- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Is Freehold Royalties a Value Gem After Strategic Acquisitions Lift Investor Optimism?

Reviewed by Bailey Pemberton

- Ever wondered if Freehold Royalties is actually a value gem in energy stocks or just looks the part? Let’s dig into what’s driving investor interest right now.

- The stock has shown solid momentum, climbing 2.8% in just the past week and returning an impressive 14.7% over the past year. These results hint at shifting views on its growth story and perceived risks.

- Shares have rallied following renewed optimism around energy prices and industry consolidation. Analysts have highlighted Freehold's recent strategic acquisitions in North America as strong tailwinds, and this recent news provides important context behind the latest upward moves in the share price.

- Our first look at the numbers gives Freehold Royalties a 3/6 valuation score based on traditional value checks. Next, we will break down how this score is determined and why there may be an even better way to size up a company's true value, which we will cover by the end of the article.

Find out why Freehold Royalties's 14.7% return over the last year is lagging behind its peers.

Approach 1: Freehold Royalties Discounted Cash Flow (DCF) Analysis

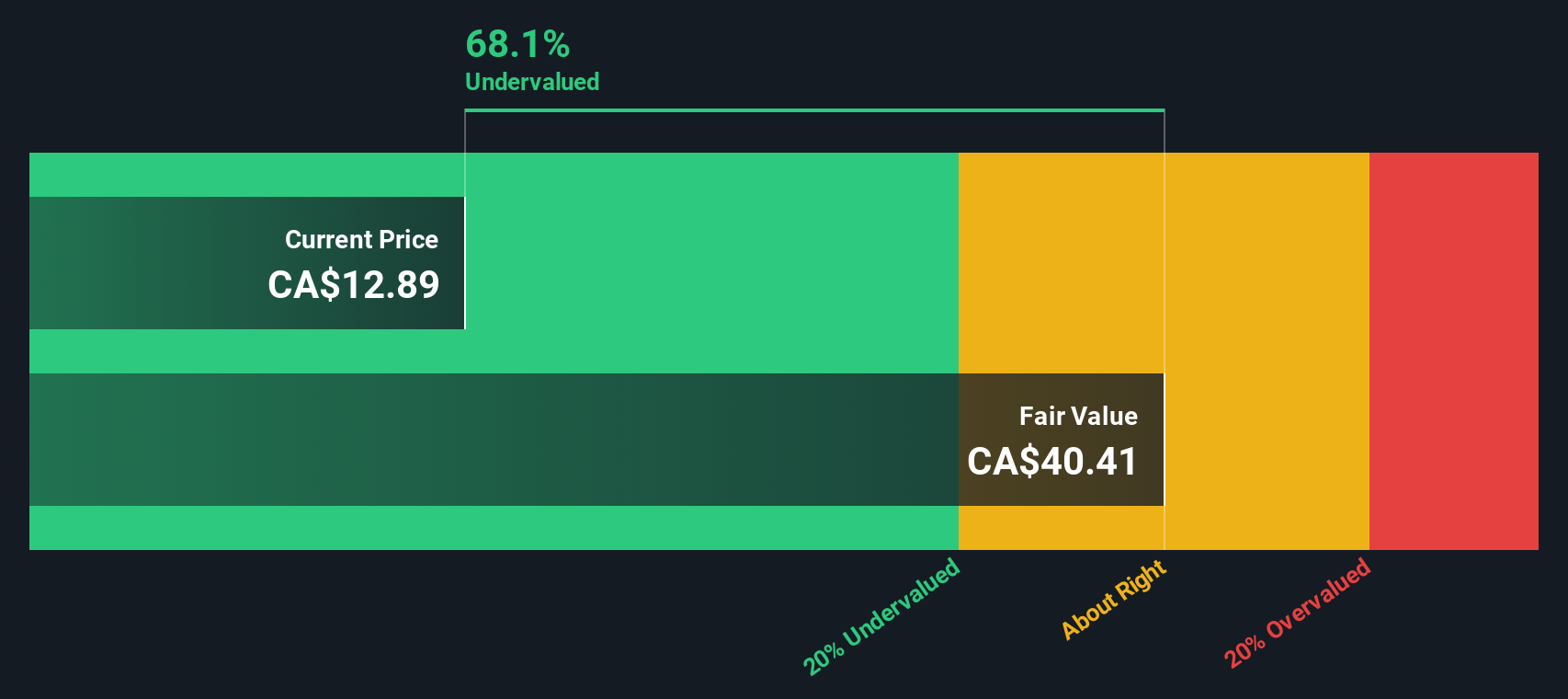

A Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and discounting them back to today’s value. In Freehold Royalties’ case, the analysis uses a 2 Stage Free Cash Flow to Equity framework to assess the business’s long-term value in today’s terms.

Freehold Royalties generated CA$85.4 million in free cash flow over the last twelve months. Analyst estimates project that this figure will climb to CA$237.5 million by 2027, reflecting a strong outlook. For the next decade, cash flow projections continue rising, with analyst-driven estimates for the first five years and extrapolations beyond that provided by Simply Wall St. This approach offers a comprehensive look at how future earnings power might unfold.

Based on these discounted projections, the DCF-derived fair value per share for Freehold Royalties is CA$41.52. With the stock currently trading at roughly a 64.6% discount to this value, the model indicates that Freehold Royalties appears deeply undervalued according to its forward-looking cash generation profile.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Freehold Royalties is undervalued by 64.6%. Track this in your watchlist or portfolio, or discover 879 more undervalued stocks based on cash flows.

Approach 2: Freehold Royalties Price vs Earnings

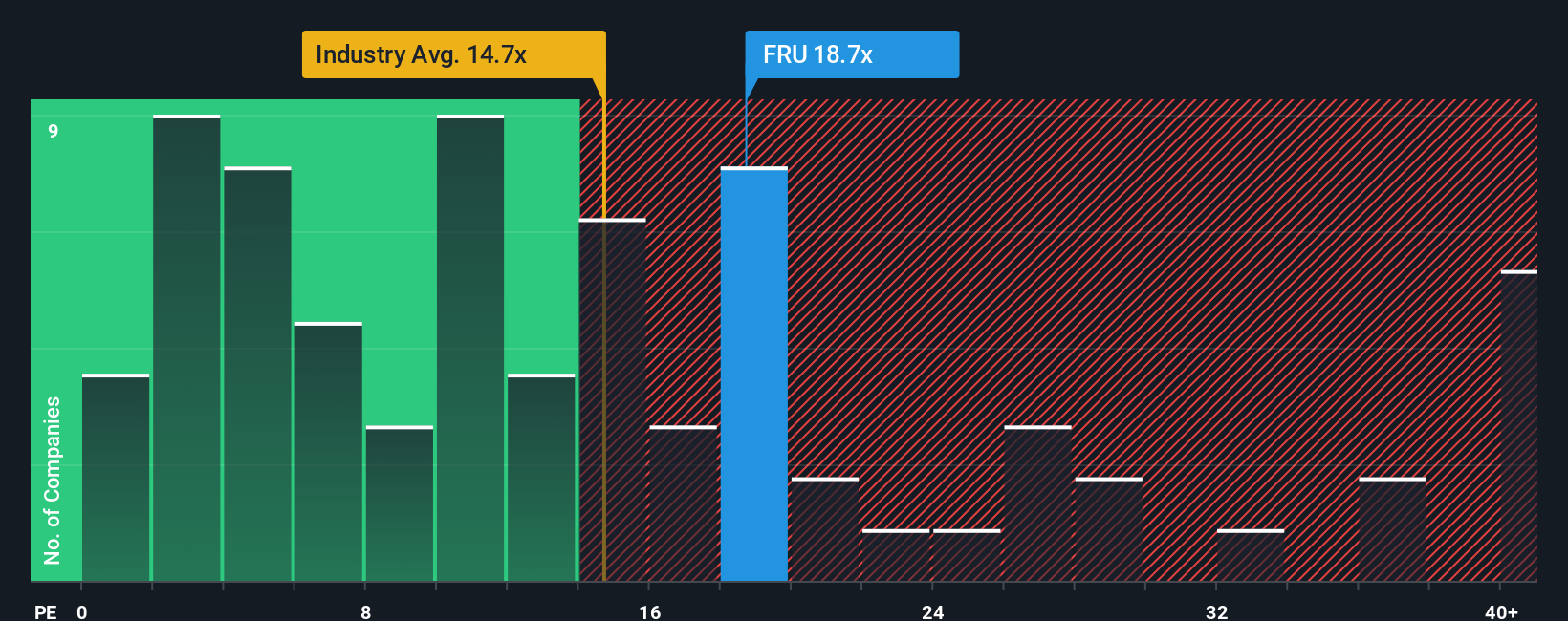

For profitable businesses like Freehold Royalties, the Price-to-Earnings (PE) ratio is one of the most reliable valuation tools. It expresses how much investors are currently willing to pay for each dollar of a company’s earnings. This makes it a straightforward way to benchmark value, especially when earnings are stable and positive.

However, what’s considered a “normal” or “fair” PE ratio depends on more than just raw earnings. Growth prospects and risk play major roles. Rapidly growing or less risky businesses tend to warrant higher PE ratios, while those facing headwinds or greater uncertainty usually trade at a discount.

Currently, Freehold Royalties trades at an 18.7x PE ratio. This is above the Oil and Gas industry average of 14.7x but well below the peer group average of 29.4x. This suggests that the company sits in the middle ground relative to its wider market.

To provide a more customized benchmark, Simply Wall St introduces the “Fair Ratio,” a proprietary metric that estimates what an appropriate PE ratio should be for Freehold Royalties. Unlike simple peer or industry comparisons, the Fair Ratio considers the company’s specific earnings growth outlook, risk profile, profit margins, market cap, and where it sits within its sector.

Comparing Freehold Royalties' current PE to its Fair Ratio helps determine if the stock is priced attractively, fairly, or at a premium after accounting for these nuanced factors. In this case, because the difference is less than 0.10, the price appears to be in line with its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1406 companies where insiders are betting big on explosive growth.

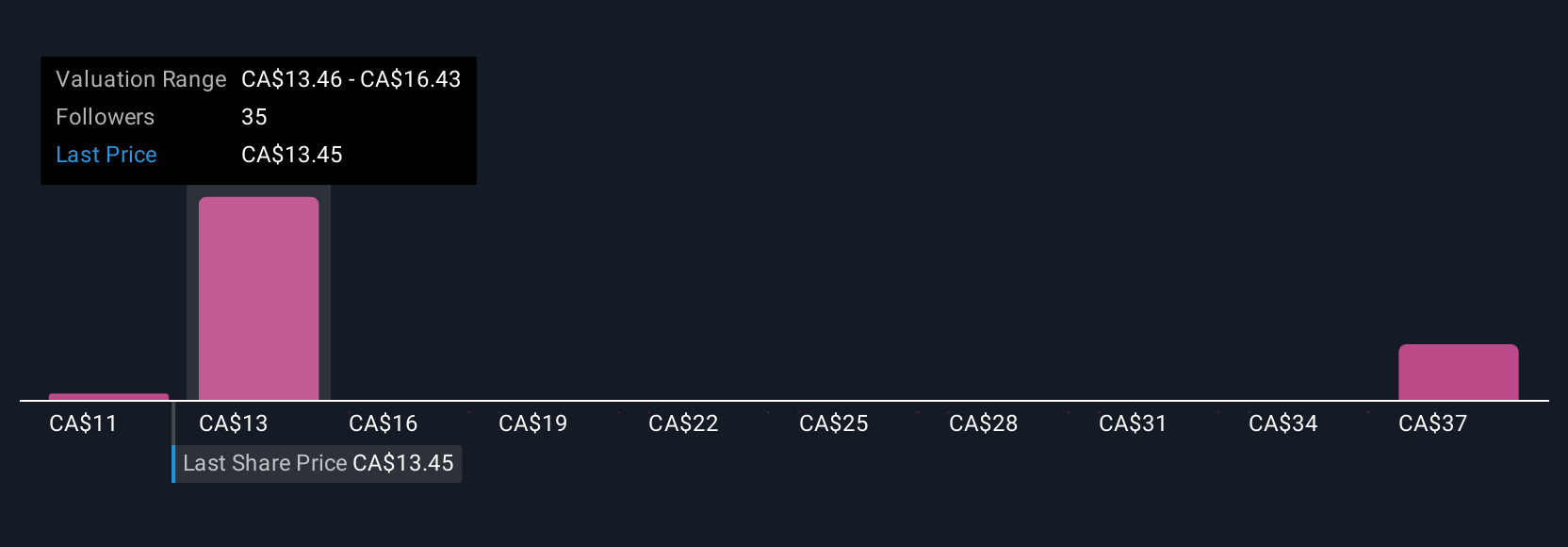

Upgrade Your Decision Making: Choose your Freehold Royalties Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your personalized story about a company, connecting your beliefs about its future—such as expected growth and fair value—to the actual financial forecast. Narratives go beyond the numbers, making it easy for anyone to tie together their own perspective with what the numbers are saying.

This approach links a company’s story directly to its projected earnings, revenue, margins, and ultimately to an estimated fair value. This helps you see exactly how your assumptions stack up. Narratives are available to millions of investors on Simply Wall St’s Community page and can be used by anyone, regardless of experience level.

What makes Narratives a powerful tool is their flexibility. They update automatically whenever there is big news or new earnings, so your view is always fresh. By comparing your Fair Value to the current Price, you can make better informed decisions about when to buy, hold, or sell.

For example, one investor’s Narrative might see Freehold Royalties as severely undervalued at CA$41.52 per share, while another’s story, based on different assumptions, suggests it is only worth CA$24.10. Your Narrative puts you in control of your investing decisions.

Do you think there's more to the story for Freehold Royalties? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Acquires and manages royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Canada and the United States.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives