BRP (TSX:DOO) Q3 2026 Margin Compression Tests Bullish Recovery Narrative

Reviewed by Simply Wall St

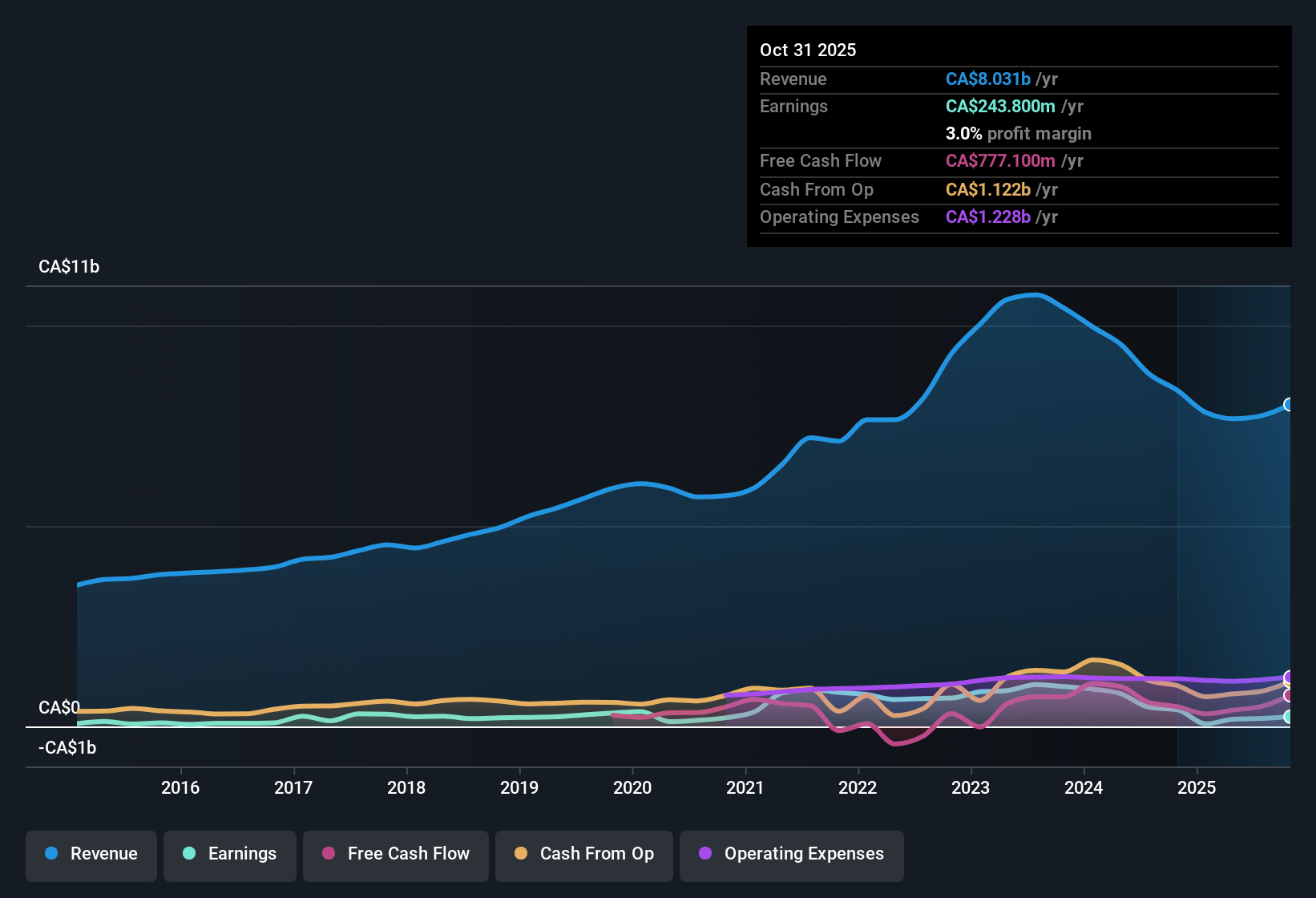

BRP (TSX:DOO) has just posted its Q3 2026 numbers with revenue of about CA$1.9 billion and basic EPS of CA$0.79, setting the stage against last year’s Q3 revenue of roughly CA$2.0 billion and EPS of CA$0.38. Over the past few quarters the top line has moved between about CA$1.8 billion and CA$2.4 billion while quarterly EPS has ranged from around CA$0.38 to CA$2.21, giving investors a choppy but data rich view of the earnings power behind the brand. Against that backdrop, the focus now shifts to where margins are heading and how sustainable the current profitability profile looks.

See our full analysis for BRP.With the headline numbers on the table, the next step is to weigh them against the most common market narratives around BRP to see which stories hold up and which ones the latest margins quietly call into question.

See what the community is saying about BRP

Margins Squeezed as Net Margin Slides to 2.6%

- Over the last 12 months, BRP turned about CA$7.8 billion in revenue into CA$197.9 million of net income, which works out to a slim 2.6 percent net margin compared with 5.4 percent a year earlier.

- Consensus narrative flags margin recovery as a key upside driver, yet the drop to 2.6 percent and the CA$63.5 million one off loss mean any bullish view has to assume BRP can reverse this compression rather than just grow sales on a structurally lower profitability base.

- Analysts expect margins to rise toward 6.6 percent over the next few years, which contrasts sharply with the current 2.6 percent reality.

- The choppy recent EPS pattern, from CA$2.21 in Q1 2026 to CA$0.79 in Q3 2026, underlines how sensitive those margin ambitions are to cost control and mix.

Premium P/E Versus Peers Despite Weak Interest Cover

- The shares trade on a trailing P or E of 38.8 times at around CA$105, which is richer than both the Global Leisure industry on 22 times and peers on 34.6 times, even though interest expenses are not well covered by earnings.

- Bears argue that paying a premium multiple while earnings have fallen about 4.7 percent per year over five years and interest coverage is thin leaves little room for disappointment, especially if the recent 2.6 percent margin does not improve.

- The weak interest coverage means more of that slim profit pool has to go to lenders, limiting how much can flow to shareholders or be reinvested.

- With earnings over the last year coming in below the prior trend, any further pressure on profitability would make the current P or E look even more demanding.

DCF Fair Value Points to Big Upside

- On the flip side, the DCF fair value sits at about CA$410.88 per share versus the current price near CA$105, implying the stock trades roughly 75 percent below that intrinsic estimate while analysts project earnings growth of roughly 22.3 percent per year and revenue growth of about 5.9 percent.

- Bullish investors lean heavily on those growth forecasts, arguing that if BRP can lift margins from 2.6 percent back toward the projected 6.6 percent, the current premium P or E could still compress over time while the share price moves closer to the DCF fair value.

- The latest trailing EPS of about CA$2.71 compares with an earnings target of CA$8.64 by around 2028, which is a large gap that would justify a higher share price if achieved.

- Because the DCF upside is so large relative to the current CA$105 price, even a partial delivery on the 22.3 percent earnings growth path could still support attractive long term returns.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for BRP on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers from another angle and think the story should read differently? Shape your own view in just a few minutes, Do it your way.

A great starting point for your BRP research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

BRP’s slim 2.6 percent net margin, weak interest coverage, and premium valuation versus peers highlight meaningful pressure on profitability and financial resilience.

If you want companies where earnings comfortably cover financing costs and balance sheets look sturdier, use our solid balance sheet and fundamentals stocks screener (1940 results) today to quickly surface financially stronger alternatives.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRP might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:DOO

BRP

Designs, develops, manufactures, and sells powersports vehicles and marine products in the Mexico, Canada, Austria, the United States, Finland, Australia, and Germany.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

TXT will see revenue grow 26% with a profit margin boost of almost 40%

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026