- Canada

- /

- Capital Markets

- /

- TSX:SII

Does Sprott’s Rapid GBUG ETF Growth Reinforce Its Active Management Edge (TSX:SII)?

Reviewed by Sasha Jovanovic

- In September 2025, Sprott Asset Management USA announced that its Sprott Active Gold & Silver Miners ETF (Nasdaq: GBUG) surpassed US$100 million in assets under management, just over seven months after its February launch.

- This rapid accumulation highlights a surge in investor appetite for precious metals and positions Sprott as a recognized player in the active gold and silver miner ETF space.

- We'll explore how Sprott’s leadership in active ETF management and gold-silver miner selection shapes its current investment narrative.

This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

What Is Sprott's Investment Narrative?

If you're considering Sprott, it's important to recognize that the story really hinges on confidence in the durability of demand for precious metals and the company's ability to translate its active management expertise into continued inflows and attractive capital returns. The recent news that the Sprott Active Gold & Silver Miners ETF hit US$100 million in assets so quickly is a strong signal that investor interest is robust and the active ETF model is resonating. This momentum may reinforce Sprott’s near-term catalysts, especially as gold and silver remain in focus amid recent price surges and concerns about supply deficits, particularly in silver. However, the backdrop of a high price-to-earnings ratio compared to industry peers and limited buyback activity continues to raise valid questions about valuation risk. If inflows were to stall or sentiment toward precious metals reversed, these risks could come to the fore faster than before this milestone. It’s a business where both conviction and caution are crucial.

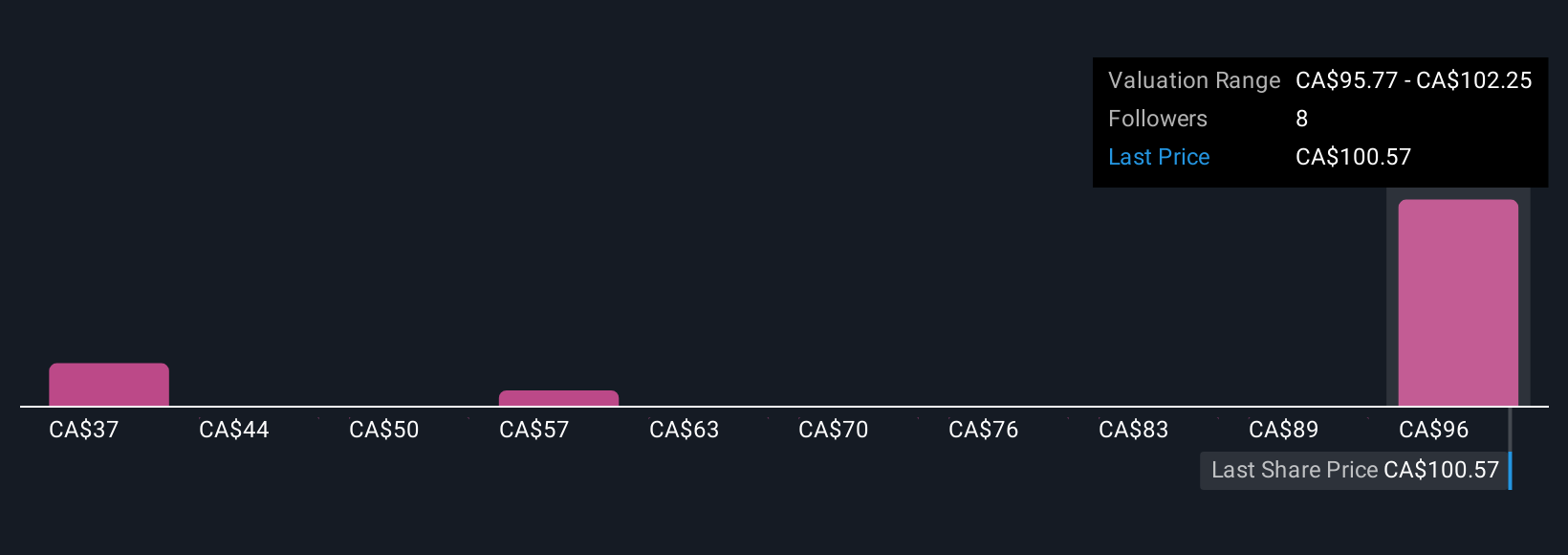

But, on the other hand, not everyone is comfortable with current valuation levels, something investors should be aware of. Sprott's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore 3 other fair value estimates on Sprott - why the stock might be worth as much as CA$102.25!

Build Your Own Sprott Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sprott research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free Sprott research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sprott's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026