- Canada

- /

- Oil and Gas

- /

- TSX:CJ

Cardinal Energy (TSX:CJ): Assessing Valuation as Reford Central Production Exceeds Forecasts and Dividend Confidence Grows

Reviewed by Simply Wall St

Cardinal Energy (TSX:CJ) is catching attention after announcing that initial production at its Reford Central facility exceeded forecasts and confirming a November dividend for shareholders. These updates are shaping sentiment around the stock right now.

See our latest analysis for Cardinal Energy.

Cardinal Energy’s latest beat on production expectations and steady dividend news come as the stock enjoys strong momentum, with a 34.8% year-to-date share price return and an eye-catching 59.4% total shareholder return over the past year. Following a stretch of muted performance, attention has shifted on the back of operational surprises and surging trading volume as the shares broke above their fifty-day moving average.

If you’re keen on more energy names shaping up this year, discover new possibilities with our auto manufacturers screener. See the full list here: See the full list for free.

With shares rallying on upbeat production news, yet annual earnings showing a decline, investors now face a key decision: is Cardinal Energy undervalued in light of future growth, or has the market already priced in its potential?

Price-to-Earnings of 18.9x: Is it justified?

Cardinal Energy’s current price-to-earnings ratio stands at 18.9x, just under the peer average of 19.1x, suggesting valuation roughly in line with similar companies. At the last close of CA$8.98, the market is treating Cardinal’s earnings much as it treats others in the sector.

The price-to-earnings (P/E) ratio is a powerful check on how a stock is valued by comparing share price versus per-share earnings. For oil and gas companies, this multiple often gives investors a quick way to judge whether the market is optimistic or pessimistic on growth potential.

Despite Cardinal being considered good value versus peers, the market price is still expensive when viewed against the estimated fair P/E ratio of 11.7x. This points to a premium which, if the market’s optimism fades or earnings disappoint, could result in a price correction toward that lower fair level.

Compared to the broader Canadian oil and gas industry, where the average P/E is 14x, Cardinal trades at a higher multiple, which reinforces that investors are pricing in more growth or are willing to pay a premium. But when judged against the company’s own fair ratio, the current valuation remains rich. This may not be sustainable if growth slows or expectations shift.

Explore the SWS fair ratio for Cardinal Energy

Result: Price-to-Earnings of 18.9x (ABOUT RIGHT)

However, slower revenue and net income growth compared to peers could challenge the premium valuation if industry sentiment quickly shifts or fundamentals weaken.

Find out about the key risks to this Cardinal Energy narrative.

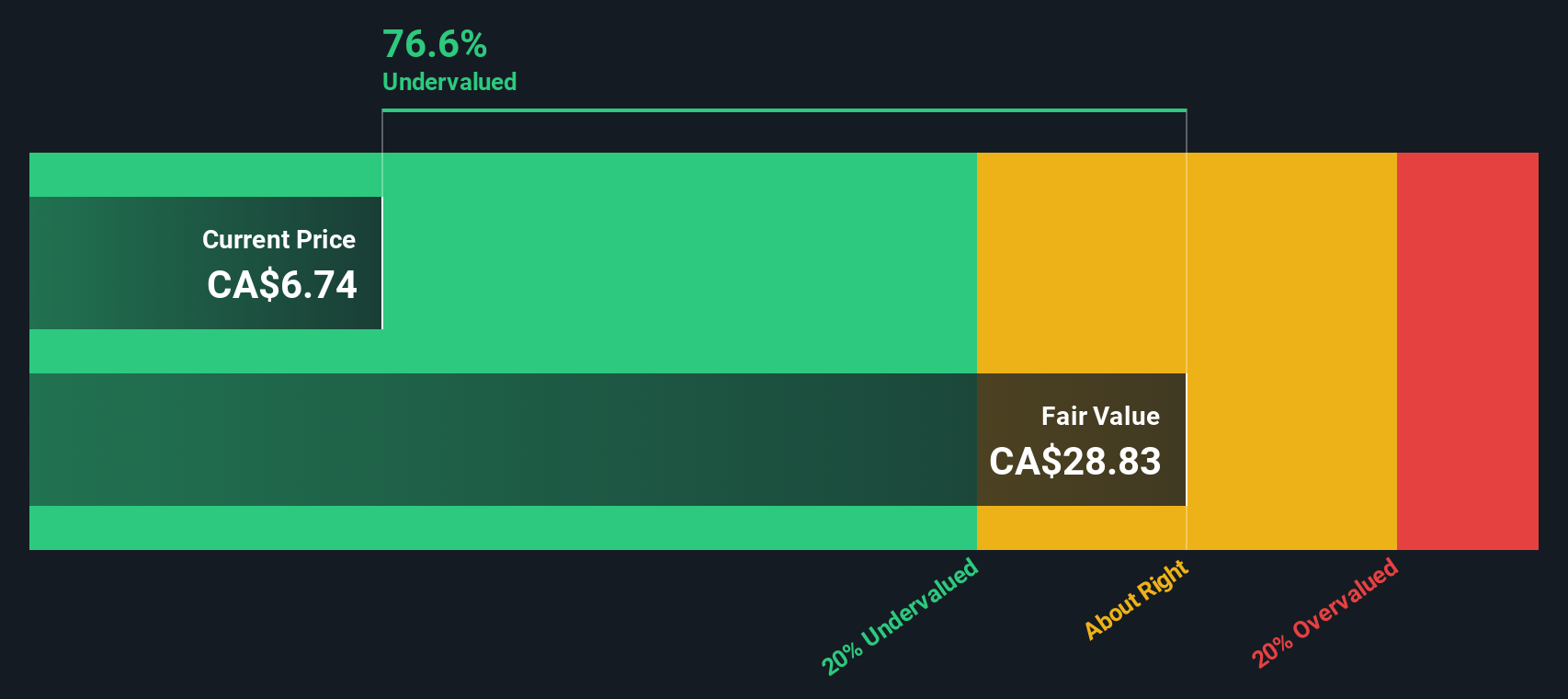

Another View: SWS DCF Model Signals Deep Undervaluation

Looking beyond multiples, our SWS DCF model suggests Cardinal Energy shares are trading at a steep discount to fair value. The current price is well below the DCF estimate, indicating much more upside than the market appears to price in. Which lens will prove right as market sentiment shifts?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Cardinal Energy for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 856 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Cardinal Energy Narrative

If you see things differently or want a hands-on look at the numbers yourself, you can easily shape your own perspective in just a few minutes. Do it your way

A great starting point for your Cardinal Energy research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Set yourself up for success by checking out fresh investment angles that others might overlook. With the right screeners, you give yourself a real edge.

- Unlock hidden value as you scan these 856 undervalued stocks based on cash flows, a tool packed with companies currently overlooked by the market but primed for a turnaround.

- Supercharge your watchlist by reviewing these 25 AI penny stocks, a collection of stocks making waves in artificial intelligence and striving to shape entire industries.

- Capitalize on the fast-changing finance landscape and uncover growth names through these 82 cryptocurrency and blockchain stocks, which showcases companies bringing blockchain innovation to the mainstream.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CJ

Cardinal Energy

Engages in the acquisition, exploration, development, optimization, and production of petroleum and natural gas in the provinces of Alberta, British Columbia, and Saskatchewan in Canada.

Adequate balance sheet and fair value.

Market Insights

Community Narratives