- Canada

- /

- Oil and Gas

- /

- TSX:CCO

Is There Still Value in Cameco After a 65% Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Cameco is trading at a bargain or riding a wave of optimism? You are not alone, especially with the market buzzing about its growth and the value investors are seeing.

- After climbing 10.7% over the last week, Cameco’s price action hints at renewed interest. However, the stock has pulled back 13.5% this past month and is still up a notable 65.1% year-to-date.

- Much of the stock’s volatility has come on the heels of a sharp rise in uranium prices and growing global momentum for nuclear energy adoption. News of new contracts and increasing policy support for clean energy alternatives has further energized investors and set the backdrop for these recent moves.

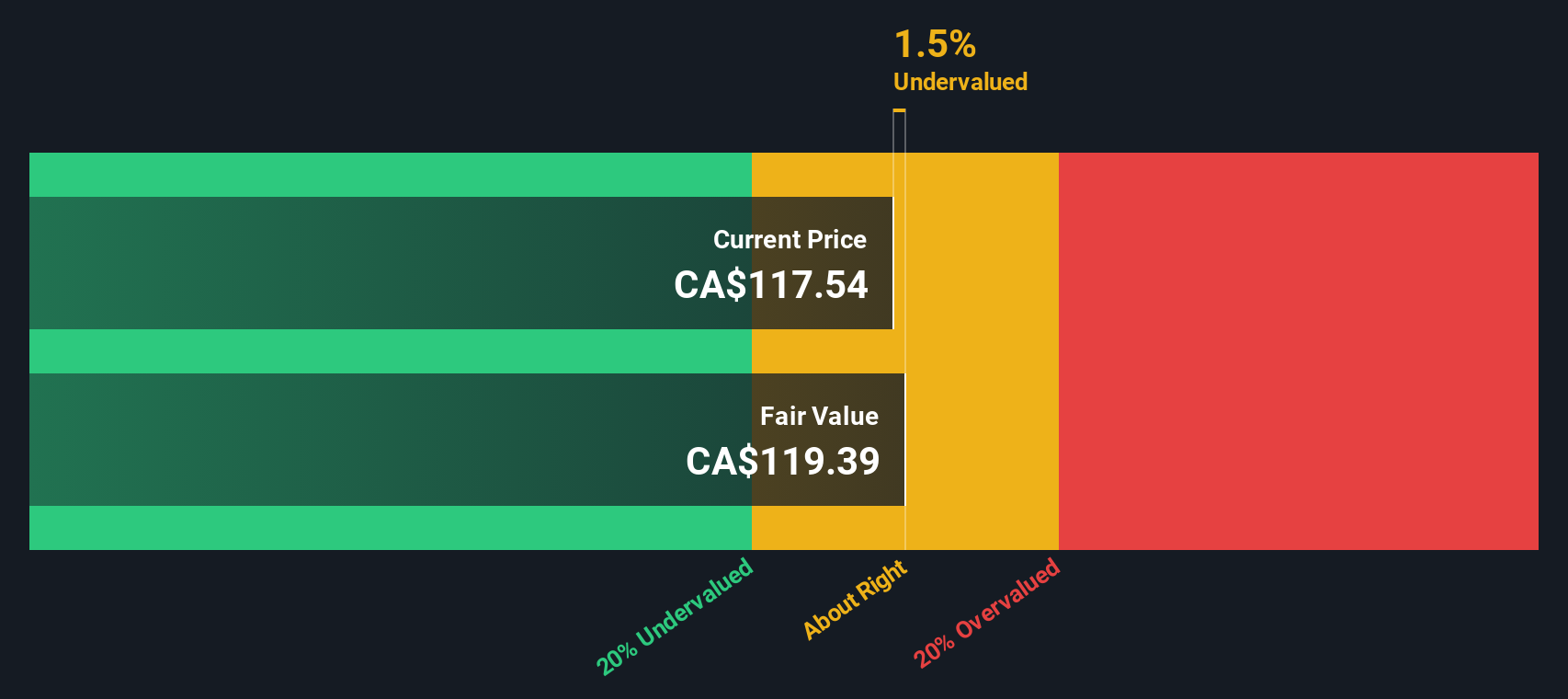

- Looking at valuation, Cameco’s current score is just 1 out of 6 on our checks for undervaluation. However, numbers only tell part of the story. Let’s dive deeper into the usual valuation approaches, and stick around to discover a more powerful way to interpret what Cameco is truly worth.

Cameco scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Cameco Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is worth by projecting its future cash flows and discounting them back to today's value. This approach attempts to capture the value Cameco can generate for shareholders by looking at its ability to produce free cash flow over time.

Cameco’s latest twelve-month Free Cash Flow (FCF) stands at CA$1.01 Billion. Analyst estimates suggest FCF will fluctuate in the near term but project it to reach about CA$1.07 Billion by 2029. After the first five years, these cash flows are further extrapolated using more conservative annual growth assumptions, building a ten-year outlook entirely in CA$.

Using the 2 Stage Free Cash Flow to Equity model, Cameco’s intrinsic value is calculated at CA$42.14 per share. However, this figure suggests the stock is 194.1% above its estimated fair value based on current market pricing. In summary, Cameco appears significantly overvalued according to this DCF analysis, and the numbers point to a considerable disconnect between recent share price performance and underlying cash generation.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Cameco may be overvalued by 194.1%. Discover 913 undervalued stocks or create your own screener to find better value opportunities.

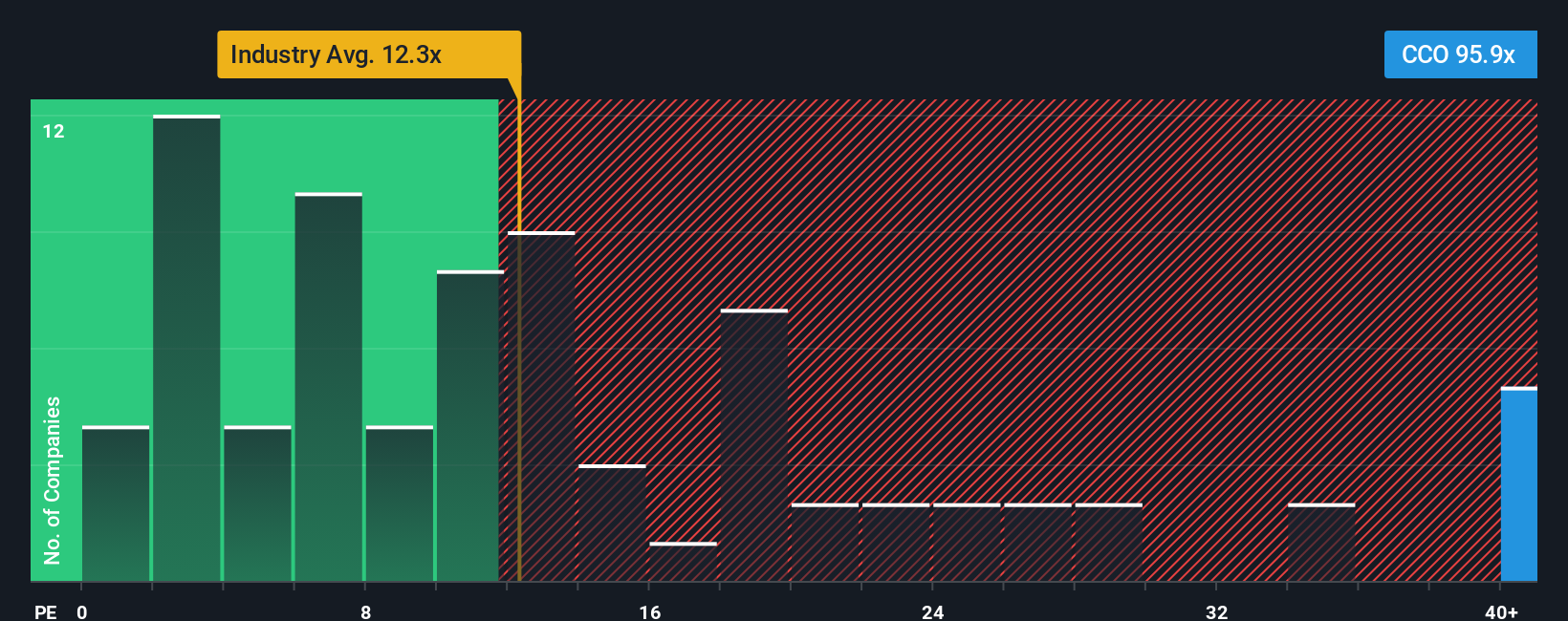

Approach 2: Cameco Price vs Earnings

The Price-to-Earnings (PE) ratio is frequently used to value profitable companies like Cameco, as it tells investors how much they are paying for each dollar of reported earnings. Since Cameco has consistent profits, the PE ratio helps put its market valuation in context compared to both similar companies and industry standards.

Growth expectations and risk play a critical role in what a “fair” PE ratio should be. Companies with stronger growth prospects, higher returns, and lower risk typically command higher PE ratios. Those facing greater uncertainty or slower growth generally trade at lower multiples.

Cameco currently trades at a notable PE ratio of 102.6x, which is considerably above both the Oil and Gas industry average of 14.8x and the average of its peers at 16.8x. While this may suggest a highly valued stock at first glance, it is important to consider additional context beyond these basic comparisons.

This is where Simply Wall St’s Fair Ratio is useful. The Fair Ratio, calculated as 18.9x for Cameco, considers the company’s growth outlook, profit margins, risk, size, industry, and other company-specific factors. This model provides a more tailored benchmark than simply comparing against the industry or peers.

When comparing Cameco’s actual PE multiple of 102.6x to its Fair Ratio of 18.9x, the stock appears to be significantly overvalued on this basis.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1437 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Cameco Narrative

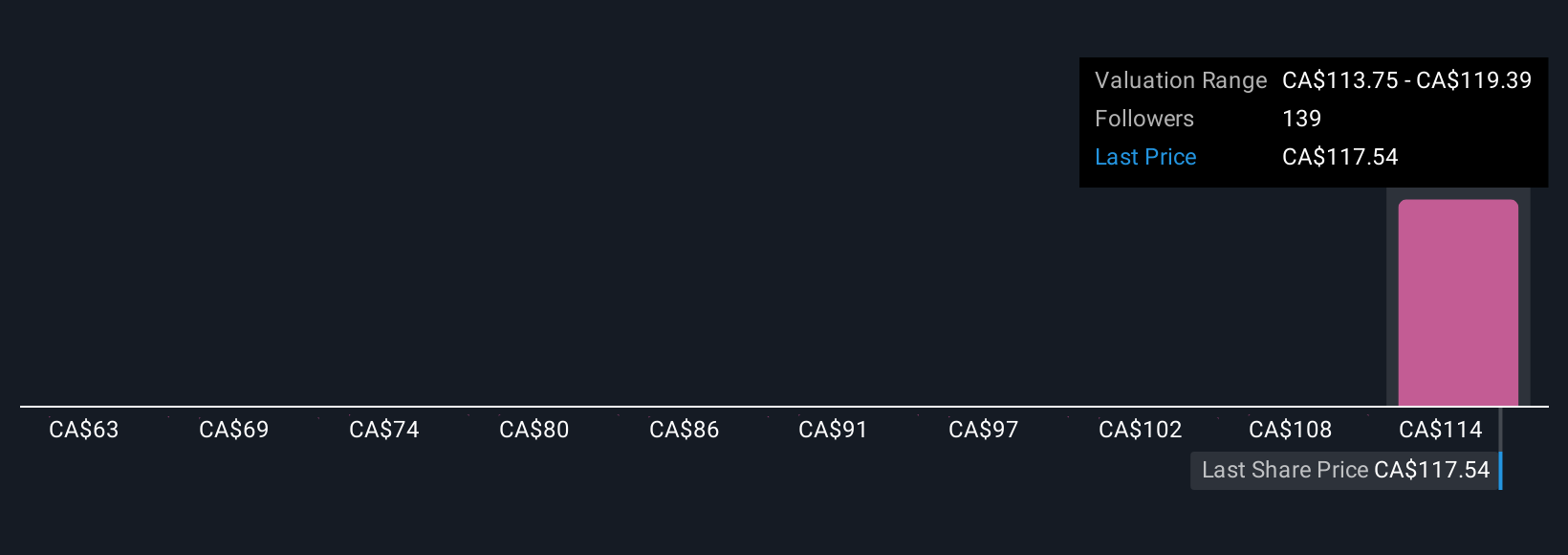

Earlier we mentioned that there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is your personal investment story. It is where you combine your perspective on a company’s future with actual numbers, such as your own expectations for fair value, future revenue, earnings, and profit margins.

This approach connects the company’s story and its key drivers (like energy demand or policy support) directly to financial forecasts, and then calculates what you believe is a fair value based on those assumptions. Narratives are easy to create and update right within the Simply Wall St Community page, used by millions of investors to share insights and track evolving outlooks.

Narratives help you make clearer buy or sell decisions by comparing your Fair Value to the current market Price, and they update automatically when new facts, such as news or quarterly results, come in, ensuring your view always reflects the latest developments.

For example, when it comes to Cameco, one investor might build a Narrative expecting long-term growth from nuclear demand and arrive at a fair value of CA$151.75, while another, more cautious, might focus on operational risks and see fair value closer to CA$100. This demonstrates how Narratives empower you to invest on your terms.

Do you think there's more to the story for Cameco? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CCO

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026