3 TSX Stocks Estimated To Be Trading At Up To 48.5% Below Intrinsic Value

Reviewed by Simply Wall St

As the U.S. government shutdown creates uncertainty south of the border, Canadian markets remain resilient, buoyed by strong consumer spending and significant investments in artificial intelligence. In this environment, identifying undervalued stocks can be a strategic move for investors seeking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WELL Health Technologies (TSX:WELL) | CA$5.57 | CA$9.83 | 43.3% |

| Vitalhub (TSX:VHI) | CA$11.19 | CA$18.83 | 40.6% |

| Savaria (TSX:SIS) | CA$21.15 | CA$41.06 | 48.5% |

| Meren Energy (TSX:MER) | CA$1.87 | CA$3.08 | 39.3% |

| Magellan Aerospace (TSX:MAL) | CA$17.45 | CA$28.29 | 38.3% |

| Haivision Systems (TSX:HAI) | CA$5.16 | CA$9.47 | 45.5% |

| GURU Organic Energy (TSX:GURU) | CA$5.20 | CA$8.97 | 42.1% |

| Boyd Group Services (TSX:BYD) | CA$222.63 | CA$361.64 | 38.4% |

| Bird Construction (TSX:BDT) | CA$31.22 | CA$56.88 | 45.1% |

| 5N Plus (TSX:VNP) | CA$17.79 | CA$33.37 | 46.7% |

We'll examine a selection from our screener results.

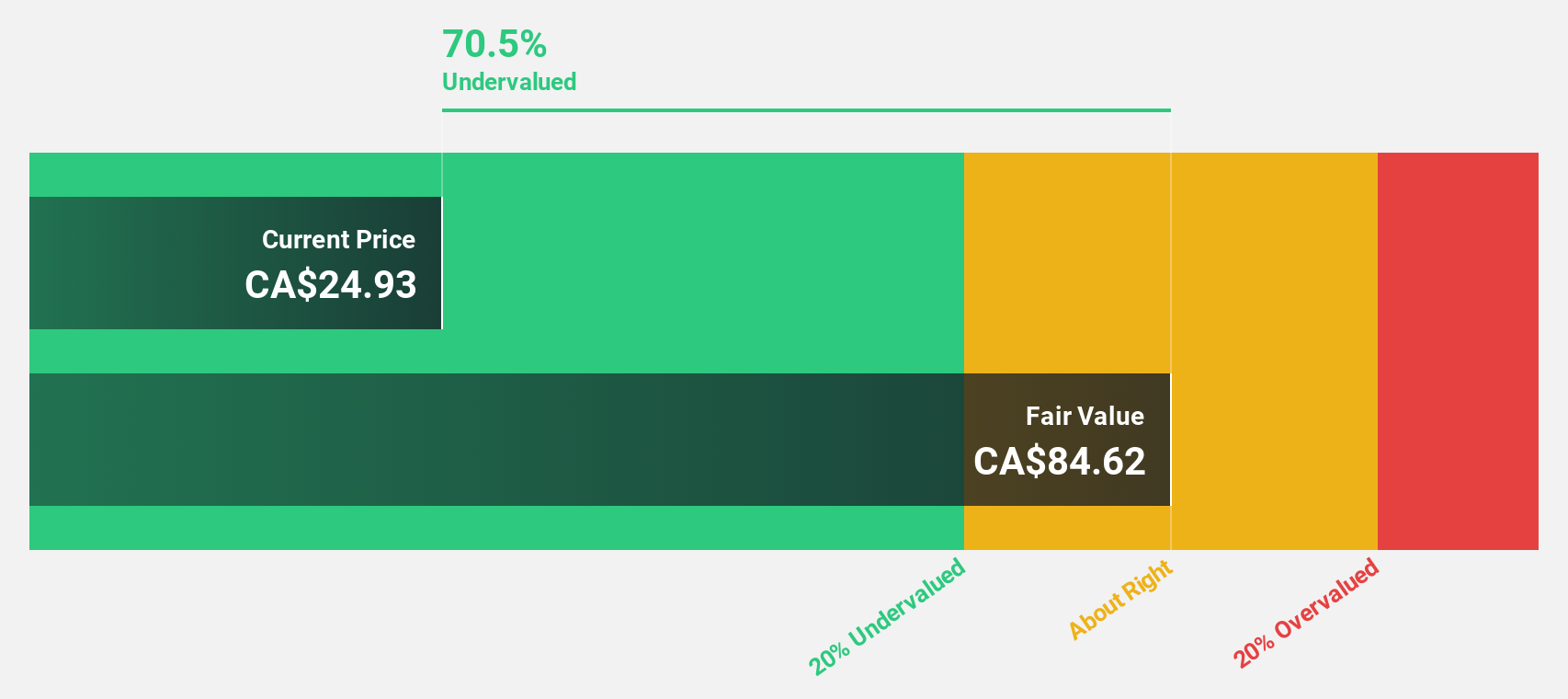

Bird Construction (TSX:BDT)

Overview: Bird Construction Inc. is a Canadian company that offers construction services, with a market cap of CA$1.68 billion.

Operations: The company generates revenue primarily from the General Contracting Sector of the Construction Industry, amounting to CA$3.40 billion.

Estimated Discount To Fair Value: 45.1%

Bird Construction appears undervalued, trading at CA$31.22 against a fair value estimate of CA$56.88, with earnings projected to grow significantly at 35.8% annually, outpacing the Canadian market's 10.9%. Despite an unstable dividend track record, recent developments like being named the Preferred Proponent for a major hospital project in Ontario and acquiring Fraser River Pile & Dredge for CA$82.3 million could enhance cash flows and support future growth potential.

- Insights from our recent growth report point to a promising forecast for Bird Construction's business outlook.

- Unlock comprehensive insights into our analysis of Bird Construction stock in this financial health report.

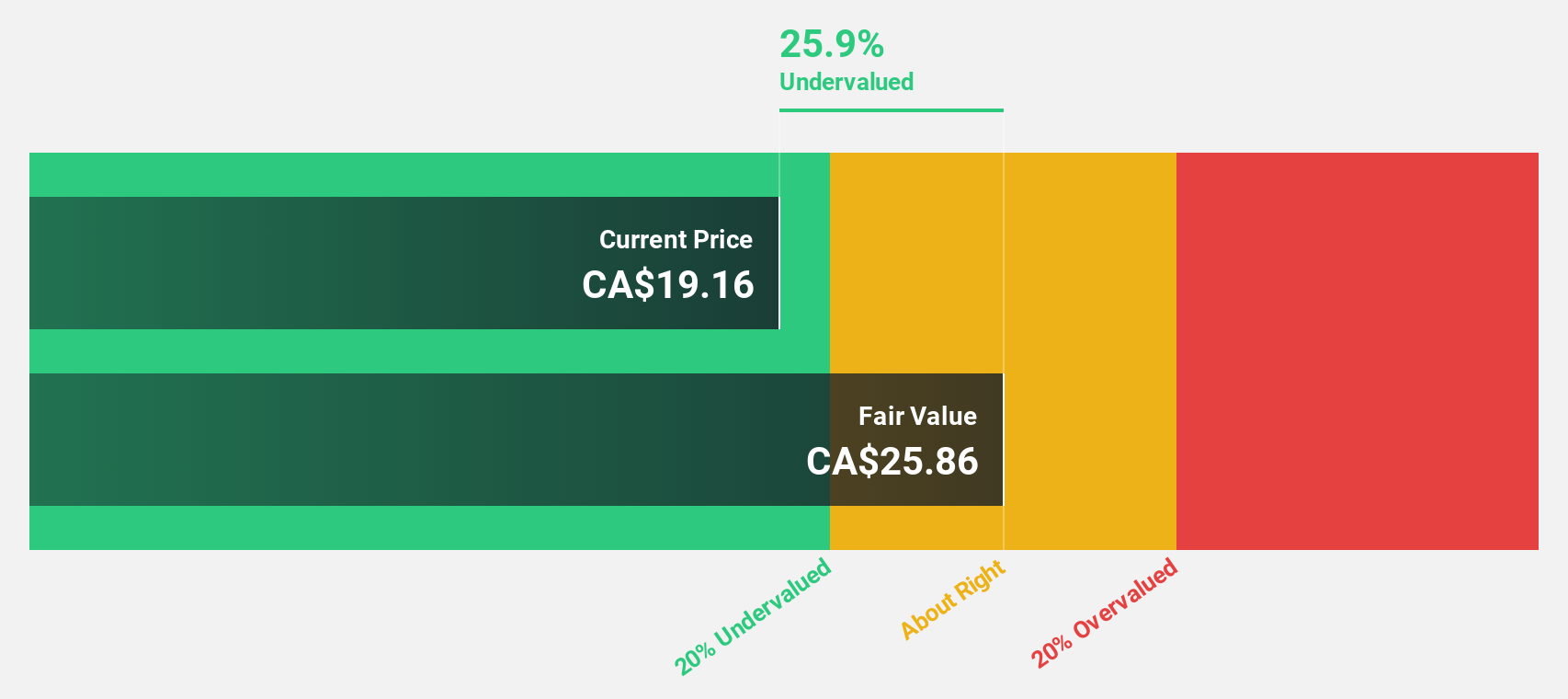

Savaria (TSX:SIS)

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally, with a market cap of CA$1.49 billion.

Operations: The company generates revenue from its Patient Care segment amounting to CA$197.05 million, with a Segment Adjustment of CA$686.90 million.

Estimated Discount To Fair Value: 48.5%

Savaria Corporation is trading at CA$21.15, substantially below its fair value estimate of CA$41.06, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 31.3% annually, surpassing the Canadian market's growth rate of 10.9%. Despite recent insider selling and large one-off items affecting results, Savaria has increased its monthly dividend to CA$0.0467 per share, reflecting a reliable income stream for investors seeking cash flow stability.

- According our earnings growth report, there's an indication that Savaria might be ready to expand.

- Dive into the specifics of Savaria here with our thorough financial health report.

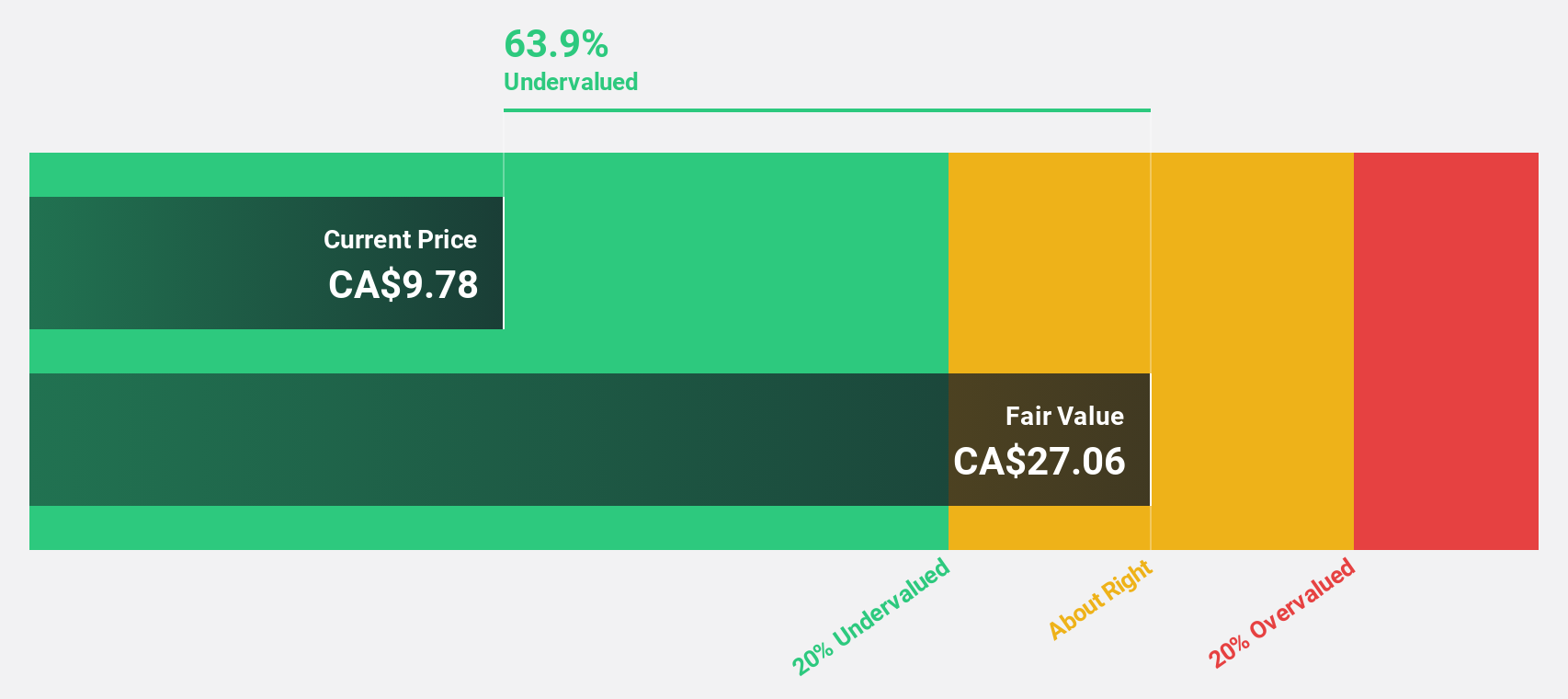

5N Plus (TSX:VNP)

Overview: 5N Plus Inc. is a company that produces and sells specialty semiconductors and performance materials across the Americas, Europe, Asia, and internationally with a market cap of CA$1.57 billion.

Operations: The company's revenue is derived from two main segments: Performance Materials, contributing $95.03 million, and Specialty Semiconductors, accounting for $238.86 million.

Estimated Discount To Fair Value: 46.7%

5N Plus Inc. is trading at CA$17.79, considerably below its estimated fair value of CA$33.37, reflecting potential undervaluation based on cash flows. The company has shown robust earnings growth, with a 189.9% increase over the past year and forecasts indicating a 14.2% annual growth rate, outpacing the Canadian market's average of 10.9%. Recent expanded agreements with First Solar enhance future revenue prospects but debt coverage by operating cash flow remains a concern for investors evaluating financial health.

- The growth report we've compiled suggests that 5N Plus' future prospects could be on the up.

- Navigate through the intricacies of 5N Plus with our comprehensive financial health report here.

Turning Ideas Into Actions

- Click this link to deep-dive into the 25 companies within our Undervalued TSX Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Established dividend payer with reasonable growth potential.

Market Insights

Community Narratives