- Canada

- /

- Oil and Gas

- /

- TSX:DML

Denison Mines (TSX:DML): Assessing Valuation Following Russell Lake Uranium Project Acquisition Deal

Reviewed by Simply Wall St

Denison Mines (TSX:DML) is moving forward with its strategy in uranium exploration after signing agreements to acquire ownership interests in Skyharbour Resources' Russell Lake Uranium Project, which is located next to its Wheeler River property.

See our latest analysis for Denison Mines.

Denison Mines’ move to acquire stakes in Russell Lake comes after a stretch of impressive market momentum, with a 15.4% 90-day share price return and a 20.8% gain year-to-date. Momentum has been building, and investors who stuck with Denison over the long haul have seen outstanding results, with a three-year total shareholder return of 137% and a massive 429% over five years. This indicates that its growth narrative is still very much alive.

If you’re interested in uncovering companies with a similar track record of fast growth and strong insider backing, this could be your moment to discover fast growing stocks with high insider ownership

With Denison’s impressive gains and new ventures stirring investor interest, the big question remains: at its current price, is Denison Mines still trading at a discount or has the market already factored in the company’s next stage of growth?

Price-to-Book of 8x: Is it justified?

Denison Mines trades at a price-to-book ratio of 8x, much higher than the industry average, making it appear expensive at its CA$3.60 closing price.

The price-to-book ratio shows how much investors are willing to pay for each dollar of net assets. For exploration-focused miners with little to no earnings, this metric can highlight market optimism or skepticism toward the company’s assets and future growth prospects.

Denison’s 8x price-to-book is well above the Canadian Oil and Gas industry average of 1.6x. This premium suggests that the market has high expectations for the company's uranium assets and future growth, possibly fueled by its ambitious project pipeline, even though it remains unprofitable. While Denison is valued much lower than its closest peers, who average an astonishing 48.3x, the current figure still indicates elevated optimism relative to the broader industry outlook.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Book of 8x (OVERVALUED)

However, Denison Mines remains unprofitable, and recent share price volatility could challenge its growth story if market sentiment or uranium prices shift unexpectedly.

Find out about the key risks to this Denison Mines narrative.

Another View: What Does Our DCF Model Suggest?

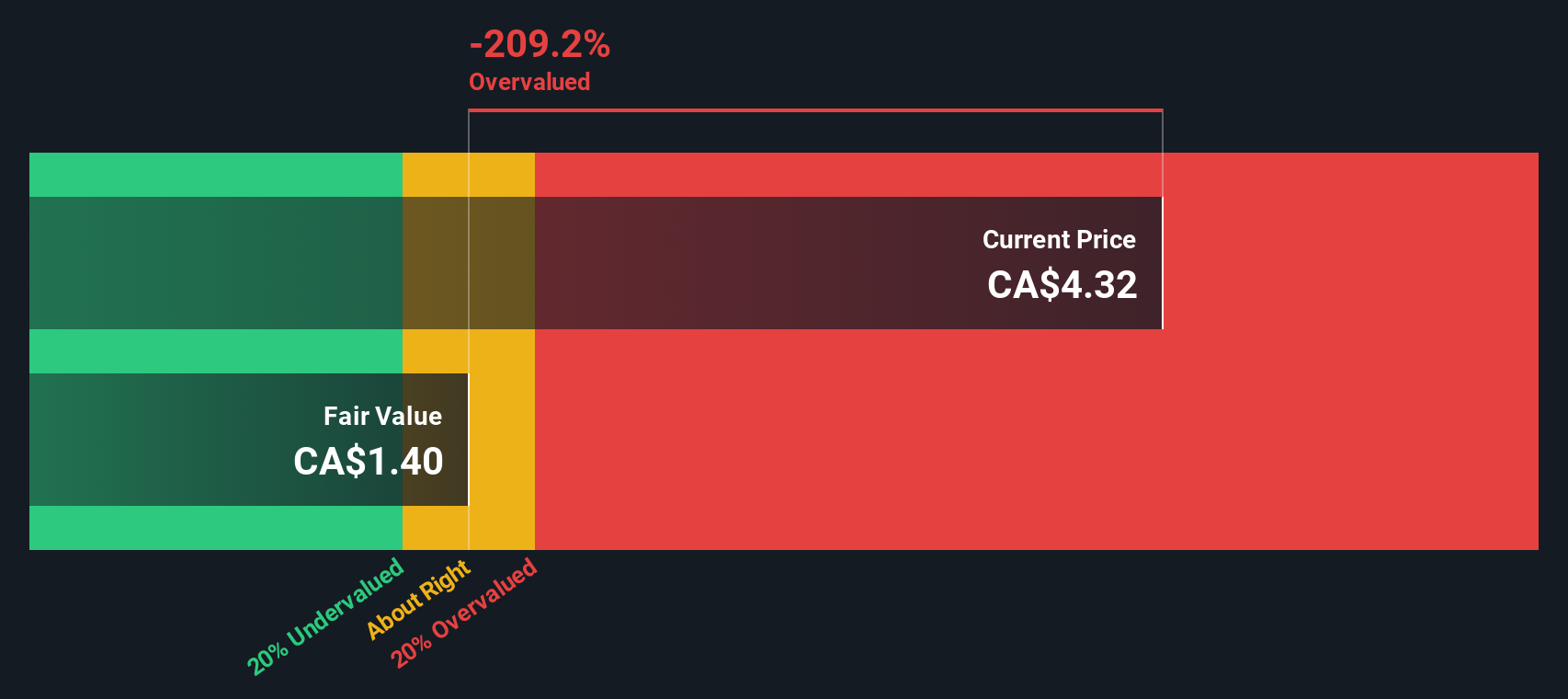

Taking a different approach, our SWS DCF model estimates Denison Mines' fair value at CA$1.39 per share. This means the stock currently trades well above this intrinsic value. While the price-to-book ratio implies strong growth optimism, the DCF model presents a more conservative outlook. Could the real value be somewhere in between?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Denison Mines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 912 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Denison Mines Narrative

If you have your own perspective or want to dig deeper, you can build a unique story around Denison Mines’ figures and outlook in just a few minutes, so why not Do it your way?

A great starting point for your Denison Mines research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Sharpen your portfolio by tapping into unusual opportunities beyond Denison Mines. Don’t let these potential winners slip by when you can easily get started:

- Jump on the momentum behind underpriced companies by reviewing these 912 undervalued stocks based on cash flows on the rise and ready for a turnaround.

- Catch the wave of impressive income earners by checking out these 15 dividend stocks with yields > 3% with yields above 3% for steady returns.

- Uncover innovation by tapping into these 25 AI penny stocks that are fueling the next generation of artificial intelligence breakthroughs.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DML

Denison Mines

Engages in the acquisition, exploration, and development of uranium bearing properties in Canada.

Adequate balance sheet with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026