- Canada

- /

- Electrical

- /

- TSX:HPS.A

Undiscovered Gems In Canada Featuring These 3 Promising Stocks

Reviewed by Simply Wall St

In the last week, the Canadian market has been flat, but it is up 19% over the past year with earnings forecasted to grow by 15% annually. In this promising environment, identifying stocks with strong fundamentals and growth potential can be key to uncovering hidden opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Jaguar Mining | 1.19% | 5.49% | 5.12% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Tenaz Energy | NA | 33.64% | 50.62% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Firm Capital Mortgage Investment | 57.73% | 9.38% | 5.91% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Freehold Royalties Ltd. focuses on acquiring and managing royalty interests in crude oil, natural gas, natural gas liquids, and potash properties across Western Canada and the United States with a market cap of CA$2.19 billion.

Operations: Freehold Royalties Ltd. generated CA$323.04 million from its oil and gas exploration and production revenue segment. The company’s market cap stands at CA$2.19 billion, reflecting its significant presence in the industry.

Freehold Royalties, a smaller player in the oil and gas sector, reported net income of CAD 39.3 million for Q2 2024, up from CAD 24.26 million a year ago. The company trades at 57.5% below its estimated fair value and has high-quality earnings despite negative earnings growth (-5.9%) over the past year compared to the industry average (-36.7%). Its debt level remains satisfactory with a net debt to equity ratio of 24.6%.

- Delve into the full analysis health report here for a deeper understanding of Freehold Royalties.

Examine Freehold Royalties' past performance report to understand how it has performed in the past.

Hammond Power Solutions (TSX:HPS.A)

Simply Wall St Value Rating: ★★★★★★

Overview: Hammond Power Solutions Inc., along with its subsidiaries, specializes in designing, manufacturing, and selling a variety of transformers across Canada, the United States, Mexico, and India with a market cap of CA$1.71 billion.

Operations: Hammond Power Solutions generates CA$754.37 million in revenue from the manufacture and sale of transformers. The company has a market cap of CA$1.71 billion.

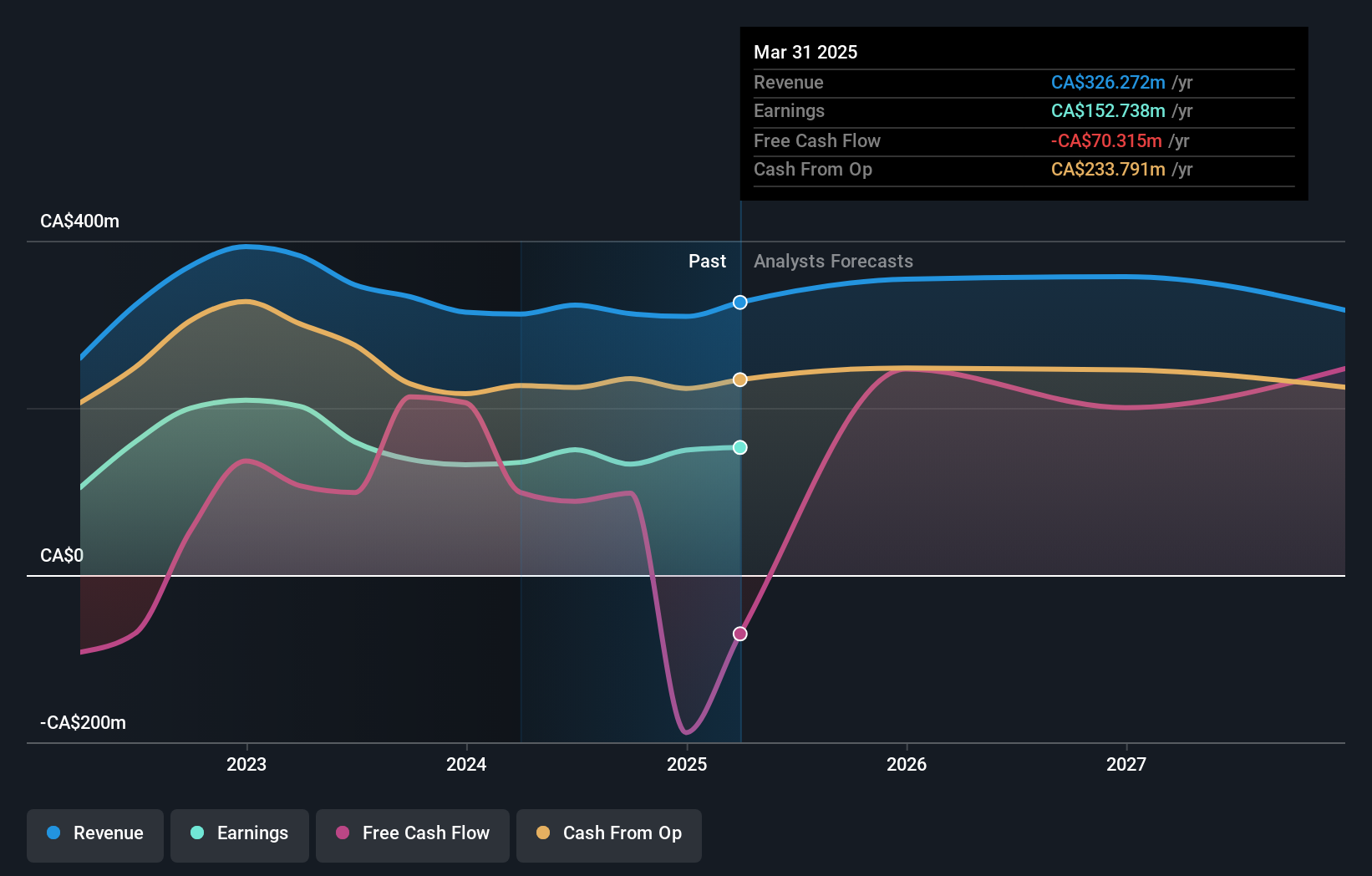

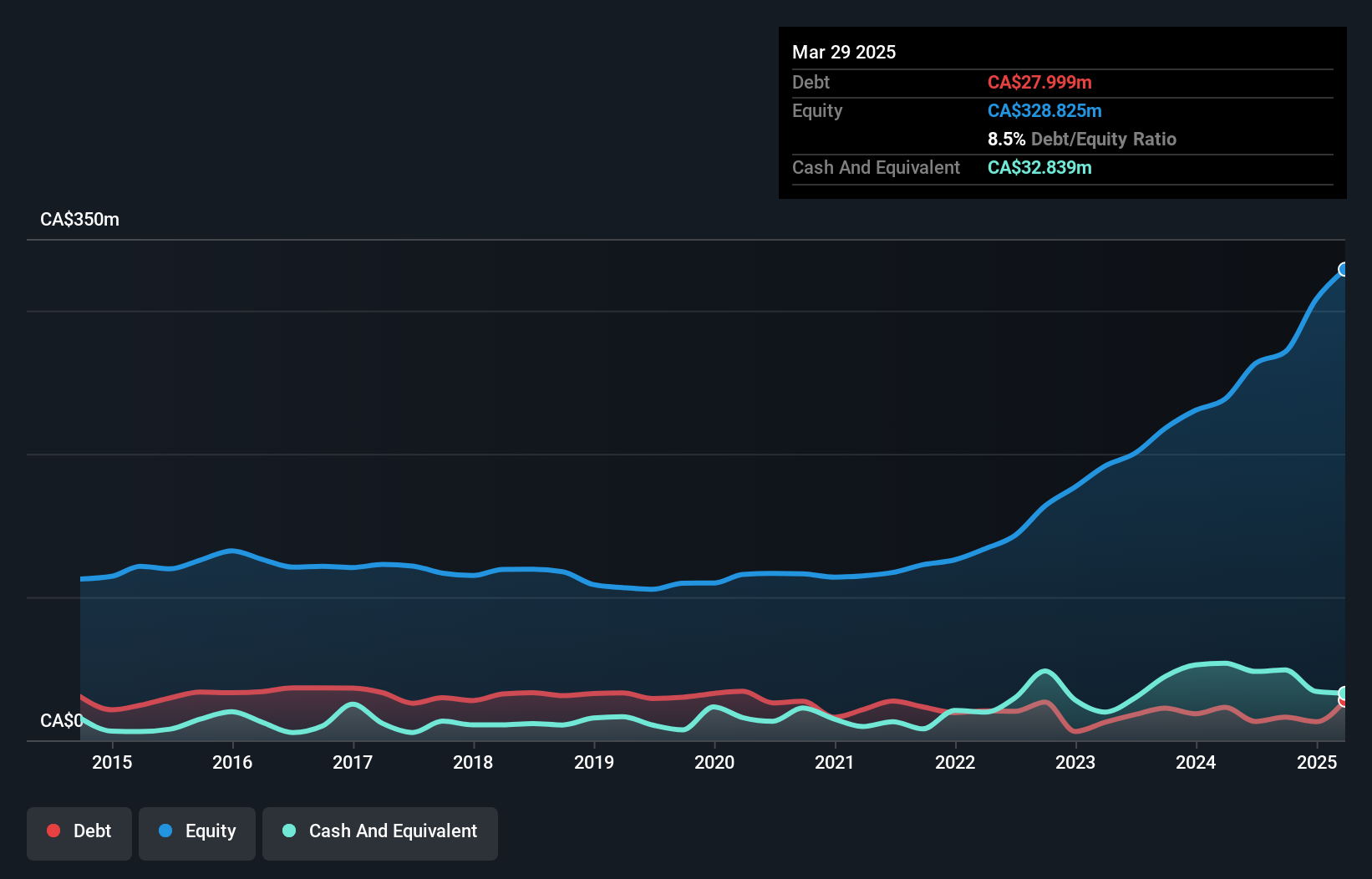

Hammond Power Solutions, a small cap player in the electrical industry, has shown impressive growth with earnings increasing by 12.3% over the past year, outpacing the industry's 6.5%. The company’s debt to equity ratio has significantly improved from 27.7% to 5% over five years, indicating better financial health. Recent quarterly results revealed CAD 197.21 million in sales and CAD 23.59 million net income, up from CAD 172.45 million and CAD 13.33 million respectively a year ago, highlighting robust performance and profitability.

- Dive into the specifics of Hammond Power Solutions here with our thorough health report.

Gain insights into Hammond Power Solutions' past trends and performance with our Past report.

Westshore Terminals Investment (TSX:WTE)

Simply Wall St Value Rating: ★★★★★☆

Overview: Westshore Terminals Investment Corporation operates a coal storage and unloading/loading terminal at Roberts Bank, British Columbia, with a market cap of CA$1.49 billion.

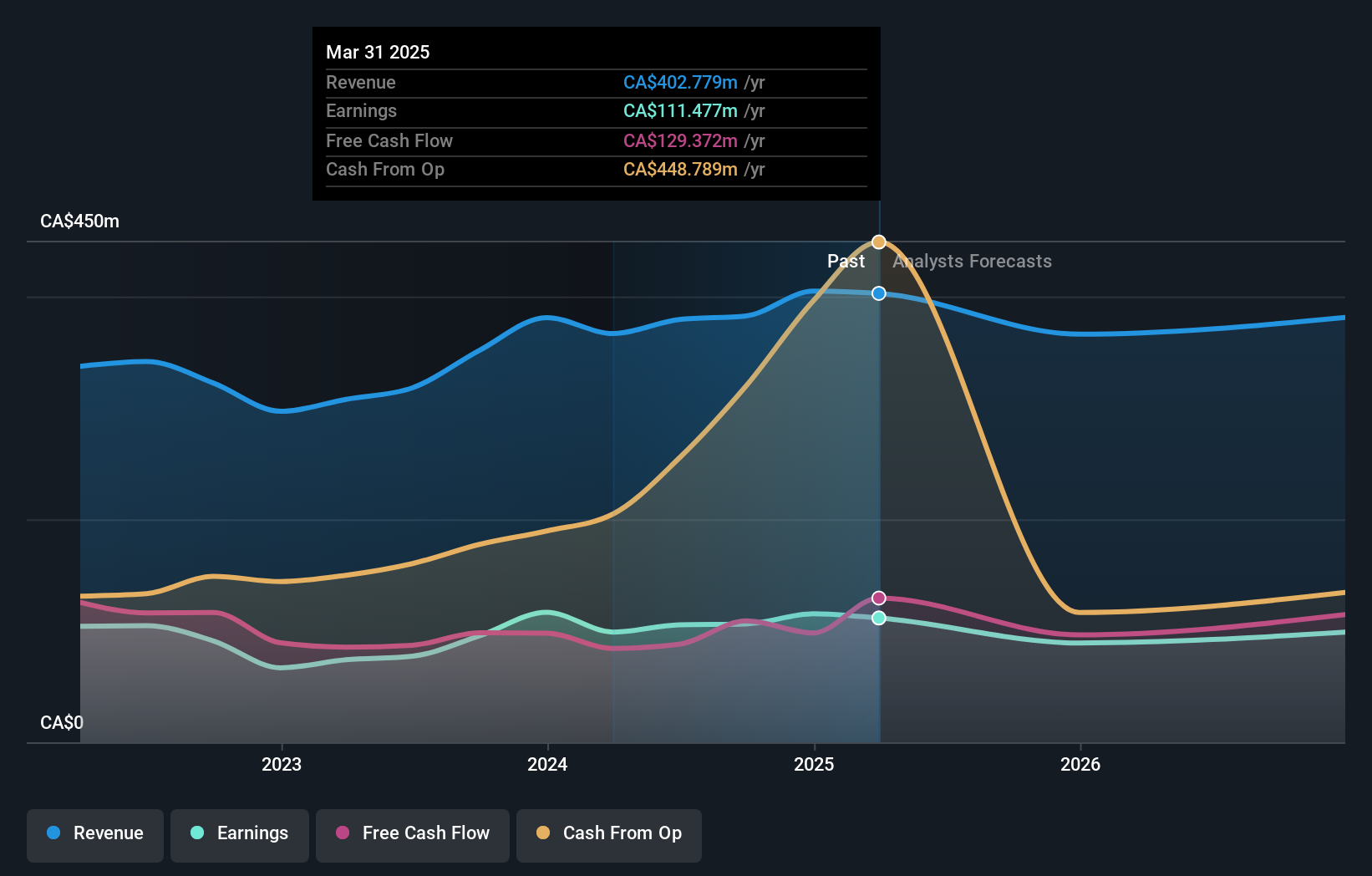

Operations: Westshore Terminals Investment Corporation generates revenue primarily from its transportation infrastructure segment, which brought in CA$379.34 million. The company has a market cap of approximately CA$1.49 billion.

Westshore Terminals Investment has shown robust earnings growth of 36.4% over the past year, far outpacing the Infrastructure industry's 10.1%. The company is debt-free and boasts high-quality earnings. Despite being dropped from multiple S&P/TSX indices recently, Westshore continues to offer value with a price-to-earnings ratio of 14.3x, below the Canadian market average of 15.2x. For Q2 2024, revenue reached C$105.62M while net income stood at C$34.61M.

- Unlock comprehensive insights into our analysis of Westshore Terminals Investment stock in this health report.

Learn about Westshore Terminals Investment's historical performance.

Make It Happen

- Dive into all 43 of the TSX Undiscovered Gems With Strong Fundamentals we have identified here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hammond Power Solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:HPS.A

Hammond Power Solutions

Engages in the design, manufacture, and sale of various transformers in Canada, the United States, Mexico, and India.

Flawless balance sheet with proven track record.