- Canada

- /

- Capital Markets

- /

- TSX:SII

A Look at Sprott (TSX:SII) Valuation Following Q3 Earnings, Asset Surge, and Dividend Boost

Reviewed by Simply Wall St

Sprott (TSX:SII) has drawn investor attention after reporting strong third quarter results, highlighted by a 23% jump in assets under management, significant revenue growth, and a 33% dividend increase.

See our latest analysis for Sprott.

Sprott’s latest surge in momentum is not just about headline earnings. Over the past twelve months, the share price has increased by 102%, supported by standout third quarter results, a 33% dividend hike, and new executive appointments that reinforced management’s growth strategy. The company’s 115% one-year total shareholder return and 166% total return over three years highlight both short-term strength and longer-term outperformance in a sector where momentum can fade fast.

If Sprott’s rapid climb has you thinking bigger, there has never been a better time to explore new opportunities and discover fast growing stocks with high insider ownership

But with Sprott’s shares more than doubling and a soaring dividend, is there still value left for investors to capture? Or has the market already priced in every bit of the company’s impressive future growth?

Price-to-Earnings of 46.2x: Is it justified?

Sprott’s recent rally has pushed its price-to-earnings (P/E) multiple to 46.2x, positioning it well above both peer and industry averages. At CA$126.54 per share, investors are paying a significant premium for each dollar of Sprott’s earnings compared to similar companies.

The P/E ratio measures how much investors are willing to pay for each dollar of a company’s earnings, serving as a quick yardstick for perceived growth potential or market confidence. For financial companies like Sprott, this multiple can reflect expectations for asset growth, recurring fees, and profitability. These are key drivers of shareholder returns in the sector.

Yet at 46.2x, Sprott’s P/E outpaces the Canadian Capital Markets industry average of just 10x, as well as the peer group’s average of 24.5x. The market is ascribing a steep premium to Sprott, likely taking into account its revenue momentum, higher dividend, and management’s demonstrated growth track record.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 46.2x (OVERVALUED)

However, any slowdown in revenue growth or a drop in investor confidence could quickly reduce Sprott’s premium valuation and recent momentum.

Find out about the key risks to this Sprott narrative.

Another View: Discounted Cash Flow Model Weighs In

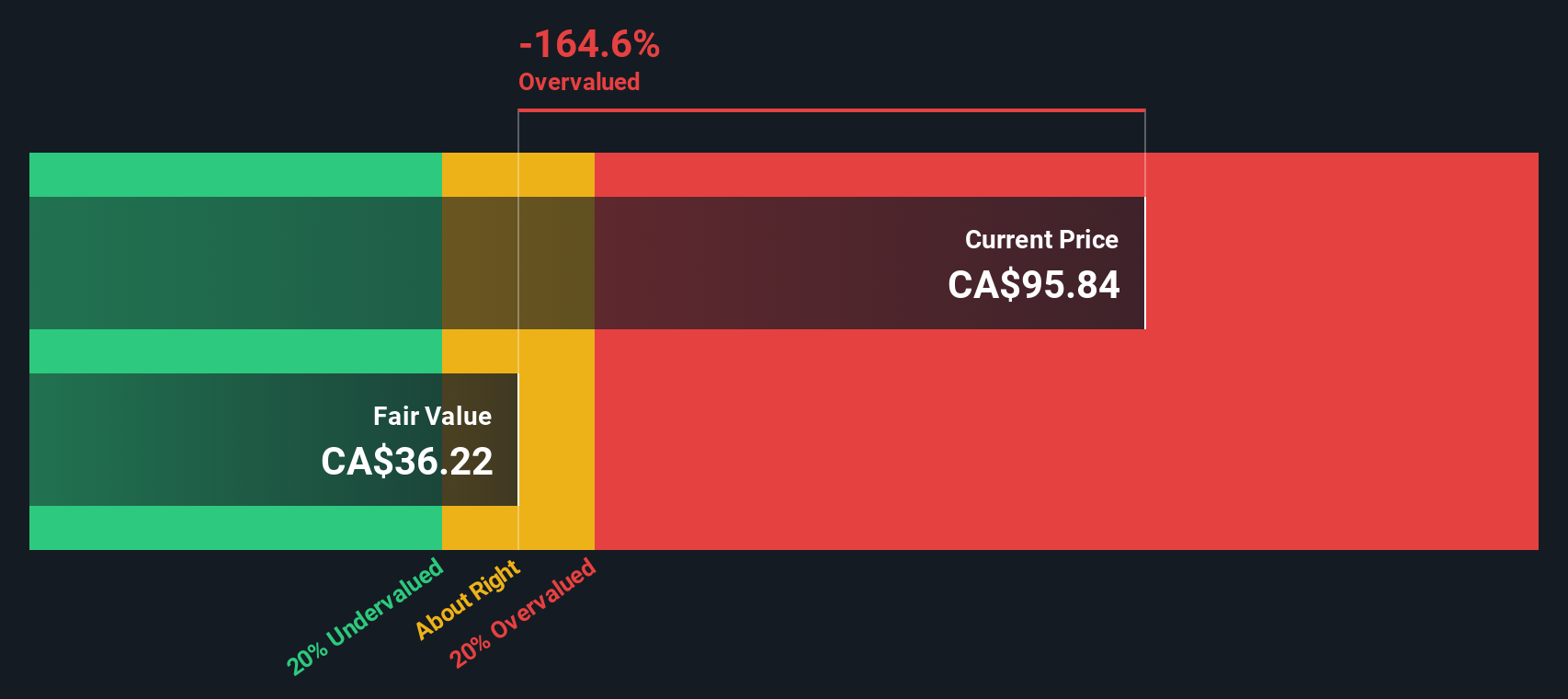

Looking through the lens of our DCF model offers a very different perspective. While Sprott’s market price sits at CA$126.54, our DCF estimate puts fair value at just CA$39.01. This suggests the shares might be trading well above their underlying value. Could investors be paying for momentum rather than fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Sprott for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 874 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Sprott Narrative

If you want to dig deeper or see things from your own perspective, it only takes a few minutes to build your own view and test your research. Do it your way

A great starting point for your Sprott research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Don’t just watch the market pass you by. Spot tomorrow’s opportunities first, grow your knowledge, and find stocks with the potential for outsized returns. Do this simply and confidently.

- Unlock access to companies set for transformation by checking out these 25 AI penny stocks that are making AI breakthroughs mainstream.

- Boost your passive income stream and tap into stability with these 16 dividend stocks with yields > 3% offering attractive yields above 3%.

- Take the lead in an emerging tech frontier by finding smart picks among these 28 quantum computing stocks shaking up the world of high-performance computing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet with acceptable track record.

Similar Companies

Market Insights

Community Narratives