- Canada

- /

- Oil and Gas

- /

- TSX:ENB

Is Enbridge Still a Bargain After 21.7% Share Price Surge?

Reviewed by Bailey Pemberton

- Ever caught yourself wondering if Enbridge is a bargain or just riding the energy wave? Let's dig into what makes this stock catch the eye of so many investors.

- Enbridge shares have climbed 3.8% in just the last week, up 10.3% year-to-date and an impressive 21.7% over the past year. This highlights renewed growth enthusiasm and shifting market sentiment.

- Recent headlines spotlight Enbridge's major expansion moves and upcoming infrastructure projects, giving the stock an extra spark. Policy developments and the push for reliable energy sources are adding important context to the price momentum we have seen.

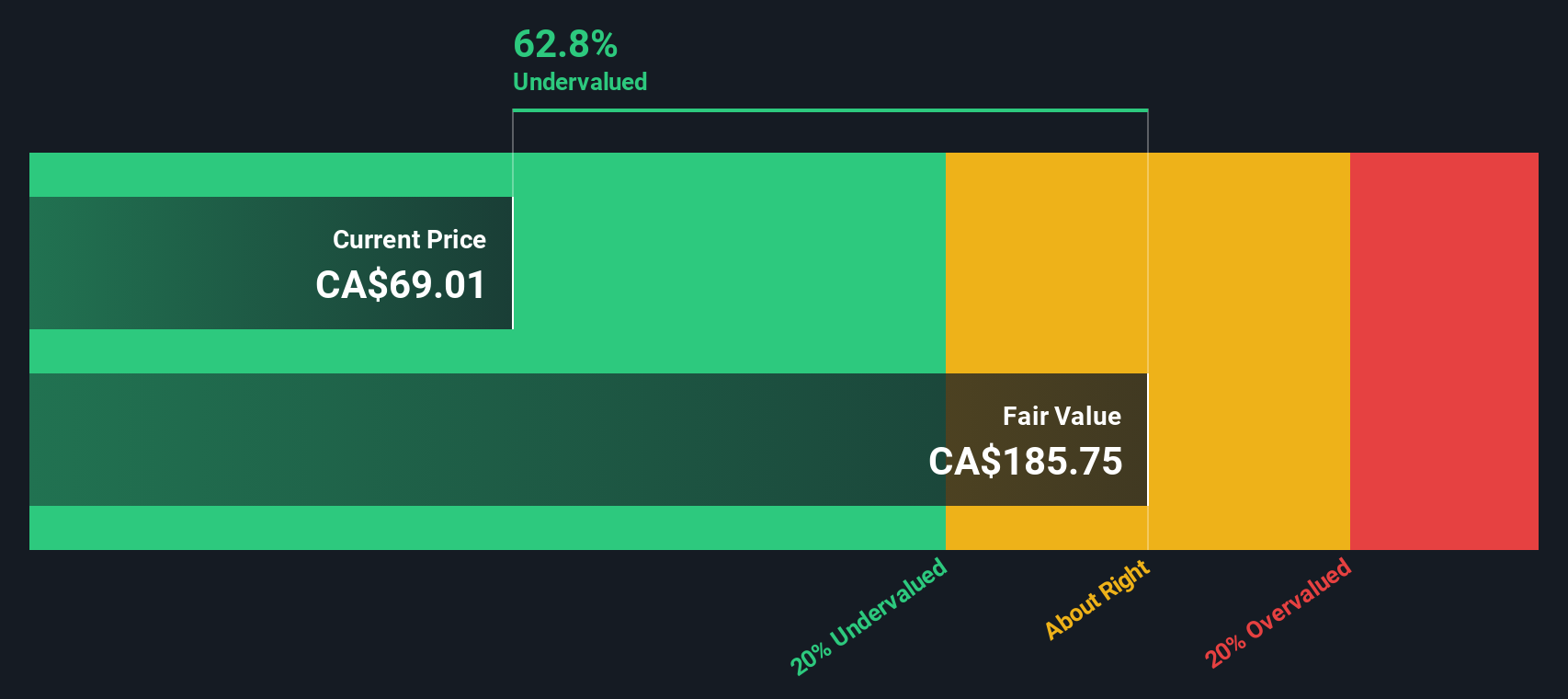

- On our valuation checks, Enbridge scores a 2 out of 6 for being undervalued, so there is more than one way to look at its true worth. Next, we will break down those valuation approaches and reveal a smarter way to size up the company at the end of the article.

Enbridge scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Enbridge Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates a company's value by projecting its future cash flows and discounting them back to their present value. This approach helps investors gauge whether the stock's current price reflects its real worth based on anticipated earnings.

For Enbridge, the model examined current Free Cash Flow of CA$4.94 billion. Analyst forecasts suggest robust annual growth, with projections reaching CA$17.38 billion by 2029. Beyond the five-year analyst window, Simply Wall St extrapolates these numbers. This results in ten-year forecasts extending past CA$38.87 billion in Free Cash Flow by 2035. All figures are shown in Canadian dollars.

With these projections, the DCF model estimates Enbridge’s intrinsic fair value at CA$335.79 per share. Compared to the current share price, this valuation model suggests the stock is trading at a 79.7% discount, indicating significant undervaluation at present levels.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Enbridge is undervalued by 79.7%. Track this in your watchlist or portfolio, or discover 882 more undervalued stocks based on cash flows.

Approach 2: Enbridge Price vs Earnings

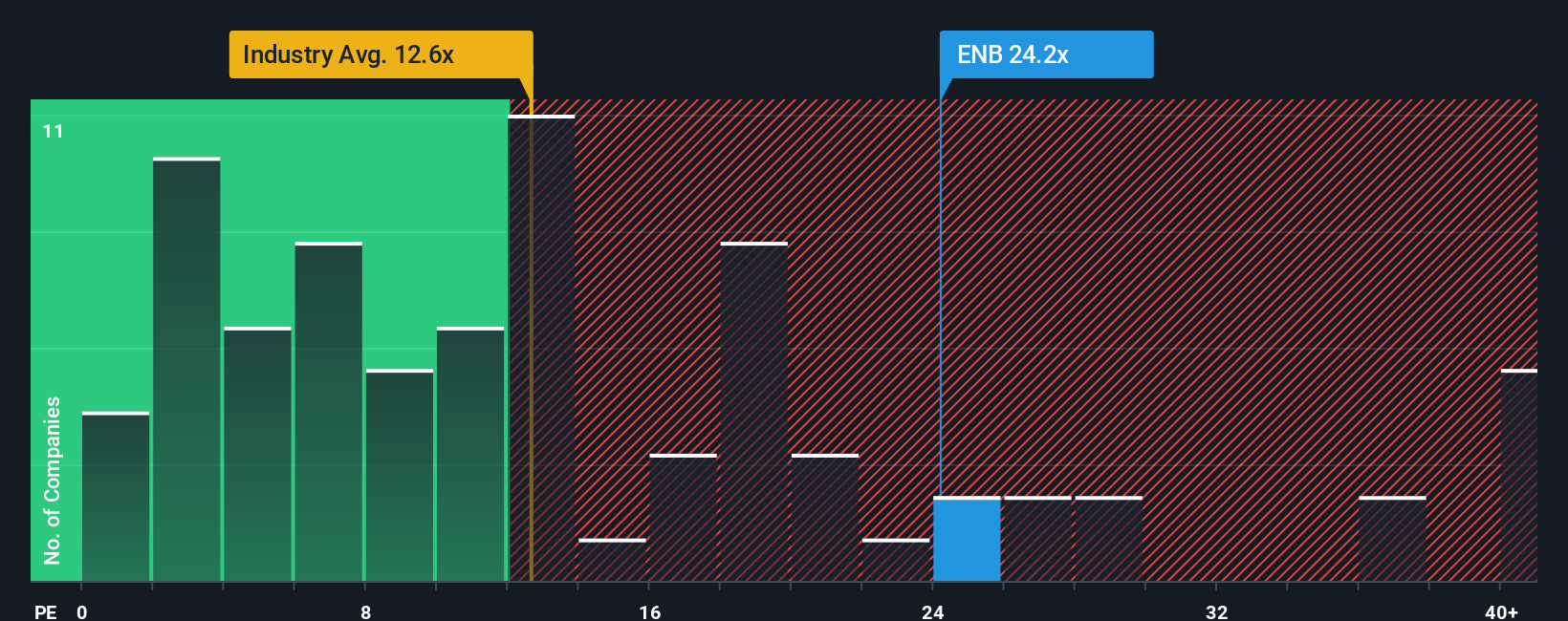

The Price-to-Earnings (PE) ratio is one of the most straightforward ways to value profitable companies like Enbridge, as it measures how much investors are willing to pay for each dollar of earnings. Since Enbridge consistently generates solid profits, the PE ratio offers a clear window into how the market weighs its earnings power.

Typically, companies with stronger growth prospects or lower risk profiles fetch higher PE ratios, while those facing slower growth or greater risk trade at lower multiples. What constitutes a "normal" or "fair" PE ratio can vary based on industry dynamics, how fast a company is expected to grow, the stability of its cash flows, and perceived risks.

Enbridge's current PE ratio stands at 26.7x. This is notably higher than both the Oil and Gas industry average of 14.5x and its peers averaging 19.3x. However, using Simply Wall St's proprietary Fair Ratio metric, which adjusts for Enbridge’s specific growth prospects, profit margins, risk profile, and market capitalization, we get a fair value PE ratio of 18.9x. The Fair Ratio is considered more reliable than just looking at peers or industry because it accounts for the unique traits driving Enbridge's future, rather than relying on a broad comparison.

With Enbridge trading at a PE of 26.7x while its Fair Ratio is 18.9x, the stock currently appears overvalued on this measure.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1407 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Enbridge Narrative

Earlier we mentioned there is an even better way to understand valuation, so let's introduce you to Narratives. A Narrative is a simple, story-driven tool that lets you connect your perspective on Enbridge—what you believe about its future growth, profitability, and risk—to the underlying numbers like expected earnings, fair value estimates, and revenue forecasts.

This approach helps you turn your personal or research-based view on Enbridge into a dynamic financial forecast, linking the company's story directly to how much you think the stock is actually worth. Narratives are easy to build and use, and are available to everyone on the Simply Wall St Community page, where millions of investors already share and track their views.

With Narratives, you can instantly compare your custom fair value to the current market price, making it clear when the stock might be a buy, hold, or sell for you, not just for the market average. Narratives update in real time as new news or earnings come through, so your view always stays relevant.

For Enbridge, some investors see a price target as high as CA$77.0, optimistic about project growth and market position, while others target just CA$60.0, pointing to margin risks and tough regulation. The right Narrative lets you decide whose story and numbers you believe.

Do you think there's more to the story for Enbridge? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enbridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ENB

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives