- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Strong U.S. Output and Higher Income Might Change the Case for Investing in Freehold Royalties (TSX:FRU)

Reviewed by Sasha Jovanovic

- Freehold Royalties Ltd. reported strong third quarter 2025 results, with net income rising to C$34.15 million and production increasing 10% year-over-year, fueled by higher U.S. output, acquisitions, and operational efficiencies.

- The company’s diversified, liquids-rich portfolio combined with its North American exposure provided stable cash flows and allowed it to benefit from favorable U.S. natural gas pricing.

- We'll examine how growth in U.S. production is shaping Freehold Royalties' investment narrative amid its expanding geographic footprint.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

What Is Freehold Royalties' Investment Narrative?

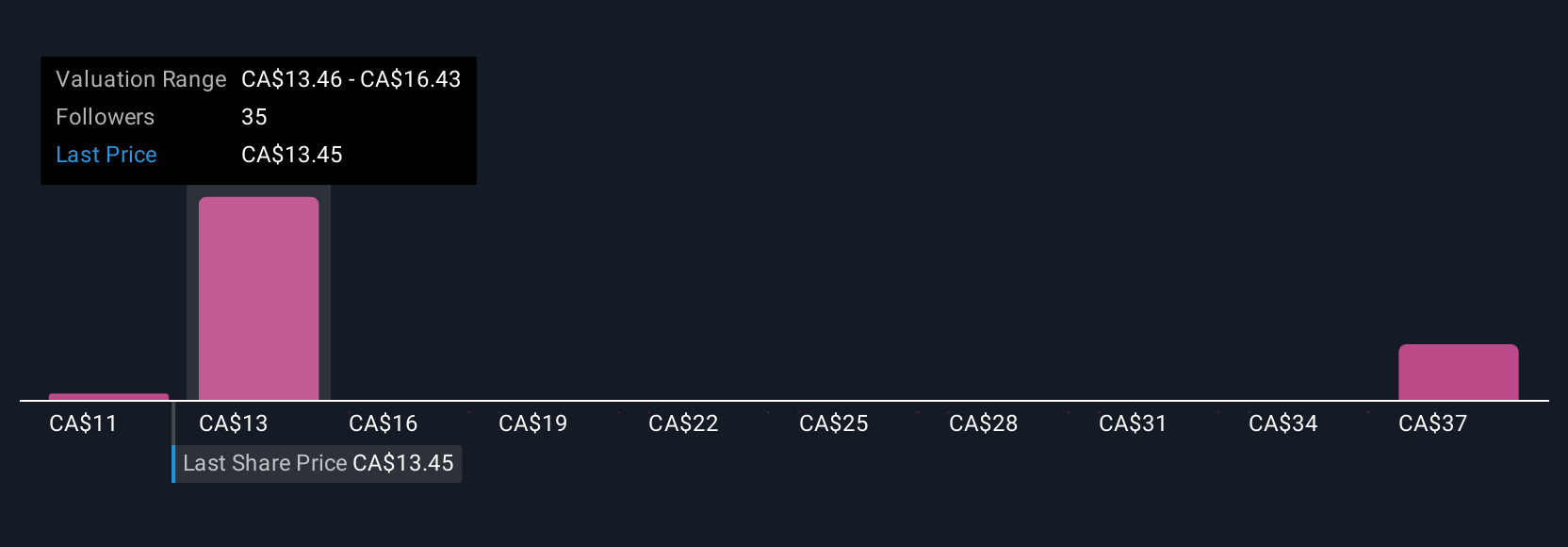

To be on board with Freehold Royalties, an investor needs conviction in the company’s ability to deliver steady cash flow from its diversified, oil and gas royalty portfolio, particularly as it expands its U.S. exposure. The recent third quarter results showed a marked improvement in production and net income compared to the prior year, largely driven by higher U.S. output, acquisitions, and operational efficiency gains. This gives some reassurance on near-term cash flow stability and supports dividend payments. However, the longer-term risks haven’t disappeared, earnings and revenue growth over the past year have lagged industry averages, and the dividend remains not fully covered by earnings and cash flow. The new results might mitigate immediate concerns over profit declines seen earlier in the year, but investors will still need to watch for sustained earnings improvement and whether recent momentum translates into lasting value. Value signals and analyst targets remain only moderately above the current share price, so the impact of this quarter’s strong production and income will take a few more reports to fully assess. On the other hand, ongoing concerns around dividend coverage and negative earnings growth linger for now.

Freehold Royalties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 8 other fair value estimates on Freehold Royalties - why the stock might be worth over 2x more than the current price!

Build Your Own Freehold Royalties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freehold Royalties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Freehold Royalties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freehold Royalties' overall financial health at a glance.

Looking For Alternative Opportunities?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives