- Canada

- /

- Capital Markets

- /

- TSX:BN

Will Brookfield’s (TSX:BN) Stock Split Redefine Market Access or Highlight Deeper Liquidity Goals?

Reviewed by Sasha Jovanovic

- Brookfield Corporation completed a three-for-two stock split, distributing additional Class A Limited Voting Shares to shareholders and starting post-split trading on October 10, 2025.

- This move is intended to increase liquidity and broaden investor access, aligning with Brookfield's ongoing efforts to strengthen its market position and appeal.

- We'll explore how the recent stock split could impact Brookfield's investment narrative, particularly in terms of market accessibility and investor engagement.

We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

Brookfield Investment Narrative Recap

Brookfield shareholders are typically looking for exposure to a growing pipeline of alternative assets, steady dividend income, diverse global reach, and value creation through active management. The recent three-for-two stock split is unlikely to have a material short-term impact on Brookfield's most important catalyst, its ability to realize value from asset sales in constructive markets, nor does it meaningfully shift the primary risk of being dependent on favorable market conditions for strong distributable earnings.

Among Brookfield’s recent announcements, the $1.25 billion refinancing of Five Manhattan West stands out. While this move reflects the company’s ongoing access to capital and ability to secure long-term financing on major assets, it doesn’t significantly move the needle regarding the central catalysts or risks facing the business at this time.

On the other hand, investors should remain aware that if market conditions weaken, the company's ability to...

Read the full narrative on Brookfield (it's free!)

Brookfield's narrative projects $8.5 billion revenue and $7.2 billion earnings by 2028. This assumes a 54.2% yearly revenue decline and an increase in earnings by $6.7 billion from the current $473.0 million.

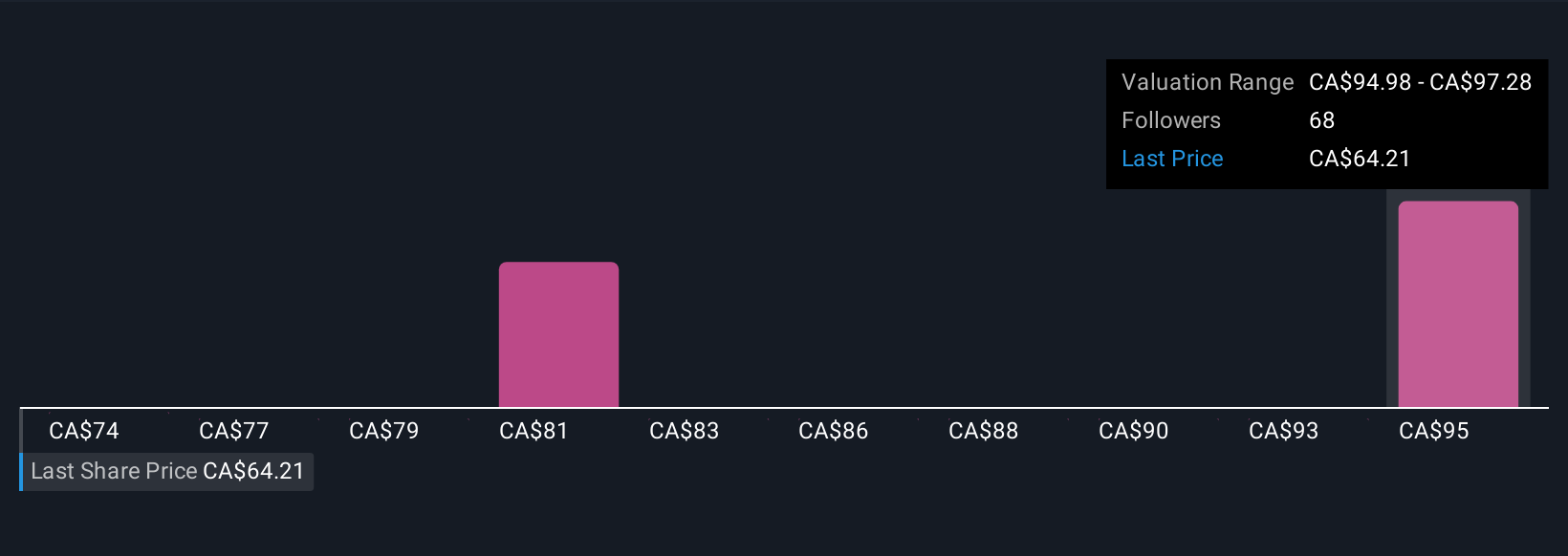

Uncover how Brookfield's forecasts yield a CA$97.28 fair value, a 61% upside to its current price.

Exploring Other Perspectives

Fair value estimates from 9 Simply Wall St Community members currently range from US$2.40 to US$106.18 per share. While you weigh these varied outlooks, remember that Brookfield’s future distributable earnings could swing with shifts in market conditions.

Explore 9 other fair value estimates on Brookfield - why the stock might be worth less than half the current price!

Build Your Own Brookfield Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Brookfield research is our analysis highlighting 3 important warning signs that could impact your investment decision.

- Our free Brookfield research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Brookfield's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BN

Brookfield

A multi-asset manager focused on real estate, credit, renewable power and transition, infrastructure, venture capital, and private equity including growth capital and emerging growth investments.

Proven track record with low risk.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success