- Canada

- /

- Oil and Gas

- /

- TSX:ENB

Enbridge (TSX:ENB) Valuation Update Following Q3 Earnings Miss and $3 Billion in New Projects

Reviewed by Simply Wall St

Enbridge (TSX:ENB) just released its third-quarter results, reporting earnings and revenue below last year’s figures. While the earnings miss is catching attention, the company reaffirmed its 2025 outlook and announced $3 billion in new projects.

See our latest analysis for Enbridge.

Enbridge’s latest earnings miss comes after a steady wave of dividend affirmations and fresh growth projects, yet the stock’s momentum has quietly picked up. While the one-year total shareholder return stands at a solid 19.3%, the current share price has climbed over 8% year-to-date, marking a real shift from last year’s sideways action. For longer-term investors, Enbridge’s 141% five-year total return shows that patience has paid off even amid recent headline swings.

If news of new energy projects has you thinking about what’s next in the market, now is a perfect time to broaden your search and discover fast growing stocks with high insider ownership

But after the latest results and fresh projects, the real question is whether Enbridge shares are trading at a bargain or if the market has already priced in all that future growth potential.

Most Popular Narrative: 3.4% Undervalued

Enbridge's narrative estimates a fair value just above the latest closing price, hinting at a small margin between where shares trade now and where consensus sees them headed. If you want clarity on whether this is a fleeting premium or a durable advantage, the underlying drivers deserve closer inspection.

Disciplined capital allocation, a growing secured project backlog with higher risk-adjusted returns, and stable balance sheet management are set to drive predictable dividend growth and increasing free cash flow per share, addressing any current undervaluation as future earnings visibility strengthens.

Wondering what powers this calculated optimism? The narrative leans heavily on aggressive project pipelines and a financial playbook designed to scale both dividends and free cash flow. The kicker? The core assumptions behind this small fair value premium are anything but modest. Click through to see the bold forward projections shaping analyst consensus and market sentiment.

Result: Fair Value of $69.26 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, potential regulatory delays or weaker demand for gas infrastructure could quickly disrupt the current outlook and challenge Enbridge's steady growth story.

Find out about the key risks to this Enbridge narrative.

Another View: Valuation Through Multiples

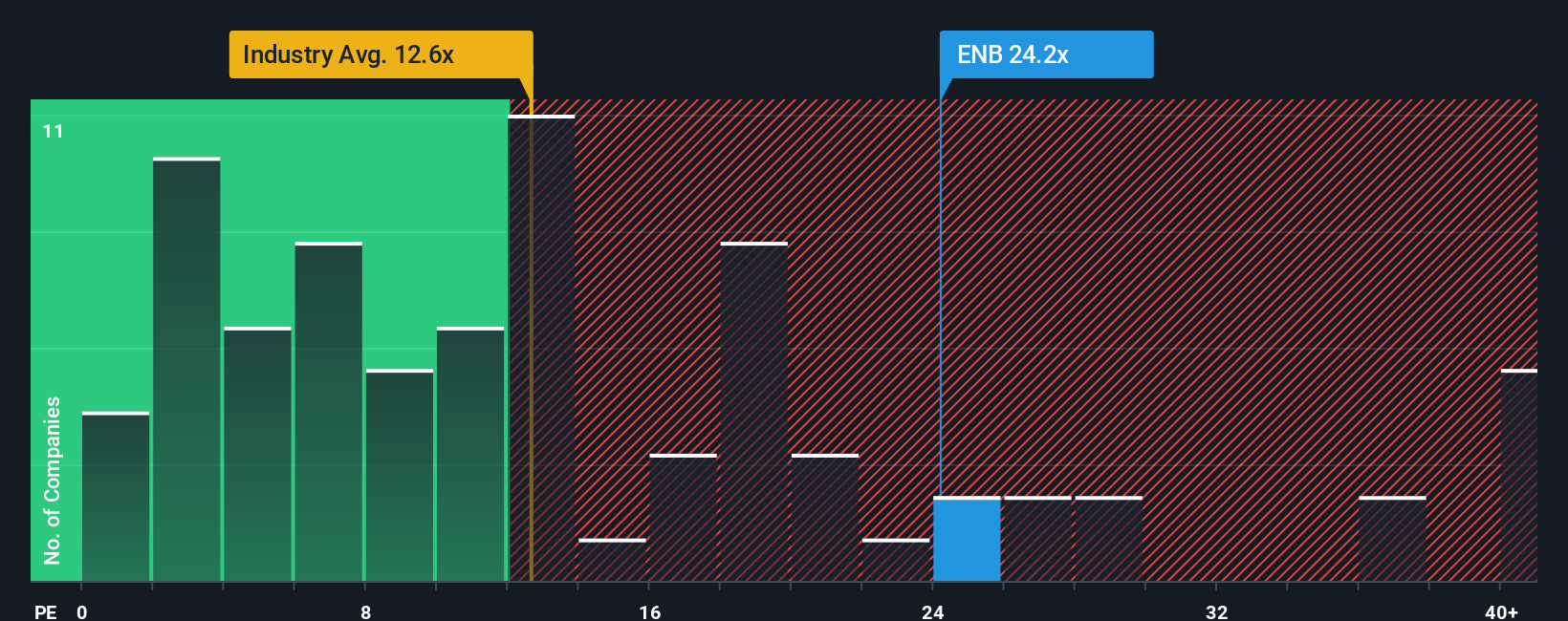

Looking at Enbridge through earnings ratios, things appear less optimistic. The company trades at a 26.1x ratio, well above the Canadian Oil and Gas industry average of 13.9x, the peer group’s 18.7x, and the market’s fair ratio of 19.1x. This sizable gap suggests investors are paying a premium for perceived growth and safety. However, does it mean Enbridge is overvalued, or are there hidden assets justifying the higher bar?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Enbridge Narrative

If these numbers do not match your view or you want to dig deeper, you can shape your own narrative from the data in just a few minutes with Do it your way.

A great starting point for your Enbridge research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Investment Ideas?

Take the lead in finding your next opportunity by checking out these timely, high-impact investment ideas trusted by savvy investors worldwide.

- Unlock fast-growing sectors with these 25 AI penny stocks, which are primed for breakthroughs in automation, efficiency, and innovation.

- Maximize steady cash flow by targeting these 16 dividend stocks with yields > 3%, offering attractive yields and resilient income streams.

- Catalyze your portfolio’s future with these 82 cryptocurrency and blockchain stocks, transforming global finance, security, and transaction technology right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Enbridge might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:ENB

Second-rate dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives