- Canada

- /

- Capital Markets

- /

- TSX:BAM

Brookfield (TSX:BAM) Valuation in Focus Following Landmark Global AI Infrastructure Partnership

Reviewed by Simply Wall St

Brookfield Asset Management (TSX:BAM) is making headlines after announcing a major global AI infrastructure initiative with NVIDIA and the Kuwait Investment Authority. This large-scale move signals Brookfield’s growing ambition in the artificial intelligence sector.

See our latest analysis for Brookfield Asset Management.

Momentum around Brookfield Asset Management has shifted gears recently, with the stock’s latest news fueling renewed interest among investors. While the share price return is down over the year to date and the past quarter, Brookfield’s three-year total shareholder return of nearly 89% stands out as evidence of its long-term strength, even as short-term sentiment remains cautious on the back of market fluctuations and new financing deals.

If Brookfield’s bold moves in infrastructure and AI have piqued your interest, this may be the perfect moment to discover fast growing stocks with high insider ownership

With the company’s recent innovations and a history of robust long-term returns, investors are left to consider: is Brookfield Asset Management undervalued at current prices, or has the market already priced in its future growth potential?

Price-to-Earnings of 32x: Is it justified?

Brookfield Asset Management currently trades at a price-to-earnings ratio of 32x, well above the industry average. This raises questions of valuation for investors considering the last close price of CA$72.65.

The price-to-earnings (P/E) ratio measures how much investors are willing to pay for each dollar of the company’s earnings. In asset management and capital markets, it serves as a common benchmark for comparing profitability and growth expectations across peers.

BAM’s P/E ratio of 32x appears justified when compared to its close peer group, where the average stands at 49.2x. This suggests the market may be pricing in the firm’s ongoing growth and margin improvements, yet it still trades at a meaningful discount to competitors. However, compared to the broader Canadian Capital Markets industry average of 9.2x, BAM stands out as expensive. This may reflect strong performance, distinctive positioning in alternative assets, and a robust earnings growth profile. Recent acceleration in profit growth and high returns on equity support the elevated valuation, although the market could adjust toward a “fair” multiple if industry dynamics shift.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 32x (ABOUT RIGHT)

However, elevated valuation leaves little room for error, especially if earnings growth stalls or if broader market volatility persists.

Find out about the key risks to this Brookfield Asset Management narrative.

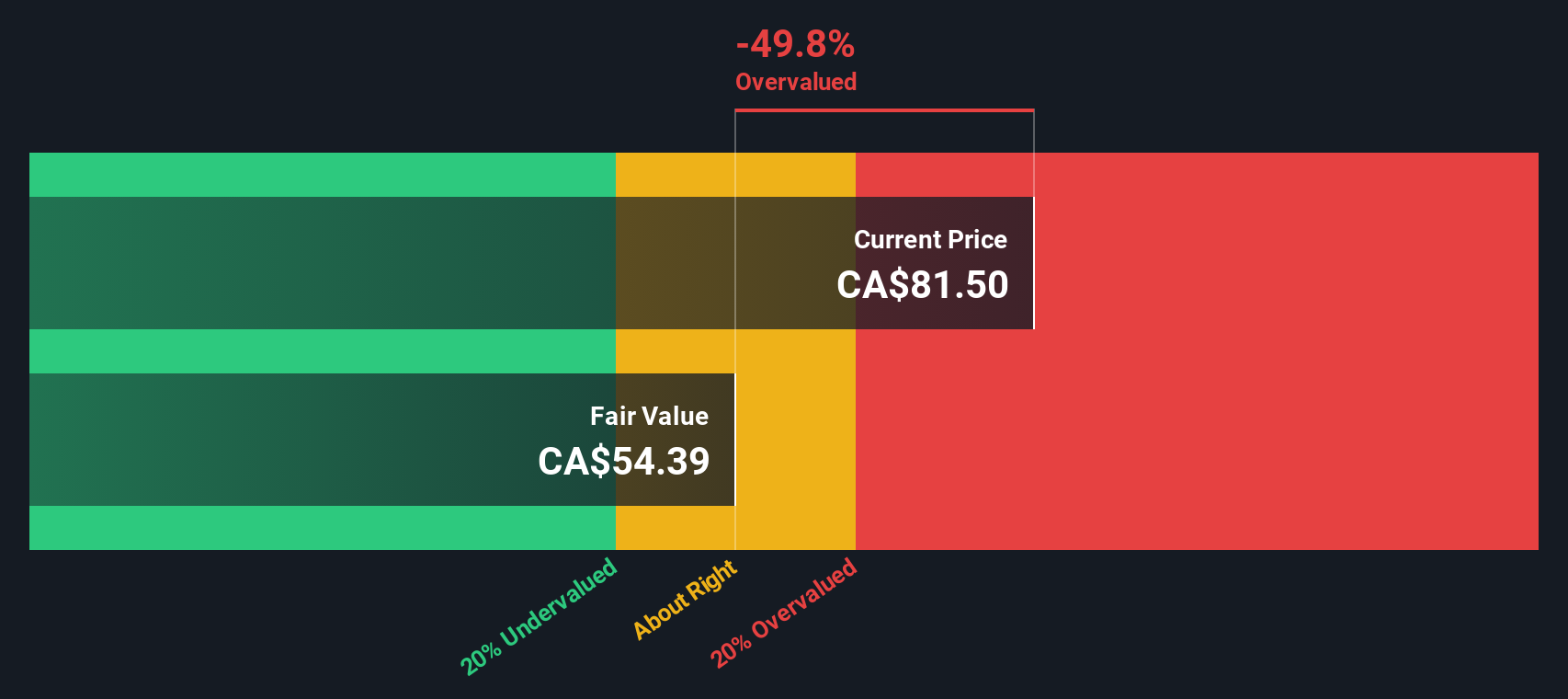

Another View: The SWS DCF Model

Looking from a different angle, our DCF model suggests Brookfield Asset Management is trading above its estimated fair value of CA$59.72, with the current price at CA$72.65. This implies the market may be assigning a premium beyond what cash flows alone support. Could this mean downside risk lies ahead, or is the market right to look beyond fundamentals?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Brookfield Asset Management for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 923 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Brookfield Asset Management Narrative

Keep in mind, if these conclusions don’t align with your perspective, or you want to dive deeper into your own research, it’s quick and straightforward to build your own view in just a few minutes. Do it your way

A great starting point for your Brookfield Asset Management research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Take action now and open your horizon to smart opportunities beyond Brookfield Asset Management with these standout strategies that could help accelerate your portfolio’s growth.

- Tap into tomorrow’s potential by browsing these 25 AI penny stocks transforming entire industries with artificial intelligence innovations you do not want to miss.

- Unlock exciting returns by exploring these 923 undervalued stocks based on cash flows that may be trading below their real worth, giving you an edge before the mainstream catches on.

- Maximize your passive income by checking out these 14 dividend stocks with yields > 3% offering strong yields above 3 percent for investors who value reliable cash flow.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Brookfield Asset Management might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BAM

Brookfield Asset Management

A private equity firm specializing in acquisitions and growth capital investments.

Outstanding track record with excellent balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026