As the Canadian TSX index has rebounded by over 5% amid easing inflation and better-than-expected economic data, investors are keenly watching how central banks' rate-cutting cycles will unfold. In this environment, identifying undervalued stocks becomes crucial as markets anticipate further positive sentiment and potential broadening of market leadership.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| goeasy (TSX:GSY) | CA$183.79 | CA$358.37 | 48.7% |

| Alvopetro Energy (TSXV:ALV) | CA$5.10 | CA$9.07 | 43.8% |

| Computer Modelling Group (TSX:CMG) | CA$12.61 | CA$22.25 | 43.3% |

| Kinaxis (TSX:KXS) | CA$150.58 | CA$282.43 | 46.7% |

| Obsidian Energy (TSX:OBE) | CA$9.14 | CA$18.08 | 49.4% |

| Africa Oil (TSX:AOI) | CA$2.04 | CA$3.70 | 44.9% |

| Calibre Mining (TSX:CXB) | CA$2.31 | CA$4.59 | 49.6% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| NFI Group (TSX:NFI) | CA$19.19 | CA$37.54 | 48.9% |

| NanoXplore (TSX:GRA) | CA$2.17 | CA$4.19 | 48.3% |

Below we spotlight a couple of our favorites from our exclusive screener.

GFL Environmental (TSX:GFL)

Overview: GFL Environmental Inc. provides non-hazardous solid waste management and environmental services in Canada and the United States, with a market cap of CA$21.51 billion.

Operations: The company's revenue segments include CA$4.79 billion from Solid Waste in the USA, CA$2.16 billion from Solid Waste in Canada, and CA$1.67 billion from Environmental Services.

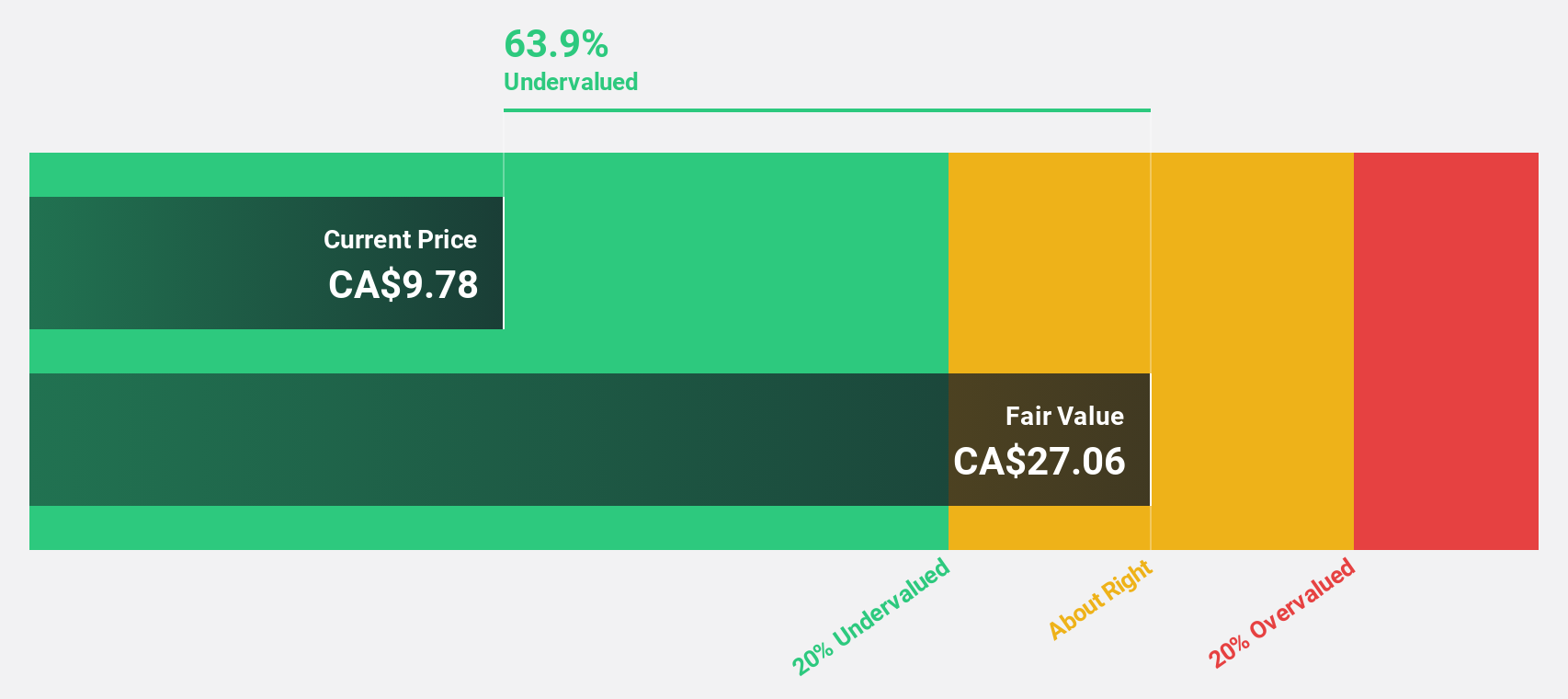

Estimated Discount To Fair Value: 31.6%

GFL Environmental is trading at CA$57.42, significantly below its estimated fair value of CA$83.99, suggesting it is undervalued based on cash flows. Despite a recent net loss of CAD 471.2 million in Q2 2024, the company has raised its revenue guidance for the year to between $7.90 billion and $7.93 billion following a divestiture impact. GFL's earnings are forecast to grow substantially over the next three years, indicating potential future profitability and investment appeal despite current challenges.

- Our earnings growth report unveils the potential for significant increases in GFL Environmental's future results.

- Dive into the specifics of GFL Environmental here with our thorough financial health report.

Triple Flag Precious Metals (TSX:TFPM)

Overview: Triple Flag Precious Metals Corp. is a company focused on acquiring and managing precious metals streams, royalties, and other mineral interests across various countries, with a market cap of CA$4.50 billion.

Operations: The company generates $222.27 million from acquiring and managing precious metal and other high-quality streams and royalties.

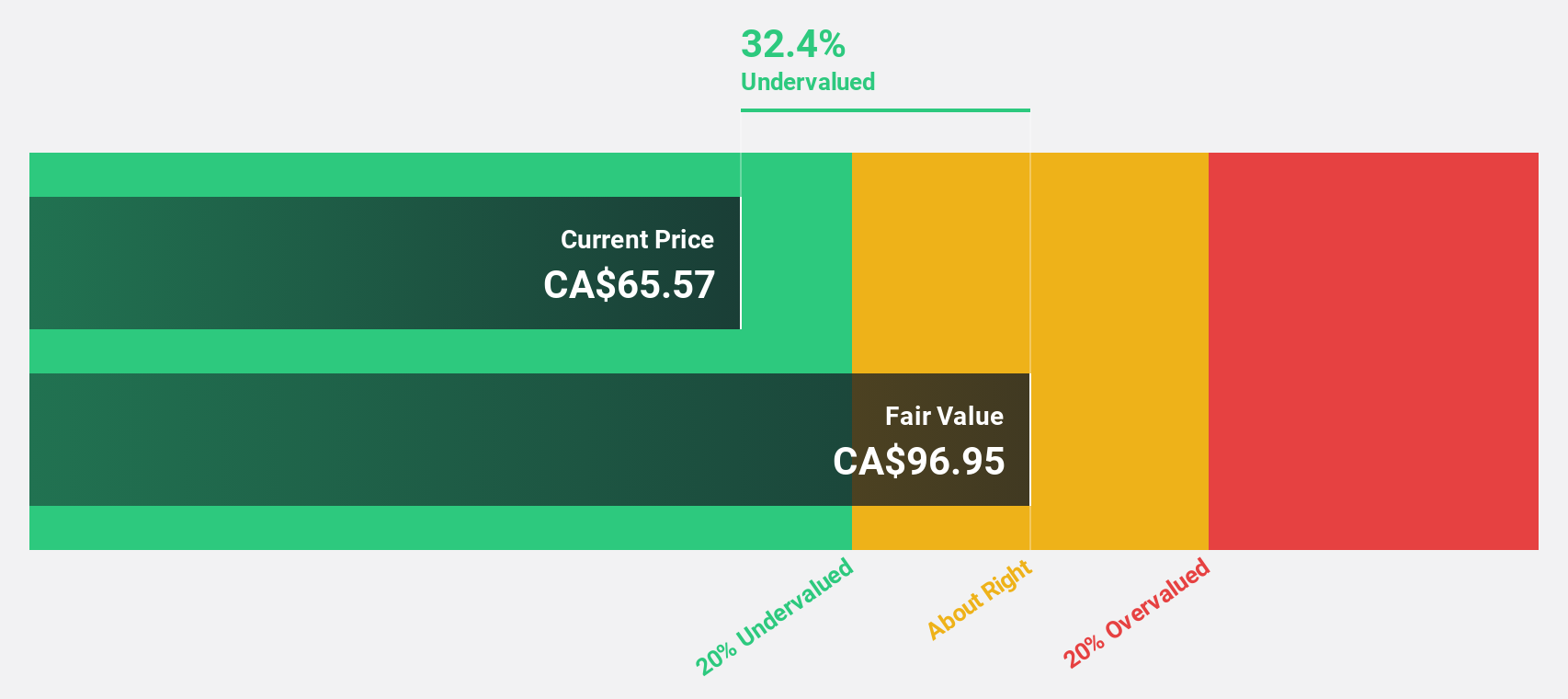

Estimated Discount To Fair Value: 32.3%

Triple Flag Precious Metals (CA$22.25) is trading 32.3% below its estimated fair value of CA$32.84, indicating it is undervalued based on cash flows. Despite a recent net loss, the company has completed a significant acquisition of gold streams for US$53 million and forecasts substantial revenue growth at 9.2% per year, outpacing the Canadian market's average growth rate. Analysts agree that the stock price will rise by 22.6%.

- The analysis detailed in our Triple Flag Precious Metals growth report hints at robust future financial performance.

- Unlock comprehensive insights into our analysis of Triple Flag Precious Metals stock in this financial health report.

5N Plus (TSX:VNP)

Overview: 5N Plus Inc. produces and sells specialty metals and chemicals across North America, Europe, and Asia, with a market cap of CA$589.53 million.

Operations: Revenue from Performance Materials was $82.69 million, while Specialty Semiconductors generated $184.92 million.

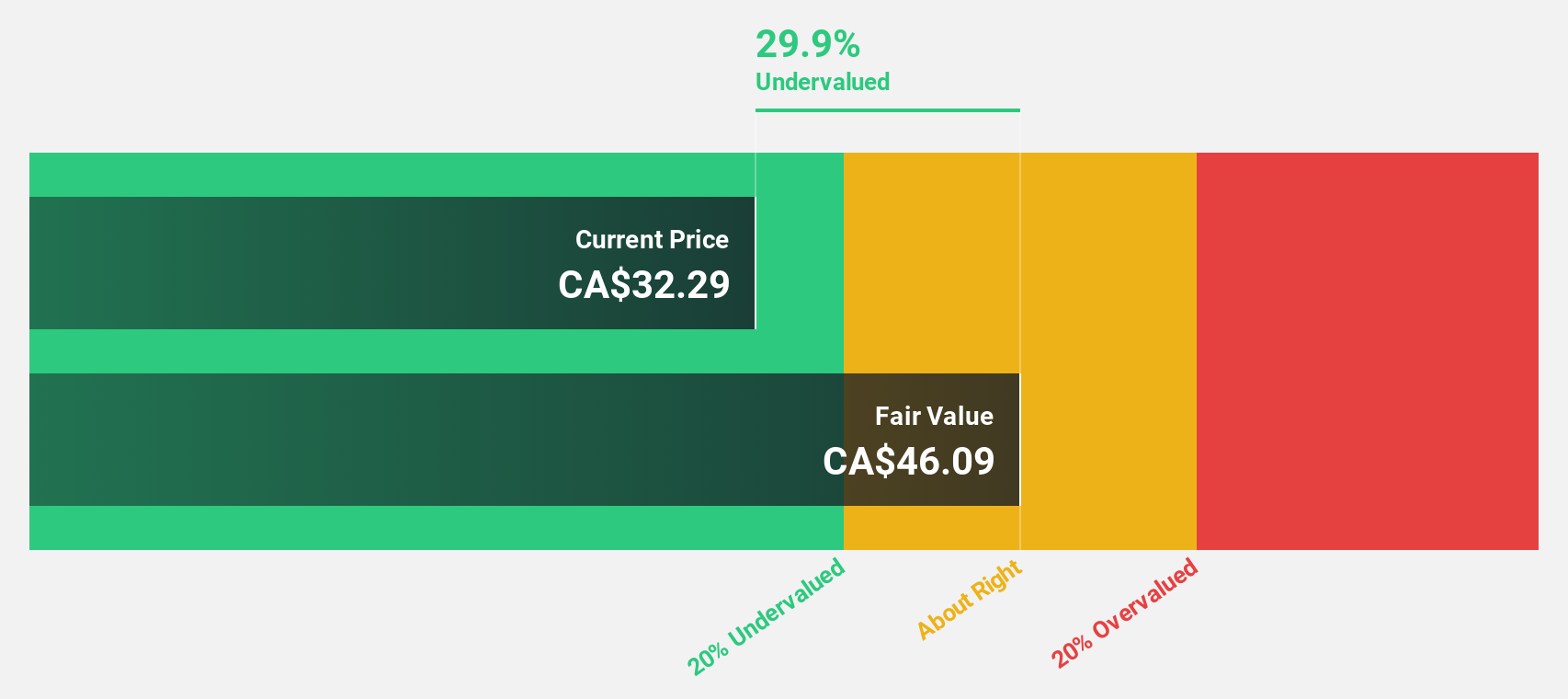

Estimated Discount To Fair Value: 19%

5N Plus (CA$6.5) is trading 19% below its estimated fair value of CA$8.02, suggesting it is undervalued based on cash flows. Despite a dip in net income to US$4.79 million for Q2 2024, the company became profitable this year and forecasts significant earnings growth at 36.37% annually, outpacing the Canadian market's average growth rate of 15.3%. The recent renewal of its supply agreement with First Solar supports future revenue expansion in high-growth markets like renewable energy.

- Upon reviewing our latest growth report, 5N Plus' projected financial performance appears quite optimistic.

- Click here to discover the nuances of 5N Plus with our detailed financial health report.

Seize The Opportunity

- Unlock our comprehensive list of 33 Undervalued TSX Stocks Based On Cash Flows by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VNP

5N Plus

Produces and sells specialty metals and chemicals in North America, Europe, and Asia.

Reasonable growth potential low.