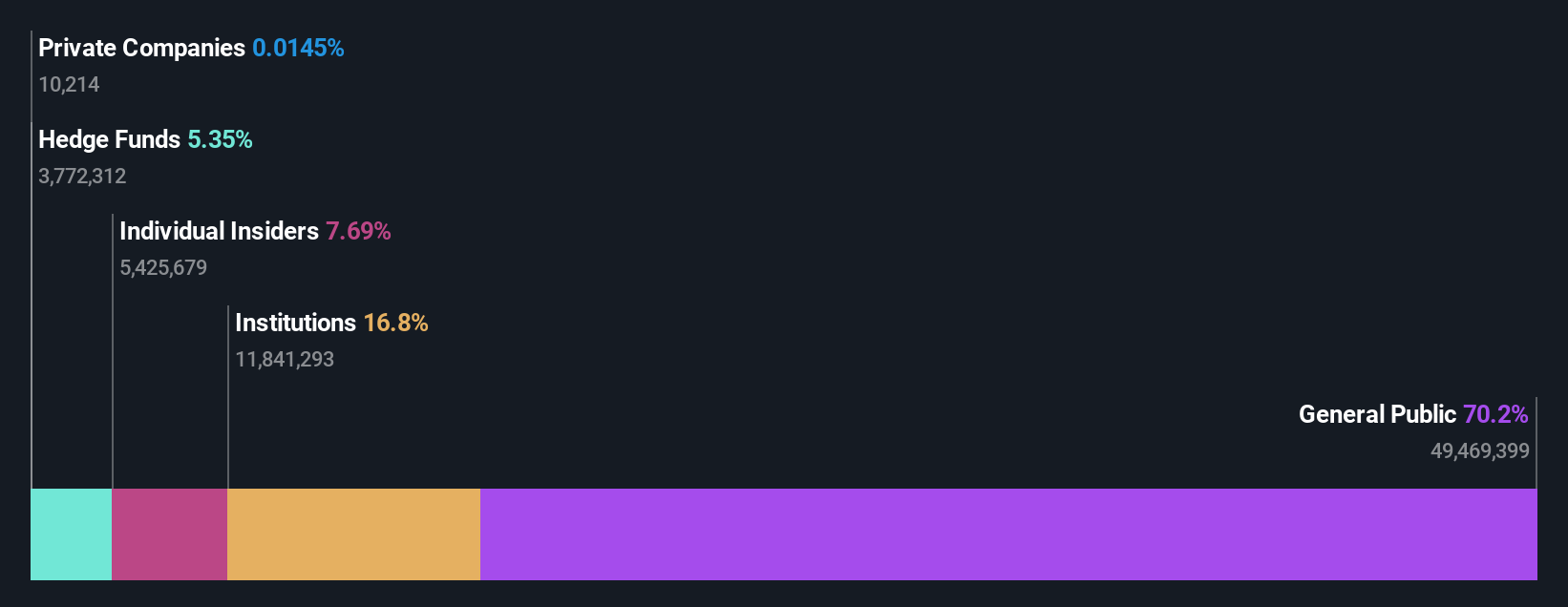

Obsidian Energy (TSX:OBE)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Obsidian Energy is an oil and gas exploration and production company with a focus on operations in Western Canada, boasting a market cap of approximately CA$0.56 billion.

Operations: Obsidian Energy generates revenue primarily from oil and gas exploration and production, with a reported revenue of CA$755.60 million in the latest period. The company has experienced fluctuations in its gross profit margin, which reached 62.19% recently. Operating expenses have varied significantly over time, impacting overall profitability.

PE: -2.7x

Obsidian Energy, a smaller company in the energy sector, has shown promising signs of growth with earnings projected to rise 161% annually. Recent insider confidence is evident through share purchases, signaling belief in future prospects. The company's strategic drilling activities have boosted production figures significantly across heavy and light oil assets. Despite higher risk funding from external borrowing and a CAD 12.1 million impairment, Obsidian's robust operational updates and completed share buybacks highlight potential for value realization amidst industry challenges.

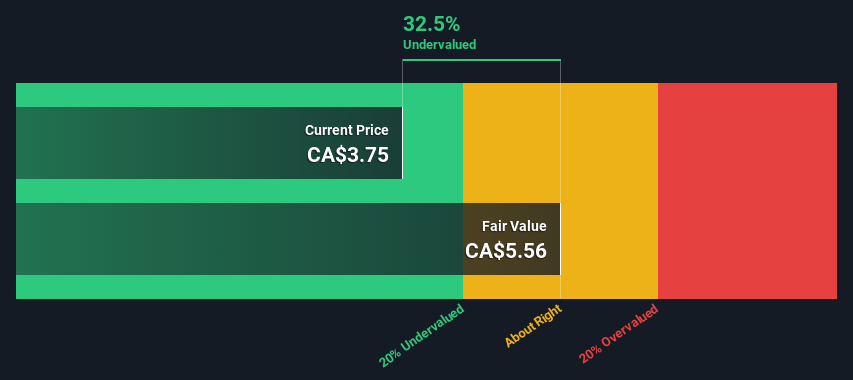

Plaza Retail REIT (TSX:PLZ.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Plaza Retail REIT focuses on the ownership and development of retail real estate, with a market capitalization of CA$0.45 billion.

Operations: The primary revenue stream comes from retail real estate ownership and development, with the latest reported revenue at CA$124.21 million. The cost of goods sold (COGS) is CA$47.54 million, resulting in a gross profit of CA$76.67 million. Operating expenses are recorded at CA$12.27 million, while non-operating expenses amount to CA$39.46 million, impacting the net income margin which stands at 20.08%.

PE: 17.5x

Plaza Retail REIT, a smaller player in the retail real estate sector, has been drawing attention for its potential value. Despite facing higher risk due to reliance on external borrowing, the company maintains regular monthly distributions of C$0.02333 per unit. Notably, insider confidence is evident as an independent director increased their holdings by 26%, investing over C$69K. Earnings showed stable sales growth with first-quarter revenue at C$31 million compared to last year's C$29 million.

Next Steps

- Click through to start exploring the rest of the 118 Undervalued Global Small Caps With Insider Buying now.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hoist Finance might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:HOFI

Hoist Finance

A credit market company, engages in the loan acquisition and management operations in Europe.

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives