- Canada

- /

- Professional Services

- /

- TSX:TRI

A Look at Thomson Reuters (TSX:TRI) Valuation Following Q3 Earnings, Buyback, and Tech Partnership News

Reviewed by Simply Wall St

Thomson Reuters (TSX:TRI) is in focus after an eventful stretch that included an upbeat third-quarter earnings report, reaffirmed guidance for 2025 and 2026, and confirmation of its quarterly dividend.

See our latest analysis for Thomson Reuters.

Thomson Reuters has seen a flurry of headlines lately, including a technology partnership with Fieldguide, completion of a $1 billion share buyback, and the reaffirmation of growth targets following a solid third-quarter earnings beat. Even so, momentum has faded as recent investor caution and sector headwinds have put pressure on shares, resulting in a 9% dip in the last month and a year-to-date share price return of -17%. However, longer-term shareholders are still well ahead, with a 37% total return over three years and nearly 96% over five years. This reflects the company's resilience and steady value creation.

If you're curious what other stocks are gaining traction as market narratives shift, now's a great moment to discover fast growing stocks with high insider ownership

With shares trading at a notable discount to analyst targets but facing recent headwinds, the key question for investors is whether Thomson Reuters is an undervalued opportunity or if the market has already priced in its next stage of growth.

Most Popular Narrative: 28.7% Undervalued

With the narrative fair value estimate at CA$270.03 and shares last closing at CA$192.46, the market appears far less optimistic than the most popular analyst projection. This gap sets the backdrop for a bullish case built on substantial innovation.

The company's proprietary, authoritative content and integrated product suite positions it as a trusted platform, benefiting from the global proliferation of data and increasingly complex regulatory environments. This "category leader" status, combined with tight workflow integration, supports higher client retention and market share gains, boosting long-term recurring revenues.

Wondering what justifies that steep upside? The narrative's ambitious price hinges on assumptions about margin expansion and relentless growth in subscription revenue, supported by aggressive bets on transformative technology. But the key quantitative leap that powers this bold valuation target will surprise you.

Result: Fair Value of $270.03 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, intensifying competition from AI start-ups and potential integration issues from recent acquisitions could present challenges to Thomson Reuters' growth expectations.

Find out about the key risks to this Thomson Reuters narrative.

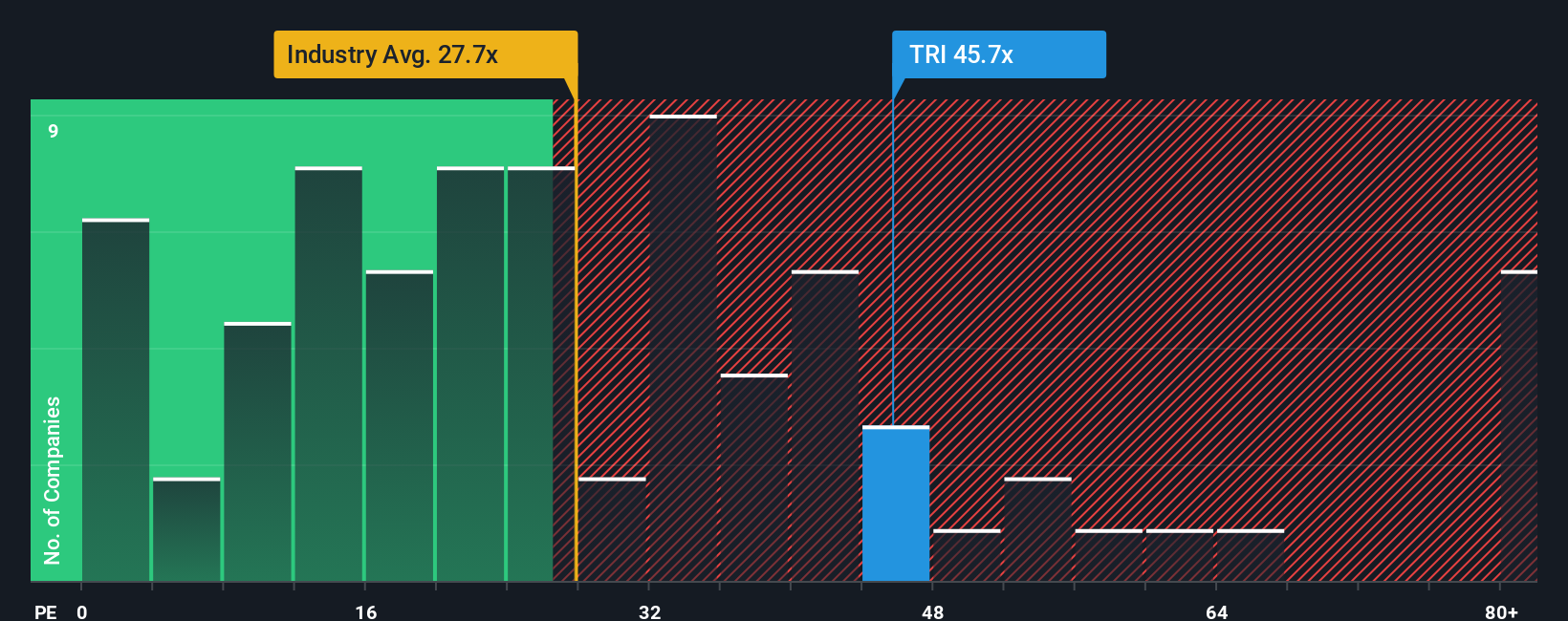

Another View: The Market's Multiple Tells a Cautionary Story

Looking from another angle, the company's price-to-earnings ratio stands at 34.9x, meaning it is well above both the industry average (24.9x) and its peers (31.2x). The fair ratio that the market could move toward is 30.6x. This premium signals investor optimism but also raises the risk that expectations may be running ahead of reality. Are investors prepared for what happens if momentum slows?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Thomson Reuters Narrative

If you see things differently or want to follow your own findings, crafting your own take is quick and straightforward. Get started in just minutes with Do it your way

A great starting point for your Thomson Reuters research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Unlock even more opportunities by targeting stocks with strong upside, future-shaping technology, or reliable income potential using the power of the Simply Wall Street Screener.

- Power your portfolio with the potential of digital assets by checking out these 82 cryptocurrency and blockchain stocks. This area is reshaping how the world transacts and stores value.

- Secure consistent returns by targeting these 16 dividend stocks with yields > 3%, which can offer higher yields and greater income stability, even when markets are volatile.

- Tap into next-level innovation by following these 24 AI penny stocks as they lead in artificial intelligence, automation, and industry transformation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Thomson Reuters might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TRI

Thomson Reuters

Operates as a content and technology company in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Adequate balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives