- Canada

- /

- Oil and Gas

- /

- TSX:HWX

Does Headwater Exploration’s (TSX:HWX) 2026 Plan Reveal Its Ideal Balance Between Growth and Dividends?

Reviewed by Sasha Jovanovic

- Headwater Exploration recently approved its initial 2026 budget, targeting annual production of 24,500 boe/d with around 8% year-over-year production per-share growth, supported by a 37% reinvestment rate at US$60.00/bbl WTI while maintaining a US$0.44 per-share annual dividend and positive exit adjusted working capital.

- The combination of planned production growth, relatively modest reinvestment, and an affirmed quarterly dividend of US$0.11 per share highlights a balanced approach to expansion and shareholder returns.

- We’ll explore how this planned 8% production per-share growth shapes Headwater Exploration’s investment narrative and what it might mean for investors.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Headwater Exploration's Investment Narrative?

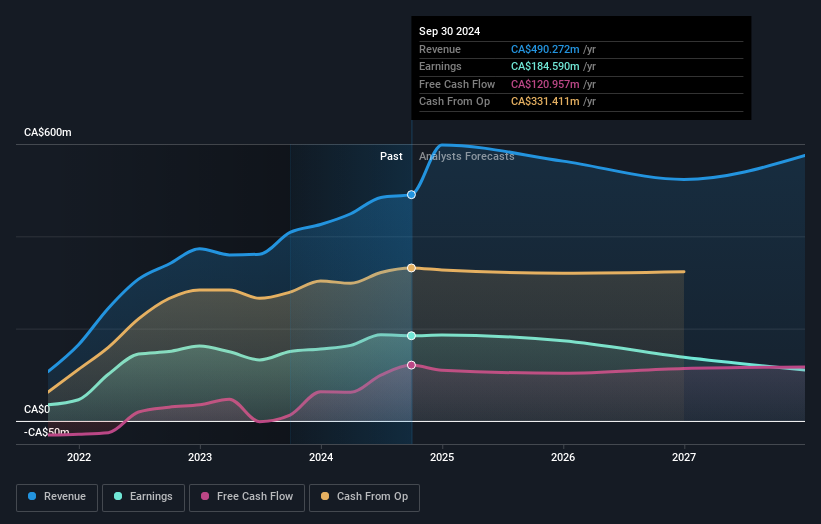

To own Headwater Exploration, you need to be comfortable with a story that leans on disciplined oil-weighted growth and cash returns, rather than aggressive expansion. The newly approved 2026 budget, with 8% production per-share growth at a 37% reinvestment rate and a held US$0.44 dividend, reinforces that message and, in the near term, likely keeps the main catalysts focused on execution: hitting production targets, managing decline rates, and proving that capital spending can stay efficient at US$60 WTI. At the same time, consensus still points to softening earnings over the next few years, so the key risk now tilts less toward balance sheet strain and more toward weaker profitability if commodity prices or operating performance slip. The stock’s strong recent run suggests this guidance is largely welcomed, but it also raises the stakes if results disappoint.

However, there is a key profitability risk in the background that investors should understand. Headwater Exploration's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Ten fair value estimates from the Simply Wall St Community span roughly CA$5 to almost CA$20, underlining how differently investors see Headwater’s prospects. Against that backdrop, the company’s commitment to production growth, dividends and a lower reinvestment rate keeps the spotlight firmly on whether forecast earnings softness becomes a bigger drag on future returns.

Explore 10 other fair value estimates on Headwater Exploration - why the stock might be worth over 2x more than the current price!

Build Your Own Headwater Exploration Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Headwater Exploration research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

- Our free Headwater Exploration research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Headwater Exploration's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Headwater Exploration might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HWX

Headwater Exploration

Engages in the exploration, development, and production of petroleum and natural gas resources in Canada.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026