- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Bombardier (TSX:BBD.B): Reassessing Valuation After Fresh Analyst Optimism and Service Centre Expansion Progress

Reviewed by Simply Wall St

Bombardier (TSX:BBD.B) has been back on investors radar after fresh optimism from National Bank of Canada and visible progress on its Abu Dhabi service centre. This combination sharpens the long runway for its business jet franchise.

See our latest analysis for Bombardier.

All this is happening against a backdrop of powerful momentum, with Bombardier delivering a 47.9% 3 month share price return and a 113% 1 year total shareholder return as investors price in stronger growth and improving cash generation.

If Bombardier’s rally has you rethinking the aerospace space, it is worth exploring other aerospace and defense stocks that could be positioned for the next leg of industry demand.

But with the share price now sitting slightly above the latest analyst target yet still screening at a sizeable intrinsic discount, is Bombardier a rare growth story trading below its true potential, or has the market already priced in tomorrow’s gains?

Most Popular Narrative: 5% Overvalued

With Bombardier last closing at CA$228 against a narrative fair value of about CA$217.12, the current setup bakes in more optimism than the model.

Ongoing innovation and introduction of next-generation models (e.g., the Global 8000 with higher pricing and margins, plus retrofit upgrades for the 7500 fleet) position Bombardier to capture industry demand for technologically advanced and environmentally progressive aircraft, enhancing margins and supporting premium pricing.

Want to unpack why strong margin expansion, accelerating cash flows, and a lower future earnings multiple still point to limited upside from here? The underlying projections combine steady top line growth, rising profitability, and a recalibrated valuation anchor that could surprise anyone just looking at the recent share price surge.

Result: Fair Value of $217.12 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution is far from guaranteed, with Bombardier’s heavy reliance on cyclical business jet demand and lingering supply chain bottlenecks both capable of derailing margin ambitions.

Find out about the key risks to this Bombardier narrative.

Another View: Market Ratios Flash Caution

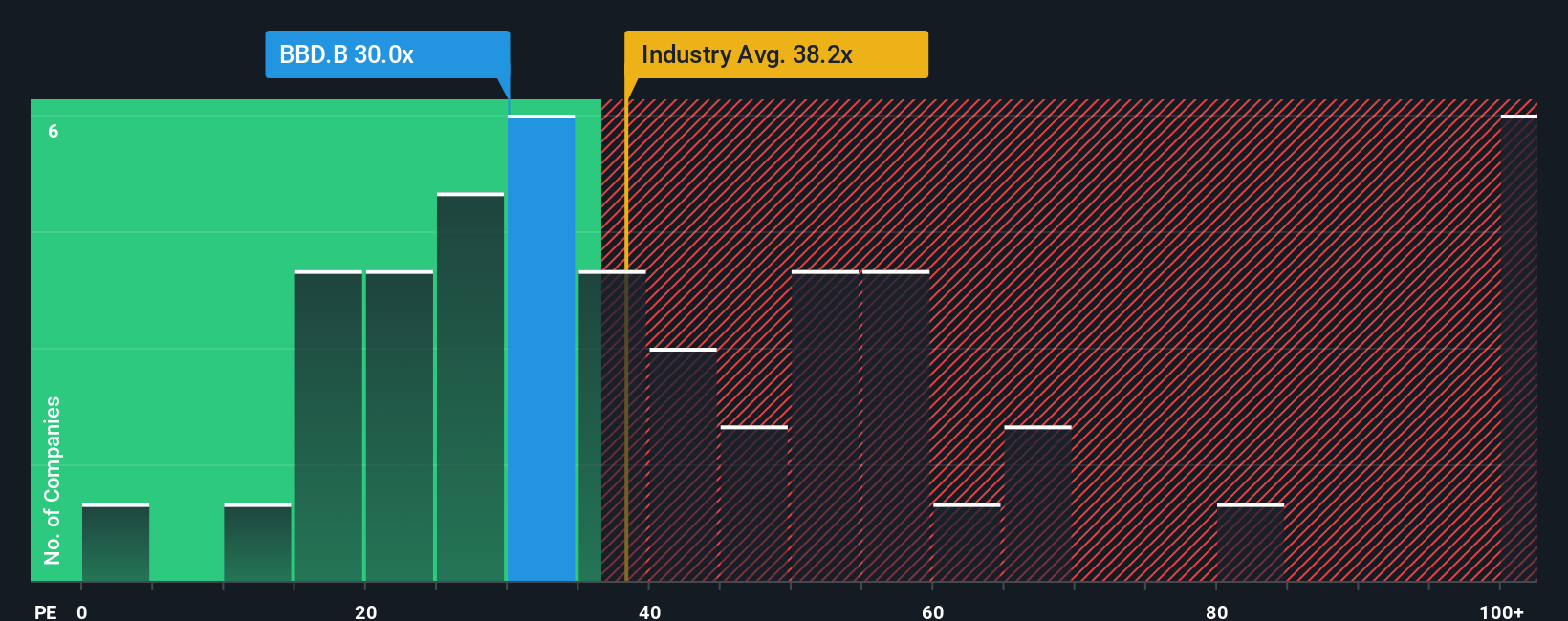

While the narrative fair value suggests Bombardier is only modestly overvalued, its current price to earnings of 39.3 times sits above both peers at 28.6 times and a fair ratio of 37.6 times. This hints at a thin margin for error if growth stumbles.

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bombardier for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bombardier Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized narrative in just a few minutes: Do it your way

A great starting point for your Bombardier research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single ticker when you can scan the market with precision, uncover fresh ideas, and stay a step ahead of slower investors.

- Capture short term catalysts and volatility by targeting these 3574 penny stocks with strong financials that already show real financial strength behind the headlines.

- Position your portfolio at the frontier of innovation by focusing on these 26 AI penny stocks shaping the future of automation, data, and intelligent software.

- Lock in quality at a discount by filtering for these 907 undervalued stocks based on cash flows where cash flow strength and sensible prices work together in your favour.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Moderate growth potential with low risk.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026