- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Is Leadership Streamlining and Insider Buying Altering The Investment Case For Freehold Royalties (TSX:FRU)?

Reviewed by Sasha Jovanovic

- Freehold Royalties Ltd. recently confirmed the departure of Chief Operating Officer Robert King and the elimination of the COO role, with his responsibilities absorbed by the existing executive team following the end of its management agreement with Rife Resources Ltd.

- A few days later, Senior Officer Lisa Farstad invested C$105,700 to acquire 7,000 Freehold shares at C$15.10 each, materially increasing her personal stake and signaling alignment with shareholders.

- We’ll now examine how Farstad’s increased ownership and the streamlined executive structure may influence Freehold Royalties’ investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is Freehold Royalties' Investment Narrative?

To own Freehold Royalties, you really need to buy into a relatively simple story: a royalty-focused business that turns steady production into generous monthly dividends, even if revenue is expected to edge slightly lower and earnings growth has cooled. The recent exit of the COO and elimination of the role looks more like a cleanup after the Rife management agreement than a reset of the thesis, and the share price has taken it in stride, with gains over the past quarter. Lisa Farstad’s C$105,700 insider purchase adds a personal vote of confidence, but it does not remove the core risks around dividend sustainability, especially with a payout that is not well covered by recent earnings. In the near term, dividend resilience and commodity prices remain the real swing factors.

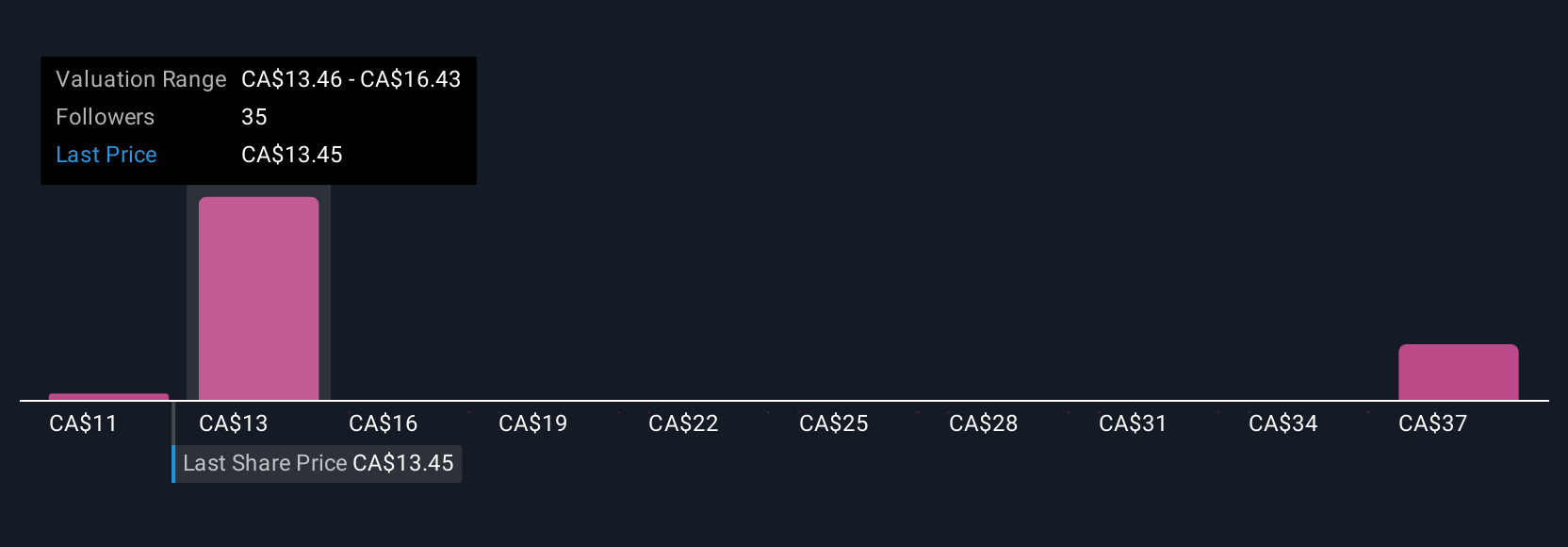

However, one key risk could catch income-focused investors off guard if conditions change. Freehold Royalties' shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 9 other fair value estimates on Freehold Royalties - why the stock might be worth over 2x more than the current price!

Build Your Own Freehold Royalties Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Freehold Royalties research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

- Our free Freehold Royalties research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Freehold Royalties' overall financial health at a glance.

No Opportunity In Freehold Royalties?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Halyk Bank of Kazakhstan will see revenue grow 11% as their future PE reaches 3.2x soon

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026