- Canada

- /

- Oil and Gas

- /

- TSX:NXE

Why NexGen Energy (TSX:NXE) Is Up 9.9% After Reporting Highest-Grade Uranium Discovery at Patterson Corridor

Reviewed by Sasha Jovanovic

- NexGen Energy announced its highest-grade uranium assay to date from Patterson Corridor East, with drill hole RK-25-256 intersecting 5.5 meters at 21.4% U3O8, including an ultra-high-grade 0.5 meters at 74.8%.

- This finding not only reinforces the potential of NexGen’s exploration near its Arrow deposit, but also positions the company as a significant contributor to meeting uranium demand for critical minerals globally.

- We’ll explore how the expansion of high-grade mineralization at Patterson Corridor East shapes NexGen Energy’s evolving investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is NexGen Energy's Investment Narrative?

NexGen Energy’s story rests on the belief in long-term demand for uranium and the successful transition from project development to producing, revenue-generating operations. The recent highest-grade assay at Patterson Corridor East and the progression into Canadian Nuclear Safety Commission hearings for Rook I could sharpen upcoming catalysts, particularly regulatory milestones and further exploration results. With Rook I now approaching final federal approval after a twelve-year journey, the timeline to possible construction start is coming into clearer view. This is likely to be material for how investors approach the stock’s near-term risks, which have included regulatory uncertainty and financing needs. While the company’s persistent losses, lack of current revenue, and premium price-to-book ratio signal continued business risks, if the Rook I approvals proceed as management expects, these could shift market sentiment and alter risk assessments for NexGen.

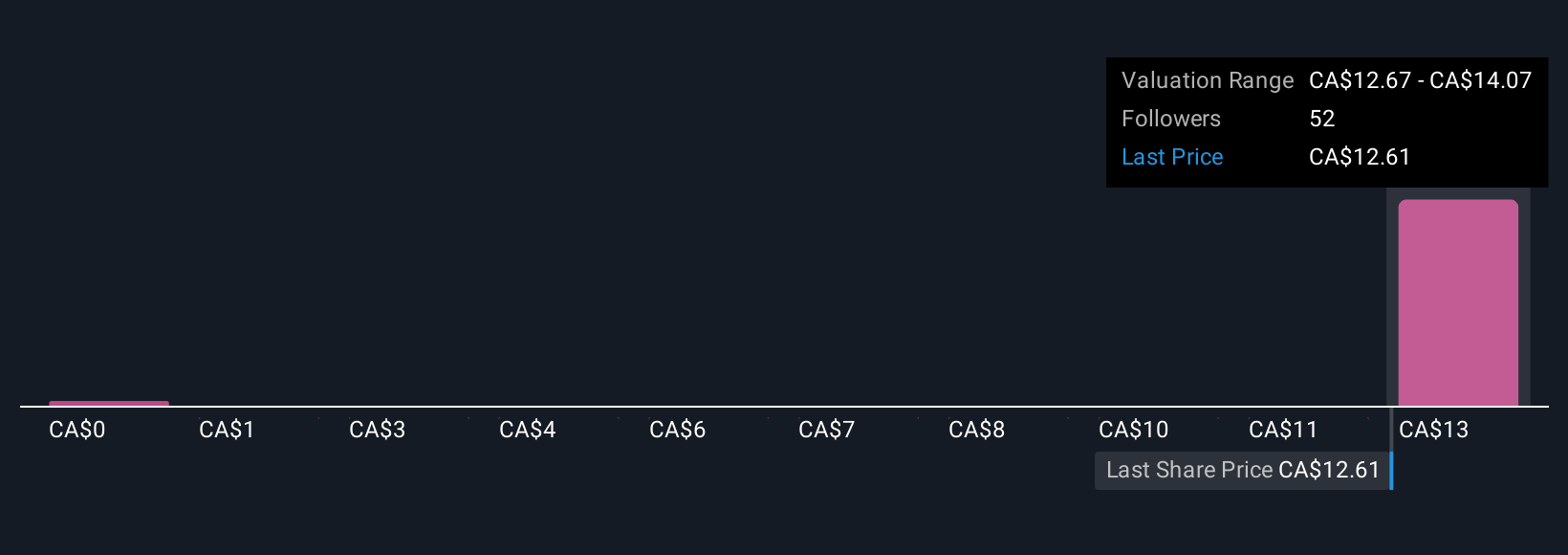

But on the other hand, investors should also be mindful of ongoing regulatory and funding challenges. Our valuation report unveils the possibility NexGen Energy's shares may be trading at a premium.Exploring Other Perspectives

Explore 5 other fair value estimates on NexGen Energy - why the stock might be worth less than half the current price!

Build Your Own NexGen Energy Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your NexGen Energy research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

- Our free NexGen Energy research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate NexGen Energy's overall financial health at a glance.

Ready For A Different Approach?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- AI is about to change healthcare. These 30 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- We've found 14 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 36 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NexGen Energy might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NXE

NexGen Energy

An exploration and development stage company, engages in the acquisition, exploration, evaluation, and development of uranium properties in Canada.

Excellent balance sheet with slight risk.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026